This month, the national average hourly construction wage was expected to top $30 for the first time in the country’s history. And in its Q3 2016 Construction Outlook, JLL forecasts another 3% increase by next March.

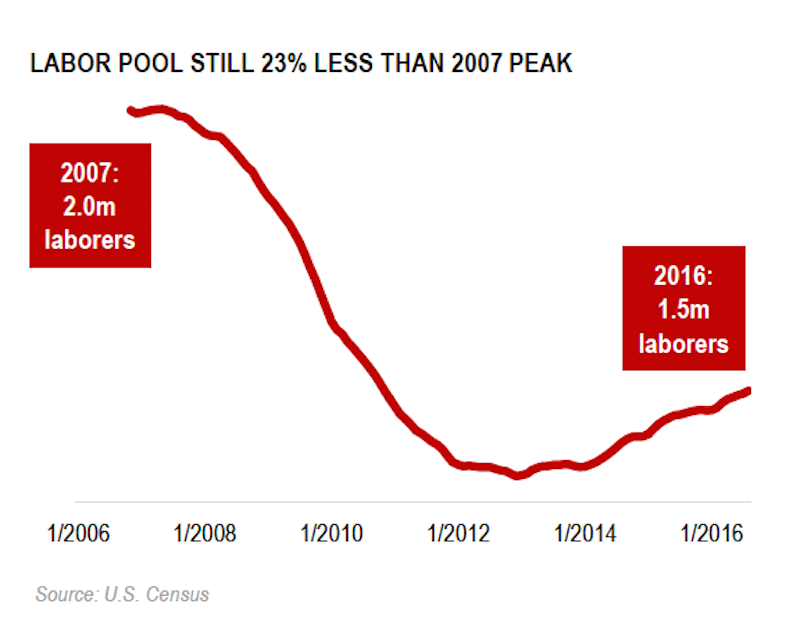

That prediction comes at a time when the number of construction workers at the end of the third quarter of 2016—1.46 million—was up 2.8% compared to the same period a year earlier. “The size of the labor pool is rebounding from the downturn, but at a much slower rate than demand,” JLL reports. Consequently, poaching labor from competing contractors and bid jumping have increased in several markets.

Labor-intensive industries, such as drywall and roofing, can expect to experience continued cost growth as a result of manpower shortages.

What’s happening on the labor scene is one of three factors that JLL identifies as having the greatest impact on U.S. construction currently.

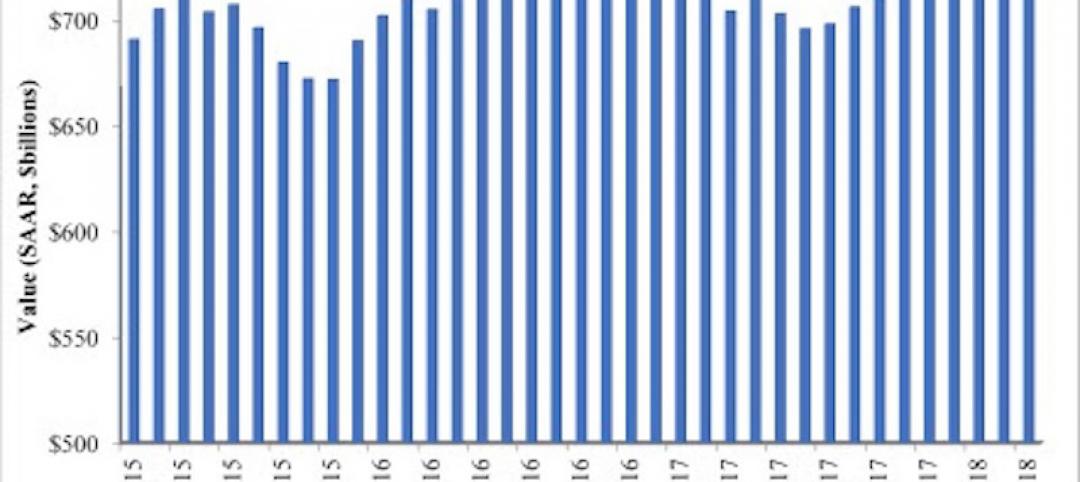

In the third quarter, $317 billion was spent on construction, up 1% from the same quarter in 2015. The national construction backlog was 8.5 months, flat from a year ago. And while the pipeline in many sectors remains strong across property types, JLL cautions that demand is “normalizing” in many markets. “We can expect to see a national slowdown in the construction industry by end-of-year 2017 and with it, a shift in how clients are using construction services.”

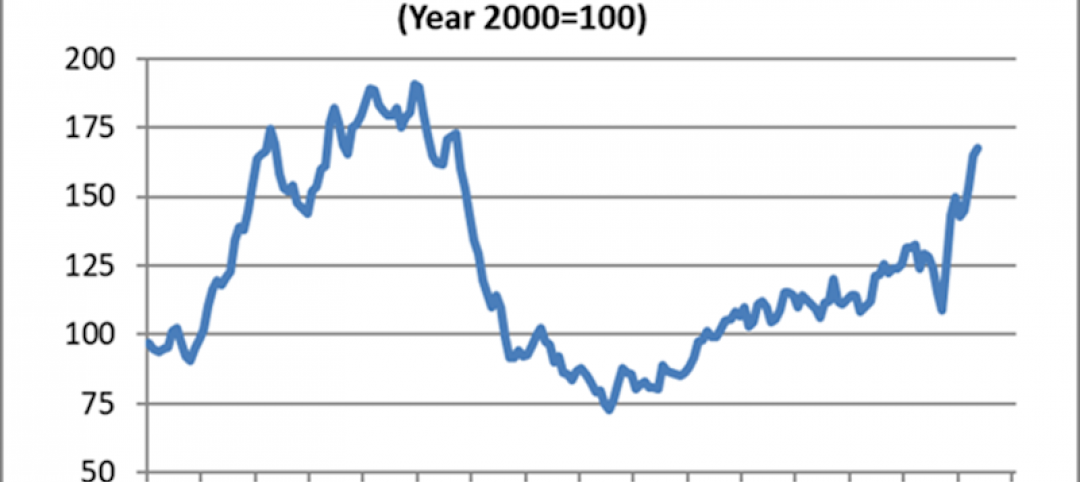

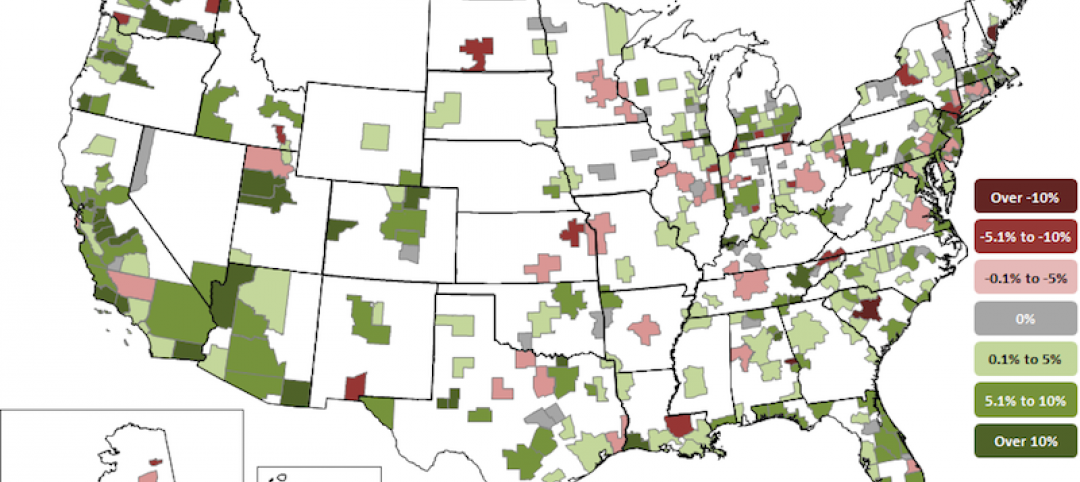

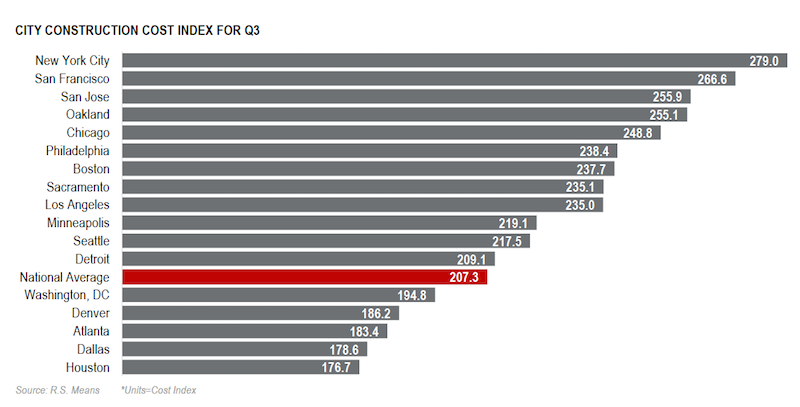

Increases in labor and materials are driving construction costs, especially in coastal metros where activity is particularly robust. Image: JLL Q3 2016 Construction Outlook.

Increases in labor and materials are driving construction costs, especially in coastal metros where activity is particularly robust. Image: JLL Q3 2016 Construction Outlook.

Already, banks have become more selective in their lending practices, financing standards continue to tighten, and securing loans for construction is tougher. JLL also expects uncertainty over the next several months pending policy decisions of the new president, Donald Trump, who has stated publicly that investment in infrastructure will be a key focus.

JLL, though, isn’t so sure:

“By end-of-year 2017, expect to see a softer construction industry across the U.S., as demand and market saturations begin to level out across property types. A significant decline isn’t expected, but the rate of growth in the industry will slow, spurring greater competition between firms seeking work.”

Material costs rose 2.2% in the quarter, compared to 2015, as lumber consumption in the U.S. rose 10%. JLL doesn't expect the lumber trend to reverse until 2018 and 2019. Whereas, steel prices, which remain low, will continue to decline through the year few years, while cement prices, which have been declining slightly this year, will level off in 2017.

The Construction Outlook finds that early adopters of technology are better positioned competitively for what could be coming next. Technology that includes BIM, drones, and 3D scanners “is having a profound impact on how project managers, contractors and service firms do their jobs through software, hardware, and the sharing economy.”

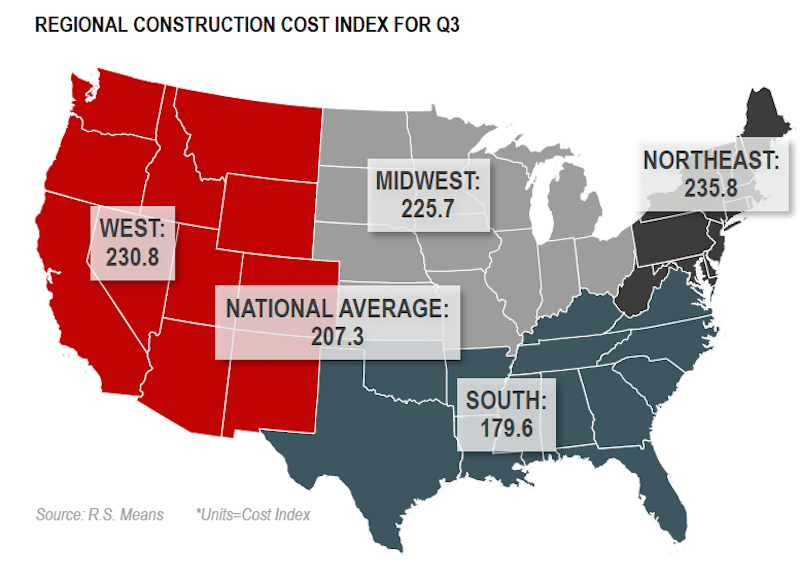

The Midwest region maintains an upward trajectory,but trails the West by two months. Southern construction markets are steadily growing and will continue to grow over the next three quarters. Image: JLL Q3 2016 Construction Outlook

The Midwest region maintains an upward trajectory,but trails the West by two months. Southern construction markets are steadily growing and will continue to grow over the next three quarters. Image: JLL Q3 2016 Construction Outlook

The Outlook examined building activity in a number of sectors:

•At the end of the third quarter, 105.4 million sf of office space was under construction, up from 100.6 million sf in the same quarter a year ago. However, starts and completions were down.

•The pipeline for industrial construction rose 5.8% to 204.3 million sf, and quarterly absorptions jumped 32.3% over the second quarter.

•Acquisitions continue to drive growth in the hospitality sector, as transaction volume in the third quarter, $10.5 billion, was nearly double Q2 2016. However, while lodging occupancy still hovers at historic highs, it was down slightly in the third quarter, to 66.9%.

•82.4 million sf of retail space was under construction in the third quarter, more than 45% of which in the Southeast. But the retail sector remains volatile, after several recent announcements of store closings by high-profile chains like Office Depot/Office Max, which shuttered 400 outlets).

Related Stories

Market Data | Jun 19, 2018

America’s housing market still falls short of providing affordable shelter to many

The latest report from the Joint Center for Housing Studies laments the paucity of subsidies to relieve cost burdens of ownership and renting.

Market Data | Jun 18, 2018

AI is the path to maximum profitability for retail and FMCG firms

Leading retailers including Amazon, Alibaba, Lowe’s and Tesco are developing their own AI solutions for automation, analytics and robotics use cases.

Market Data | Jun 12, 2018

Yardi Matrix report details industrial sector's strength

E-commerce and biopharmaceutical companies seeking space stoke record performances across key indicators.

Market Data | Jun 8, 2018

Dodge Momentum Index inches up in May

May’s gain was the result of a 4.7% increase by the commercial component of the Momentum Index.

Market Data | Jun 4, 2018

Nonresidential construction remains unchanged in April

Private sector spending increased 0.8% on a monthly basis and is up 5.3% from a year ago.

Market Data | May 30, 2018

Construction employment increases in 256 metro areas between April 2017 & 2018

Dallas-Plano-Irving and Midland, Texas experience largest year-over-year gains; St. Louis, Mo.-Ill. and Bloomington, Ill. have biggest annual declines in construction employment amid continuing demand.

Market Data | May 29, 2018

America’s fastest-growing cities: San Antonio, Phoenix lead population growth

San Antonio added 24,208 people between July 2016 and July 2017, according to U.S. Census Bureau data.

Market Data | May 25, 2018

Construction group uses mobile technology to make highway work zones safer

Mobile advertising campaign urges drivers who routinely pass through certain work zones to slow down and be alert as new data shows motorists are more likely to be injured than construction workers.

Market Data | May 23, 2018

Architecture firm billings strengthen in April

Firms report solid growth for seven straight months.

Market Data | May 22, 2018

Vacancies stable, rents rising, and pipeline receding, according to Transwestern’s 1Q US Office Market report

The Big Apple still leads the new construction charge.