Construction backlog for large contractors reached a new peak of 14.06 months during the second quarter of 2016 according to the Associated Builders and Contractors (ABC) Construction Backlog Indicator (CBI) released today. The new high for companies with annual revenue above $100 million shattered the previous high of 12.25 months for any revenue segment, which was recorded in the first quarter of 2016 and second quarter of 2013.

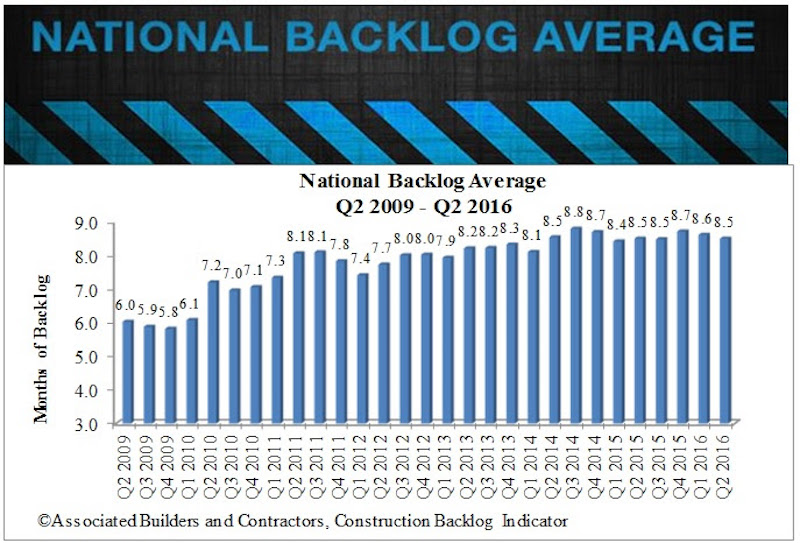

Nationally, average backlog fell to 8.5 months during the second quarter, down 1.6 percent from the prior quarter. CBI remained virtually unchanged on a year-over-year basis, signaling that growth in the nation’s nonresidential construction industry is slowing.

“There are a number of potential explanatory factors regarding the lack of growth in backlog, the most obvious of which is the continued slow growth of the economy,” says ABC Chief Economist Anirban Basu. “Financial regulators have begun to express growing concern regarding possible bubbles forming in certain real estate segments in certain cities, which may have rendered the developer financing environment somewhat more challenging. A slowdown in business investment, including in energy-related sectors, has undoubtedly also played a role.”

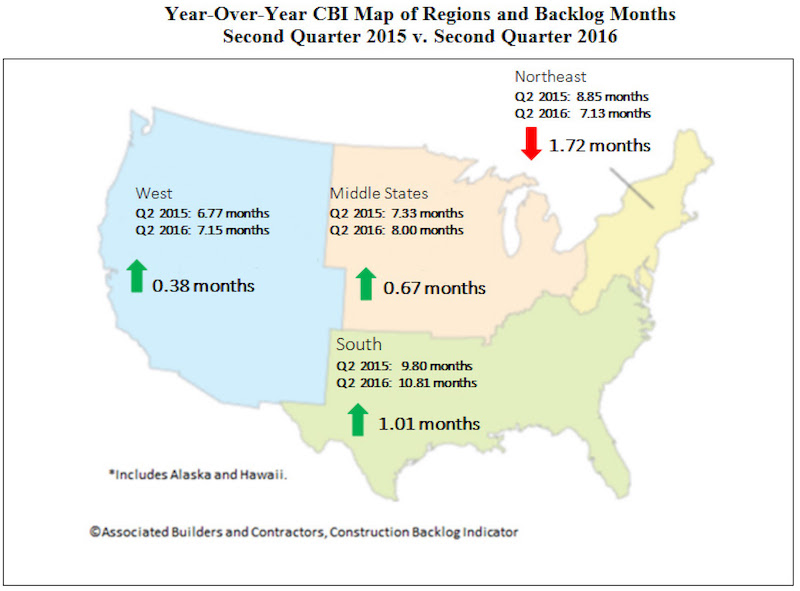

Regional Highlights

- Contractors in the South have reported average backlog in excess of 10 months for fourth consecutive quarters. Backlog in the South has never been higher than it has been over the past year, with significant activity reported in several South Carolina, Georgia and Florida markets.

- Backlog in the West expanded during the second quarter, with contractors in Seattle, Portland, Boise and in a number of California markets reporting still expanding backlog. Many contractors report both more private and public contracting as local governments scramble to accommodate rapidly expanding populations.

- Backlog in the Middle States hit the eight-month threshold, the highest level recorded in the history of the series. The expansion of the U.S. auto sector appears to be disproportionately responsible.

Sector Highlights

- Average backlog in the heavy industrial category rose to 7.4 months during the second quarter, the highest level on record. The U.S. auto industry appears to be largely responsible, with contractors in Mississippi, Tennessee, Indiana and other significant auto supply markets reported stable to rising backlog levels.

- Backlog in the infrastructure category declined for a second consecutive quarter during the second quarter, but remains well above 10 months. Only on two occasions have infrastructure contractors reported higher backlog. However, the impact of the passage of a federal highway bill last year has been generally less than anticipated.

Highlights by Company Size

- Backlog for firms with revenue less than $30 million—the smallest delineation—declined by 0.1 months in the second quarter and has now fallen during five of the previous seven quarters. These firms are among the most likely to be limited by skilled labor shortfalls, which prevent them from effectively bidding on larger projects, thereby setting the stage for gradual declines in backlog.

- A softening of backlog in the northeast helps to explain the year-over-year decline in backlog among firms in the $30-$100 million annual revenue category.

- Large industrial projects represent a primarily explanatory factor behind the surge in backlog among the largest construction firms. Large-scale industrial projects have been reported in Texas, Louisiana and other markets, setting the stage for stable to rising construction investment in those markets. Over the past two years, construction volumes have been falling in a number of Texas and Louisiana markets, likely attributable to diminished oil and natural gas prices.

Related Stories

Market Data | Jun 14, 2016

Transwestern: Market fundamentals and global stimulus driving economic growth

A new report from commercial real estate firm Transwestern indicates steady progress for the U.S. economy. Consistent job gains, wage growth, and consumer spending have offset declining corporate profits, and global stimulus plans appear to be effective.

Market Data | Jun 7, 2016

Global construction disputes took longer to resolve in 2015

The good news: the length and value of disputes in the U.S. fell last year, according to latest Arcadis report.

Market Data | Jun 3, 2016

JLL report: Retail renovation drives construction growth in 2016

Retail construction projects were up nearly 25% year-over-year, and the industrial and office construction sectors fared well, too. Economic uncertainty looms over everything, however.

Market Data | Jun 2, 2016

ABC: Nonresidential construction spending down in April

Lower building material prices, a sluggish U.S. economy, and hesitation among private developers all factor into the 2.1% drop.

Market Data | May 20, 2016

Report: Urban area population growth slows

Older Millennials are looking to buy homes and move away to more affordable suburbs and exurbs.

Market Data | May 17, 2016

Modest growth for AIA’s Architecture Billings Index in April

The American Institute of Architects reported the April ABI score was 50.6, down from the mark of 51.9 in the previous month. This score still reflects an increase in design services.

Market Data | Apr 29, 2016

ABC: Quarterly GDP growth slowest in two years

Bureau of Economic Analysis data indicates that the U.S. output is barely growing and that nonresidential investment is down.

Market Data | Apr 20, 2016

AIA: Architecture Billings Index ends first quarter on upswing

The multi-family residential sector fared the best. The Midwest was the only U.S. region that didn't see an increase in billings.

Building Technology | Apr 11, 2016

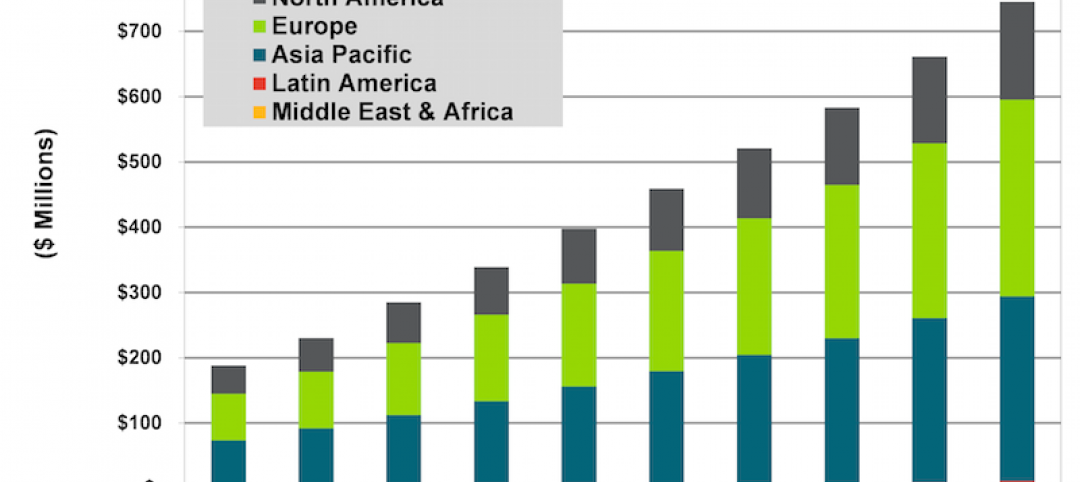

A nascent commercial wireless sensor market is poised to ascend in the next decade

Europe and Asia will propel that growth, according to a new report from Navigant.

Industry Research | Apr 7, 2016

CBRE provides latest insight into healthcare real estate investors’ strategies

Survey respondents are targeting smaller acquisitions, at a time when market cap rates are narrowing for different product types.