Contractors continue to face a shortage of building materials like lumber and steel, while cost fluctuations for the building products are having increasing impact on business, according to second quarter data from the U.S. Chamber of Commerce Commercial Construction (Index). This quarter, 84% of contractors are facing at least one material shortage. Almost half (46%) of contractors say less availability of building products has been a top concern lately, up from 33% who said the same last quarter.

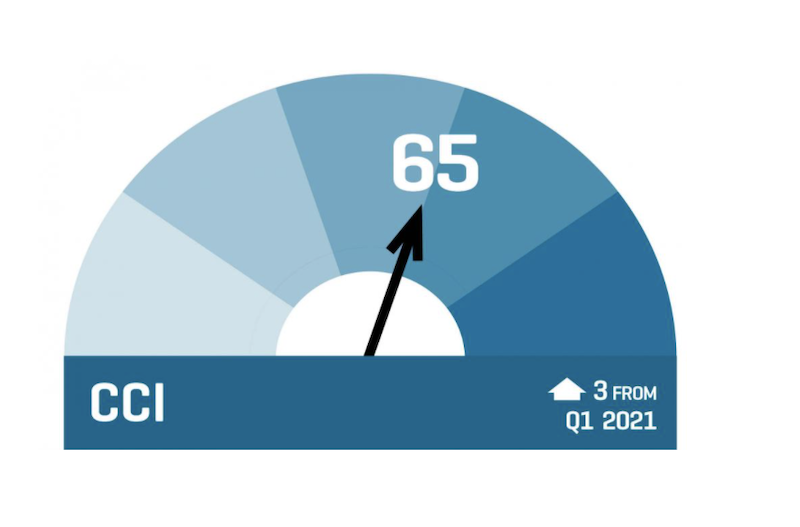

Despite the materials challenges, the overall Index score rose three points to 65 (its highest reading since a score of 74 in Q1 2020 ahead of the pandemic) and contractors are optimistic on outlook for revenue expectations, new business

— 89% of contractors report a moderate to high level of confidence in new business opportunities in the next 12 months, up from 86% in Q1. Those indicating a high level of confidence jumped 10 points to 34% from last quarter.

— Over half (52%) of contractors say they will hire more employees in the next six months, up from 46% in Q1.

— More contractors (39%) expect

— For the first time in a year, the percentage of contractors planning to spend more on tools and equipment in the next six months (44%) is higher than those who say they will not spend more (42%).

“Businesses are experiencing a great resurgence as vaccines allow the economy to fully reopen. Rising optimism from the commercial construction industry reflects what we’re seeing across the broader economy,” said U.S. Chamber of Commerce Executive Vice President and Chief Policy Officer Neil Bradley. “However, contractors continue to face challenges navigating materials shortages and

Materials Shortages Worsen

Most (84%) contractors say they face at least one material shortage, up from 71% in Q1. One in three (33%) are experiencing a shortage in wood/lumber, and 29% are seeing a shortage of steel. Of those contractors experiencing shortages, 46% say they are having a high impact on projects, up from 20% saying the same in Q1.

Additionally, almost all (94%) contractors say cost fluctuations are having a moderate to high impact on their business, up 12 percentage points from Q1 and up 35 points year-over-year. Wood/lumber and steel are the products of highest concern.

Contractors Face Worker Shortage Crisis

In the midst of a deepening workforce crisis, finding skilled labor continues to be a challenge for contractors. This quarter, 88% report moderate to high levels of difficulty finding skilled workers, of which, nearly half (45%) report a high level of difficulty. Of those who reported difficulty finding skilled labor, over a third (35%) have turned down work because of skilled labor shortages.

Most (87%) contractors also report a moderate to high level of concern about the cost of skilled labor. Of those who expressed concern, 64% say the cost has increased over the past six months, and more than three-quarters (77%) expect it to continue to increase over the next year.

Trade and Tariff Concerns are Up

This quarter, contractors expressed increasing concern about the potential effect of tariffs and trade wars on access to materials over the next three years.

More (45%) say steel and aluminum tariffs will have a high to very-high degree of impact, up from 35% in Q1. Forty percent now say new construction material and equipment tariffs will have a high to very-high degree of impact, up from 29% in Q1. And 30% expect high impacts from trade conflicts with other countries, up from 19% in Q1.

About the Index

The U.S. Chamber of Commerce Commercial Construction Index is a quarterly economic index designed to gauge the outlook for, and resulting confidence in, the commercial construction industry. The Index comprises three leading indicators to gauge confidence in the commercial construction industry, generating a composite Index on the scale of 0 to 100 that serves as an indicator of health of the contractor segment on a quarterly basis.

The Q2 2021 results from the three key drivers are:

— Revenue: Contractors’ revenue expectations over the next 12 months increased to 61 (up four points from Q1).

— New Business Confidence: The overall level of contractor confidence increased to 62 (up three points from Q1).

— Backlog: The ratio of average current to ideal backlog rose three points to 72 (up three points from Q1).

The research was developed with Dodge Data & Analytics (DD&A), the leading provider of insights and data for the construction industry, by surveying commercial and institutional contractors.

Visit www.

Related Stories

Engineers | May 3, 2017

At first buoyed by Trump election, U.S. engineers now less optimistic about markets, new survey shows

The first quarter 2017 (Q1/17) of ACEC’s Engineering Business Index (EBI) dipped slightly (0.5 points) to 66.0.

Market Data | May 2, 2017

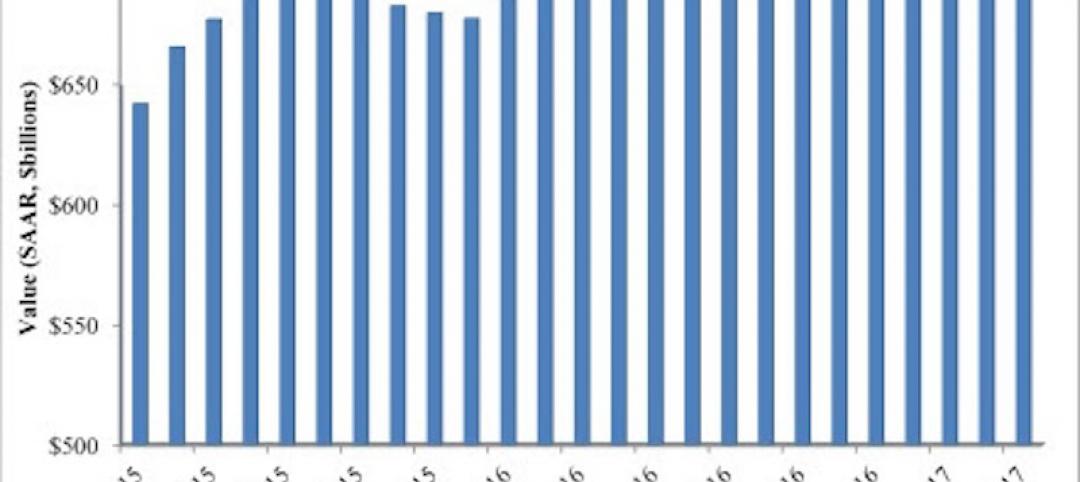

Nonresidential Spending loses steam after strong start to year

Spending in the segment totaled $708.6 billion on a seasonally adjusted, annualized basis.

Market Data | May 1, 2017

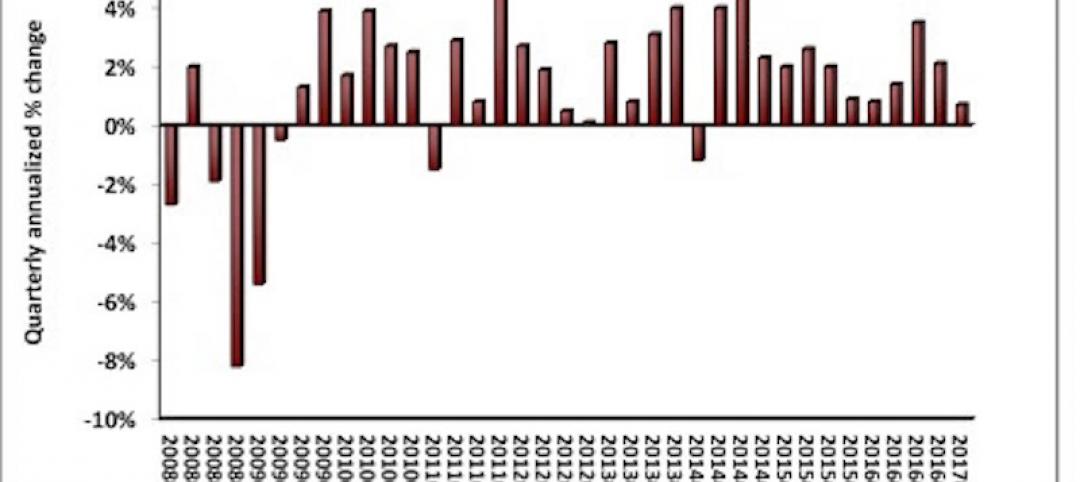

Nonresidential Fixed Investment surges despite sluggish economic in first quarter

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year.

Industry Research | Apr 28, 2017

A/E Industry lacks planning, but still spending large on hiring

The average 200-person A/E Firm is spending $200,000 on hiring, and not budgeting at all.

Market Data | Apr 19, 2017

Architecture Billings Index continues to strengthen

Balanced growth results in billings gains in all regions.

Market Data | Apr 13, 2017

2016’s top 10 states for commercial development

Three new states creep into the top 10 while first and second place remain unchanged.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

Market Data | Apr 3, 2017

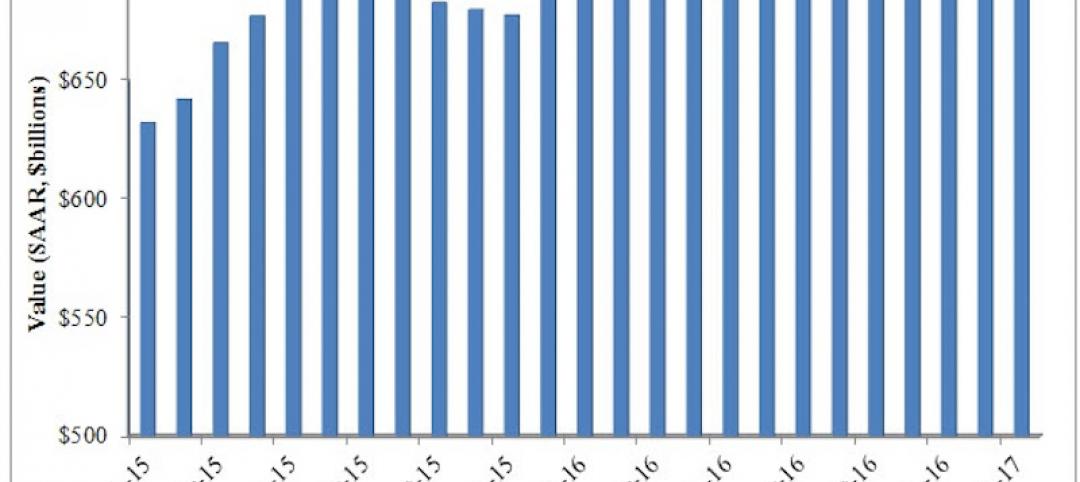

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

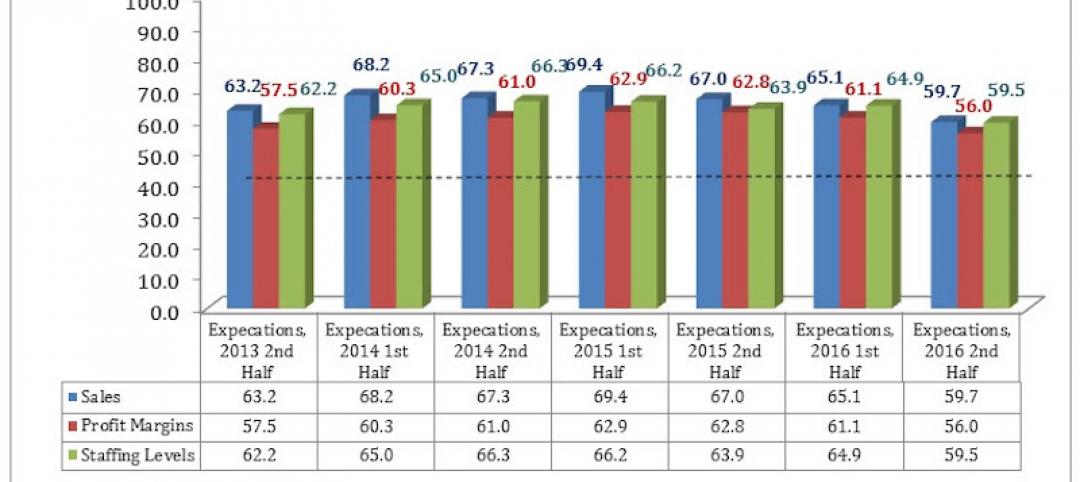

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.