The Tax Cuts and Jobs Act of 2017 created the designation “Opportunity Zone,” for which the Internal Revenue Service will allow tax advantages for certain investments in lower-income areas when an Opportunity Fund invests more than 90% of its assets in a zoned property.

As of last December, there were nearly 8,800 Opportunity Zones in the U.S. and its five possessions, according to the Treasury Department. Developers must invest in Qualified Opportunity Zones by the end of this year to meet a seven-year holding period that allows them to exclude 15% of the deferred capital gain. The IRS is in the final stages of finalizing this program’s regulatory framework.

One such investment entity is Chicago-based Decennial Group, which is targeting investment of $1 billion in development projects to leverage the tax incentives created by the 2017 law. Over the next decade the JV could look to invest up to $20 billion for new projects, according to The Real Deal, which also reports that Decennial Group is exploring 250 potential projects in Opportunity Zones around the country, and is in advanced negotiations on at least three projects.

Decennial Group is a joint venture comprised of Scott Goodman, the founding principal of Farpoint Development, a real estate development company; Bob Clark, founder and CEO of Clayco, the full-service development, planning, architecture, engineering, and construction firm; and Shawn Clark, president of CRG, Clayco’s real estate and development company.

According to a prepared statement, Decennial Group will focus on commercial, industrial, multifamily, and energy projects located in Opportunity Zones, and especially in America’s heartland region.

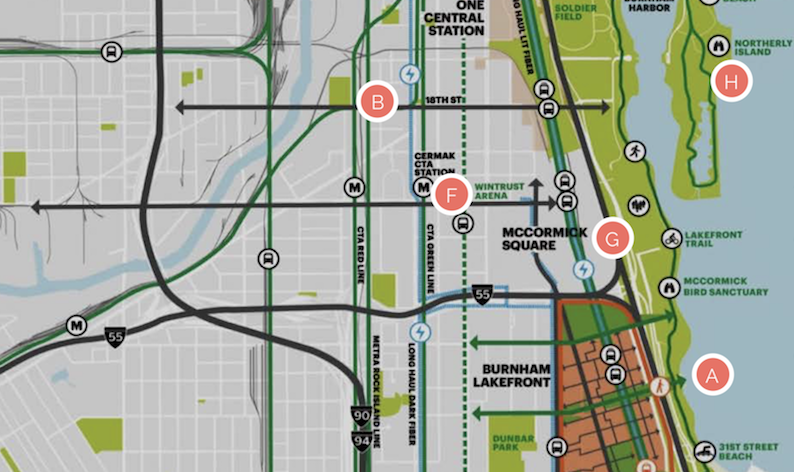

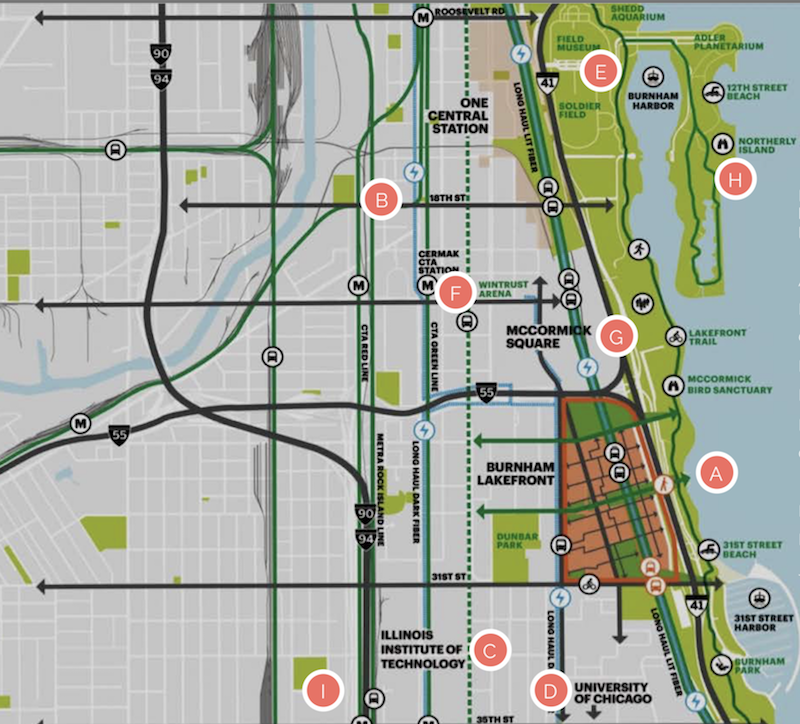

One of Farpoint Development's investments is Burnham Lakefront, located within an Opportunity Zone on Chicago's South Side. Image: Farpoint Development

Among Goodman’s development projects is Burnham Lakefront, a 100-acre campus within a recently designated Opportunity Zone that’s the former site of Michael Reese Hospital near the McCormick Place Marshalling Yard on Chicago South Side. The developer is planning 12 million sf of vertical construction along two miles of lakefront.

“Decennial will make smart, long-term investments throughout the country, but we will begin by capitalizing on deep relationships and an already strong pipeline of deals in the Heartland, where we have unparalleled investing experience,” says Goodman.

Bob Clark adds that CRG will provide development and site selection expertise as well as design-build services so that Decennial Group can “act quickly on great OZ opportunities around the country.”

Decennial Group is distinguishing itself from other OZ funds with a renewable energy strategy that’s being led by David Pavlik, cofounder and principal with 11 Million Acres, a leading energy real estate development platform that has structured over $2 billion in renewable energy and infrastructure projects.

The joint venture has tapped Steve Glickman, founder and CEO of Washington D.C.-based Develop LLC, as a senior advisor to the management team. Glickman is cofounder and former CEO of the economic Innovation Group, which was an architect of the Opportunity Zone program.

Related Stories

Mixed-Use | Jul 22, 2020

Skanska selects Pickard Chilton to design innovative office tower in Bellevue, Wash.

The 800,000-gsf mixed-use project is located at 10660 NE 8th Street.

Mixed-Use | Jul 21, 2020

Phase one of The Orbit masterplan detailed for Innisfil, Ontario

Partisans is designing the project.

Mixed-Use | Jul 20, 2020

J. Small Investments, Lyda Hill Philanthropies have unveiled plans for a 23-acre mixed-use development in Dallas

The vacant campus was purchased from ExxonMobil Oil Corporation in 2015.

Mixed-Use | Jul 17, 2020

Ryan Companies breaks ground on 122-acre Highland Bridge redevelopment in St. Paul, Minn.

The community’s goal is to provide 100% renewable energy to its houses and businesses.

Mixed-Use | Jul 15, 2020

1928 hotel reimagined as new residential and cultural hub in Merced, Calif.

Page & Turnbull designed the project.

Mixed-Use | Jul 14, 2020

Apartments and condos occupy what was once a five-story car dealership

Wisznia | Architecture+Development designed, developed, and is managing the project.

Mixed-Use | Feb 21, 2020

SB Architects to design Fort Lauderdale’s FATVillage mixed-use destination

The project will build upon the existing FATVillage Arts District.

Mixed-Use | Feb 14, 2020

Kenya’s Pinnacle Tower will be the tallest tower in Africa

ArchGroup Consultants is designing the project.

Mixed-Use | Feb 13, 2020

1010 On-The-Rhine creates a walkable destination in Cincinnati

GBBN designed the project.

Sustainability | Feb 12, 2020

KPF unveils The Pinnacle at Central Wharf, a high-performance, resilient tower

The project will reconnect Downtown Boston to the waterfront.