The Tax Cuts and Jobs Act of 2017 created the designation “Opportunity Zone,” for which the Internal Revenue Service will allow tax advantages for certain investments in lower-income areas when an Opportunity Fund invests more than 90% of its assets in a zoned property.

As of last December, there were nearly 8,800 Opportunity Zones in the U.S. and its five possessions, according to the Treasury Department. Developers must invest in Qualified Opportunity Zones by the end of this year to meet a seven-year holding period that allows them to exclude 15% of the deferred capital gain. The IRS is in the final stages of finalizing this program’s regulatory framework.

One such investment entity is Chicago-based Decennial Group, which is targeting investment of $1 billion in development projects to leverage the tax incentives created by the 2017 law. Over the next decade the JV could look to invest up to $20 billion for new projects, according to The Real Deal, which also reports that Decennial Group is exploring 250 potential projects in Opportunity Zones around the country, and is in advanced negotiations on at least three projects.

Decennial Group is a joint venture comprised of Scott Goodman, the founding principal of Farpoint Development, a real estate development company; Bob Clark, founder and CEO of Clayco, the full-service development, planning, architecture, engineering, and construction firm; and Shawn Clark, president of CRG, Clayco’s real estate and development company.

According to a prepared statement, Decennial Group will focus on commercial, industrial, multifamily, and energy projects located in Opportunity Zones, and especially in America’s heartland region.

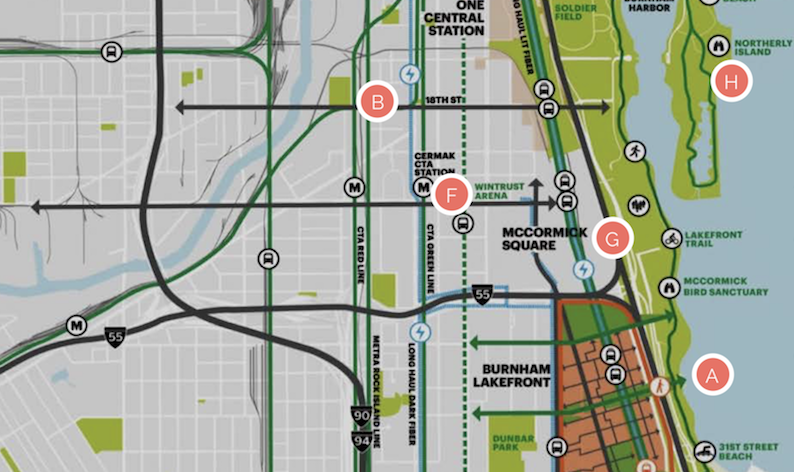

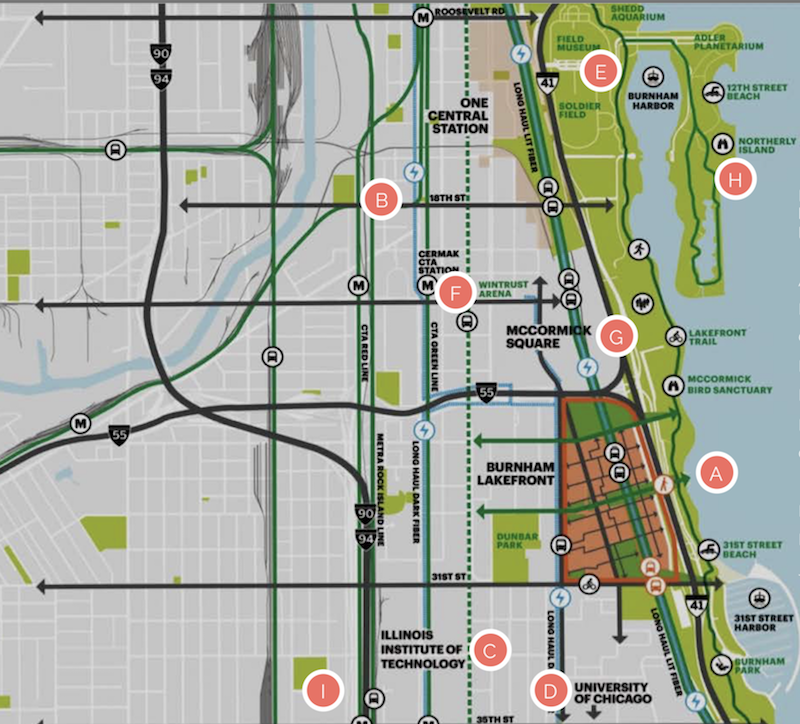

One of Farpoint Development's investments is Burnham Lakefront, located within an Opportunity Zone on Chicago's South Side. Image: Farpoint Development

Among Goodman’s development projects is Burnham Lakefront, a 100-acre campus within a recently designated Opportunity Zone that’s the former site of Michael Reese Hospital near the McCormick Place Marshalling Yard on Chicago South Side. The developer is planning 12 million sf of vertical construction along two miles of lakefront.

“Decennial will make smart, long-term investments throughout the country, but we will begin by capitalizing on deep relationships and an already strong pipeline of deals in the Heartland, where we have unparalleled investing experience,” says Goodman.

Bob Clark adds that CRG will provide development and site selection expertise as well as design-build services so that Decennial Group can “act quickly on great OZ opportunities around the country.”

Decennial Group is distinguishing itself from other OZ funds with a renewable energy strategy that’s being led by David Pavlik, cofounder and principal with 11 Million Acres, a leading energy real estate development platform that has structured over $2 billion in renewable energy and infrastructure projects.

The joint venture has tapped Steve Glickman, founder and CEO of Washington D.C.-based Develop LLC, as a senior advisor to the management team. Glickman is cofounder and former CEO of the economic Innovation Group, which was an architect of the Opportunity Zone program.

Related Stories

Mixed-Use | Apr 28, 2021

The Dime is Williamsburg’s newest mixed-use development

Fogarty Finger designed the project.

Mixed-Use | Apr 22, 2021

Jakarta’s first supertall tower tops out

The project will anchor the Thamrin Nine development.

Mixed-Use | Apr 20, 2021

EskewDumezRipple and Wolf Ackerman unveil the Center for Developing Entrepreneurs

The Charlottesville, Va. project is slated for completion later this year.

Mixed-Use | Apr 19, 2021

BIG unveils design for the new OPPO R&D Headquarters in Hangzhou’s Future Sci-Tech City

The project sits between a natural lake, an urban center, and a 10,000-sm park.

Mixed-Use | Apr 16, 2021

Wrigleyville Lofts to bring 120 apartment units to Chicago’s Wrigleyville neighborhood

The project will also include 14,000 sf of ground floor retail.

Mixed-Use | Apr 8, 2021

New mixed-use development under construction at Naperville’s CityGate Centre

The project will comprise 285 multifamily units and the shell for a future event center.

Mixed-Use | Apr 7, 2021

New mixed-use rental community breaks ground in Chicago’s Bronzeville neighborhood

The building marks the latest phase of the Oakwood Shores revitalization plan.

Mixed-Use | Mar 24, 2021

Austin United Alliance’s proposal selected for redevelopment of Chicago’s Austin-Laramie State Bank site

The winning scheme was chosen from among six others.

Mixed-Use | Mar 22, 2021

Mixed-use, mixed-income development under construction in Salt Lake City

KTGY Architecture + Planning is designing the project.

Mixed-Use | Mar 9, 2021

47-story residential and office building set for San Francisco’s new ‘Hub’

Solomon Cordwell Buenz designed the project.