According to the year-end Lodging Econometrics (LE) Construction Pipeline Trend Report for Canada, analysts at LE state that Canada’s hotel construction pipeline ended 2021’s fourth quarter at 262 projects/35,325 rooms. The pipeline is down a mere 3% by projects and up 2% by rooms, year-over-year (YOY).

At the close of 2021, projects under construction stand at 62 projects/8,100 rooms. Projects scheduled to start construction in the next 12 months stand at 85 projects/10,536 rooms and projects in the early planning stage are at an all-time high at Q4 with 115 projects/16,689 rooms, a 15% increase by projects and 14% by rooms YOY.

Leisure and business travel has increased in recent months thanks to the holiday season and the country’s COVID booster rollout program, that was executed more quickly than expected.

Ontario continues to lead Canada’s construction pipeline in Q4, reaching the province’s highest project count since Q4‘19, with 154 projects/19,818 rooms. Ontario accounts for 59% of the projects and 56% of the rooms in Canada’s total pipeline. British Columbia follows with 37 projects/5,675 rooms, then Alberta with 24 projects/3,739 rooms, and Quebec with 18 projects/2,481 rooms.

Markets with the most projects in the pipeline continue to be led by Toronto, at an all-time high, with 65 projects/9,621 rooms. Toronto, alone, has 25% of all the projects in Canada’s construction pipeline. Distantly following are Vancouver with 14 projects/2,016, then Niagara Falls with 13 projects/2,341 rooms, Montreal with 13 projects/1,956 rooms, and Ottawa with 10 projects/1,694 rooms. These top five cities, combined, account for 44% of the projects and 50% of the rooms in Canada’s total pipeline.

The top hotel franchise company in Canada's construction pipeline at Q4‘21 is Marriott International, at all-time high of 71 projects/8,890 rooms. Hilton Worldwide follows closely with 65 projects/7,870 rooms, then InterContinental Hotels Group (IHG) with 47 projects/4,732 rooms. These three companies claim 70% of the projects and 61% of the rooms in the country’s total construction pipeline.

The top brands in Canada’s pipeline are Hampton by Hilton, with 26 projects/2,946 rooms and IHG’s Holiday Inn Express, with 24 projects/2,461 rooms. Next is Marriott’s TownePlace Suites, at record counts, with 17 projects/1,817 rooms. This is followed by Hilton’s Home2Suites with 16 projects/1,706 rooms, then Marriott’s Fairfield Inn brand with 16 projects/1,533 rooms.

Canada had 35 new hotels with 3,742 rooms open in 2021 at a growth rate of 1.1%. In 2022, the country is forecast to have a growth rate of 1.2% with 38 new hotels/4,251 rooms expected to open. LE is forecasting a slight increase in Canada’s growth rate to 1.3% in 2023 and expects 41 new hotels/4,632 rooms to open by year-end.

Related Stories

Market Data | May 12, 2022

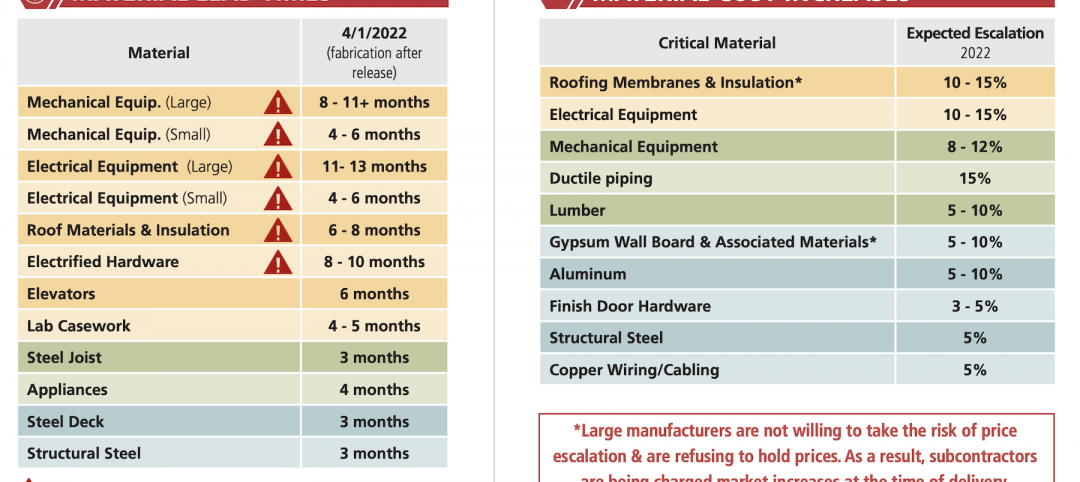

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

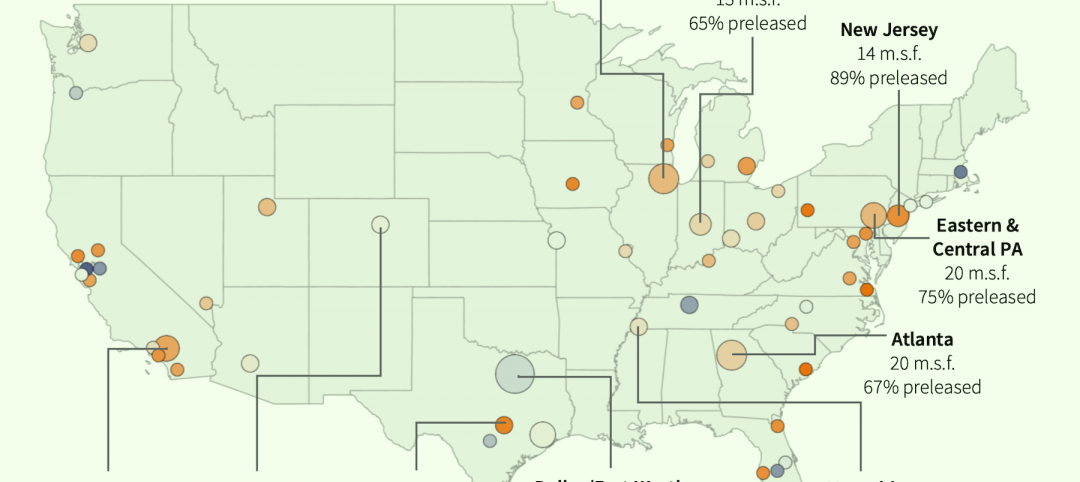

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.