In the midst of political and economic uncertainty, U.S. engineering firm leaders expressed newfound optimism in the current status and future potential of primary markets, according to the latest Engineering Business Index (EBI), just released by the American Council of Engineering Companies (ACEC).

The 3rd Quarter 2016 (Q3/2016) EBI was 61.4, up 1.2 points from the Q2/2016 score of 60.2—which was the lowest score since ACEC launched the EBI in January 2014.

EBI is a diffusion index that charts the health of the engineering industry by consolidating senior leadership responses on market and firm performance into a single composite score. Any number above 50 indicates expansion. The Q3/2016 survey of 326 engineering firm leaders was conducted September 15 to October 5.

Market expectations for one year from today among engineering firm leaders rose a healthy 6.2 points to 63.3—the largest quarter-to-quarter increase since the EBI’s inception. The increased optimism for one year from today was reflected in nine of the 11 surveyed market sectors—a drastic turnaround from the Q2/2016 survey, when engineering leaders expected only one of the 11 sectors—energy and power—to improve over the coming year.

Among public markets, transportation was the strongest sector, up 2.1 points to 64.2. Other rising sectors include water/wastewater (up 0.9, to 63.0); healthcare construction (up 0.8, to 55.8), and education facilities (up 3.0, to 55.0).

Only the environmental sector fell, dropping 0.8 points to 54.3. Among private markets, firm leaders were most bullish about the buildings sector, up 4.4 points to 62.9, followed by energy and power (up 0.7, to 60.4), land development (up 1.2, to 60.2), and Industrial/Manufacturing (up 2.8, to 58.2).

For the complete summary of ACEC’s Q3/2016 Engineering Business Index (EBI), go to www.acec.org.

Related Stories

Giants 400 | Feb 8, 2024

Top 40 Museum Engineering Firms for 2023

Arup, KPFF Consulting Engineers, Alfa Tech Consulting Engineers, Kohler Ronan, and Thornton Tomasetti top BD+C's ranking of the nation's largest museum and gallery engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

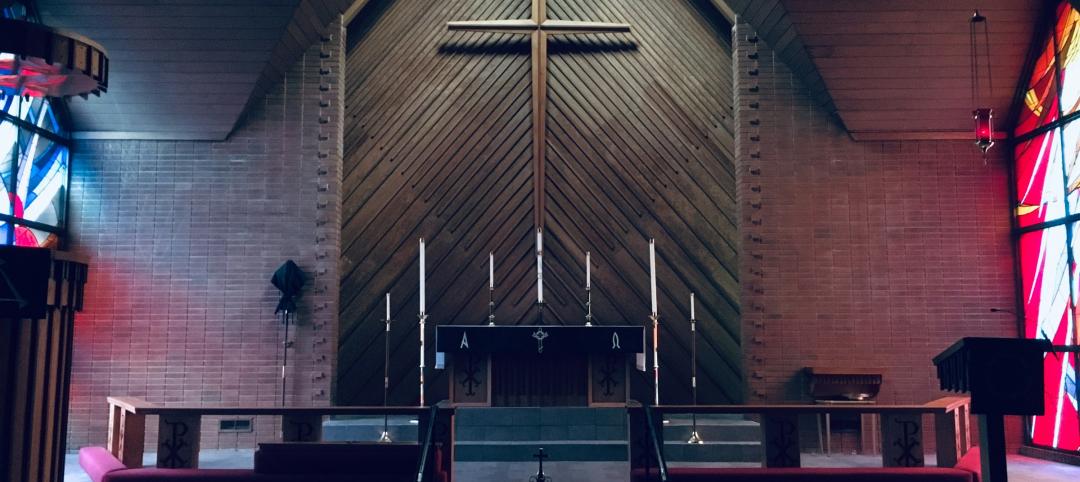

Religious Facilities | Feb 6, 2024

Top 50 Religious Facility Engineering Firms for 2023

KPFF Consulting Engineers, Wiss, Janney, Elstner Associates, Langan, Kimley-Horn, and Morrison Hershfield top BD+C's ranking of the nation's largest religious facility engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Feb 5, 2024

Top 40 Entertainment Center, Cineplex, and Theme Park Engineering Firms for 2023

Kimley-Horn, EXP, BRPH Companies, and Alfa Tech Consulting Engineers top BD+C's ranking of the nation's largest entertainment center, cineplex, and theme park engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Feb 5, 2024

Top 60 Shopping Mall, Big Box Store, and Strip Center Engineering Firms for 2023

Kimley-Horn, Henderson Engineers, Jacobs, WSP, and Wallace Design Collective top BD+C's ranking of the nation's largest shopping mall, big box store, and strip center engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Feb 1, 2024

Top 40 Restaurant Engineering Firms for 2023

Kimley-Horn, NV5 Global, Langan, RTM Engineering Consultants, and Henderson Engineers top BD+C's ranking of the nation's largest restaurant engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Standards | Feb 1, 2024

Prioritizing water quality with the WELL Building Standard

In this edition of Building WELLness, DC WELL Accredited Professionals Hannah Arthur and Alex Kircher highlight an important item of the WELL Building Standard: water.

Giants 400 | Jan 29, 2024

Top 80 Office Core and Shell Engineering Firms for 2023

Jacobs, WSP, Alfa Tech Consulting Engineers, Thornton Tomasetti, and Burns & McDonnell top BD+C's ranking of the nation's largest office core and shell engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 29, 2024

Top 50 Workplace Interior Engineering Firms for 2023

AECOM, Jacobs, Alfa Tech Consulting Engineers, Tetra Tech High Performance Buildings Group, and IMEG top BD+C's ranking of the nation's largest workplace interior and interior fitout engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Mixed-Use | Jan 29, 2024

12 U.S. markets where entertainment districts are under consideration or construction

The Pomp, a 223-acre district located 10 miles north of Fort Lauderdale, Fla., and The Armory, a 225,000-sf dining and entertainment venue on six acres in St Louis, are among the top entertainment districts in the works across the U.S.