The new Trump Administration’s aggressive policies, particularly on international trade and immigration reform, could, if executed as planned, “greatly affect” how America’s construction industry does business this year and beyond.

In its Q4 2016 Construction Outlook, which it released earlier this week, JLL also continued to see construction labor as a “pain point” for the industry that will cause wages to rise and impact project timelines and budgets. And materials costs, which for the most part stabilized in the latter months of 2016, should hold steady if, as expected, construction activity slows this year.

Twenty-sixteen was a banner year for construction spending. Led by the hotel and office sectors, spending increased over the previous year by 4.5% to $1.2 trillion. That rate of growth was nearly triple the GDP inflation rate.

Nationally, the construction and contractor backlog in Q4 2016 stood at 8.7 months of future work across all sectors, up 2.2 percent from the fourth quarter 2015 and tracking closely with national trends. The Midwest in particular enjoyed sizable year-over-year growth that quarter, while work in the South remains steady. The Northeast and West regions continued to slip, each well below 2015 levels.

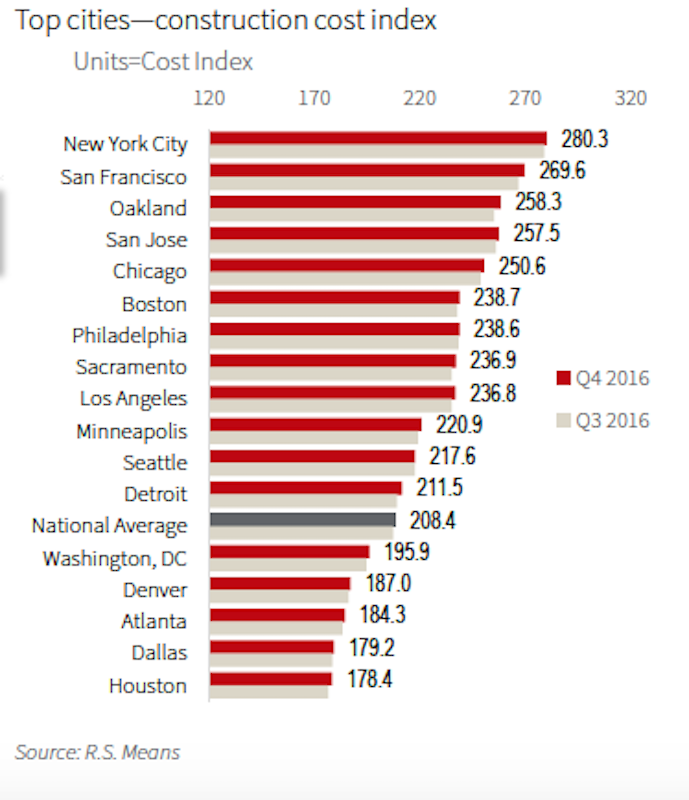

Not surprisingly, construction costs are rising faster in metros where construction activity has been robust, but also where labor is in shorter supply. Image: JLL Research

Building costs rose nationally by a modest 2.7%, with nearly half of that increase occurring in the fourth quarter, spurred by strong residential construction that drove demand, and uncertainly surrounding the effects of the Trump presidency.

JLL doesn’t expect the manifestations of policy decisions coming out of Washington to intervene on the construction industry until later this year. But JLL’s forecast strikes a cautionary pose about the prospects of “voided international trade deals and new import tariffs [that] could drive up materials costs faster.”

And at a time when construction unemployment continues to fall—last week, AGC America reported that from January 2016 to January 2017 construction employment rose in 39 states and in 216 of 358 metro areas—immigration reform “could shrink the skilled labor supply and spur further wage increases,” says JLL’s report. Large-scale infrastructure projects will create a premium on materials and workforce in specific markets such as Oakland and San Francisco, Chicago, and New York.

Inflation in materials costs is harder to gauge when trade agreements are in flux. The largest price swings in 4Q 2016 were seen on the cement and lumber fronts: cement costs were down 4.7% compared to the same time last year, while lumber was priced 9%-plus higher. Steel, on the other hand, maintained negligible price changes, not even breaking one-tenth of a percentage point over third-quarter prices.

One barometer worth keeping an eye on is the IHS Markit PEG Engineering and Construction Cost Index, which tracks procurement activity among engineering and construction firms. In March, that Index registered its fifth consecutive month of rising prices.

Eight of 12 materials/equipment categories tracked showed rising prices in March. And the six-month expectation index stayed positive, although materials and equipment prices are projected to rise at a slower pace than subcontractor labor.

Related Stories

Hotel Facilities | Jul 28, 2022

As travel returns, U.S. hotel construction pipeline growth follows

According to the recently released United States Construction Pipeline Trend Report from Lodging Econometrics (LE), the total U.S. construction pipeline stands at 5,220 projects/621,268 rooms at the close of 2022’s second quarter, up 9% Year-Over-Year (YOY) by projects and 4% YOY by rooms.

Codes and Standards | Jul 22, 2022

Hurricane-resistant construction may be greatly undervalued

New research led by an MIT graduate student at the school’s Concrete Sustainability Hub suggests that the value of buildings constructed to resist wind damage in hurricanes may be significantly underestimated.

Market Data | Jul 21, 2022

Architecture Billings Index continues to stabilize but remains healthy

Architecture firms reported increasing demand for design services in June, according to a new report today from The American Institute of Architects (AIA).

Market Data | Jul 21, 2022

Despite deteriorating economic conditions, nonresidential construction spending projected to increase through 2023

Construction spending on buildings is projected to increase just over nine percent this year and another six percent in 2023, according to a new report from the American Institute of Architects (AIA).

Building Team | Jul 18, 2022

Understanding the growing design-build market

FMI’s new analysis of the design-build market forecast for the next fives years shows that this delivery method will continue to grow, despite challenges from the COVID-19 pandemic.

Market Data | Jul 1, 2022

Nonresidential construction spending slightly dips in May, says ABC

National nonresidential construction spending was down by 0.6% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Jun 30, 2022

Yardi Matrix releases new national rent growth forecast

Rents in most American cities continue to rise slightly each month, but are not duplicating the rapid escalation rates exhibited in 2021.

Market Data | Jun 22, 2022

Architecture Billings Index slows but remains strong

Architecture firms reported increasing demand for design services in May, according to a new report today from The American Institute of Architects (AIA).

Building Team | Jun 17, 2022

Data analytics in design and construction: from confusion to clarity and the data-driven future

Data helps virtual design and construction (VDC) teams predict project risks and navigate change, which is especially vital in today’s fluctuating construction environment.

Market Data | Jun 15, 2022

ABC’s construction backlog rises in May; contractor confidence falters

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to nine months in May from 8.8 months in April, according to an ABC member survey conducted May 17 to June 3. The reading is up one month from May 2021.