Altus Group Limited (“Altus Group”) (TSX: AIF), a provider of software, data solutions and independent advisory services to the global commercial real estate industry, recently released the Altus Group Real Estate Development Trends Report, which provides an outlook of a global property development industry being hit by rapid change from disruptive market forces that did not exist a few years ago or have evolved substantially.

According to the report, which is based on a global survey of more than 400 property development executives, 68% said cost escalation is the biggest business challenge they are facing over the next five years. Several related factors account for this, which in combination are creating a ‘domino effect’ for developers:

- 34% of developers view cross-border trade policy as having a negative impact on the industry as uncertainty continues about future implications stemming from international tariffs and trade agreements

- 65% of developers are facing challenges with labour shortages, which are exacerbated by government policy and booming demand

- 60% of developers are concerned about the development approval process which is often complex and protracted

“It’s clear from the report that the global development sector is facing an increasingly complex set of challenges and rapid change, from escalating construction costs through to a sea-change in the development financing environment,” said Bob Courteau, Chief Executive Officer, Altus Group. “However, development leaders clearly see significant opportunities to manage risk and take advantage of changing conditions through a number of future-ready strategies including investments in technology and performance management along with consideration of new ways of managing and financing projects.”

When asked about the impact of emerging technologies on the property development industry, many respondents expressed a significant degree of uncertainty around some technologies that are experiencing successful application and adoption in other industries. Only a minority of respondents recognized a potential for major disruptive change with certain technologies:

- 3D printing – 65% see little to no impact / 16% anticipate major disruptive change

- Process automation – 56% see little to no impact / 22% anticipate major disruptive change

- Augmented reality/Virtual reality – 45% see little to no impact / 20% anticipate major disruptive change

Development industry leaders seem to have significant reservations about the potential impact of 3D printing, a rapidly evolving technology which is already being applied successfully to smaller scale development projects in countries such as China, Netherlands and USA.

Respondents, however, appeared to acknowledge the potential of more established technologies. Smart building technologies were regarded as the most disruptive, with 49% expecting major disruptive changes, and 42% anticipating a significant impact on efficiencies and how development is conducted.

Finally, the report also indicated a decade-on shift since the financial crisis in financing patterns, away from traditional and institutional lending, with 82% of respondents reporting they were utilizing at least one source of alternative financing while 46% are using traditional or institutional financing. Further, over 45% indicated they were considering, planning or utilizing some form of alternative financing exclusively.

This shift has coincided with a rapidly expanding range of financial options and sources coupled with a substantial increase in global capital inflow into real estate in recent years. Many alternative lenders and private funds have actively positioned themselves toward the space of traditional lenders, with investors increasingly seeing real estate as an income source as well as an opportunity for premium returns on the equity and joint venture structure side. In addition, there has been an increase and acceleration in the adoption and utilization of real estate joint ventures with 62% of development executives indicating they are considering entering into partnerships or joint ventures.

Related Stories

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

Retail Centers | Mar 16, 2016

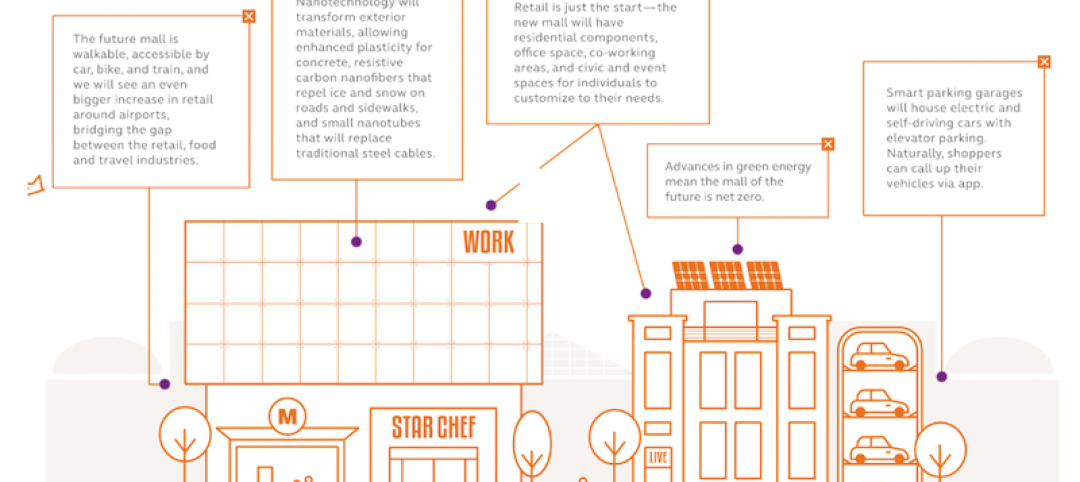

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.