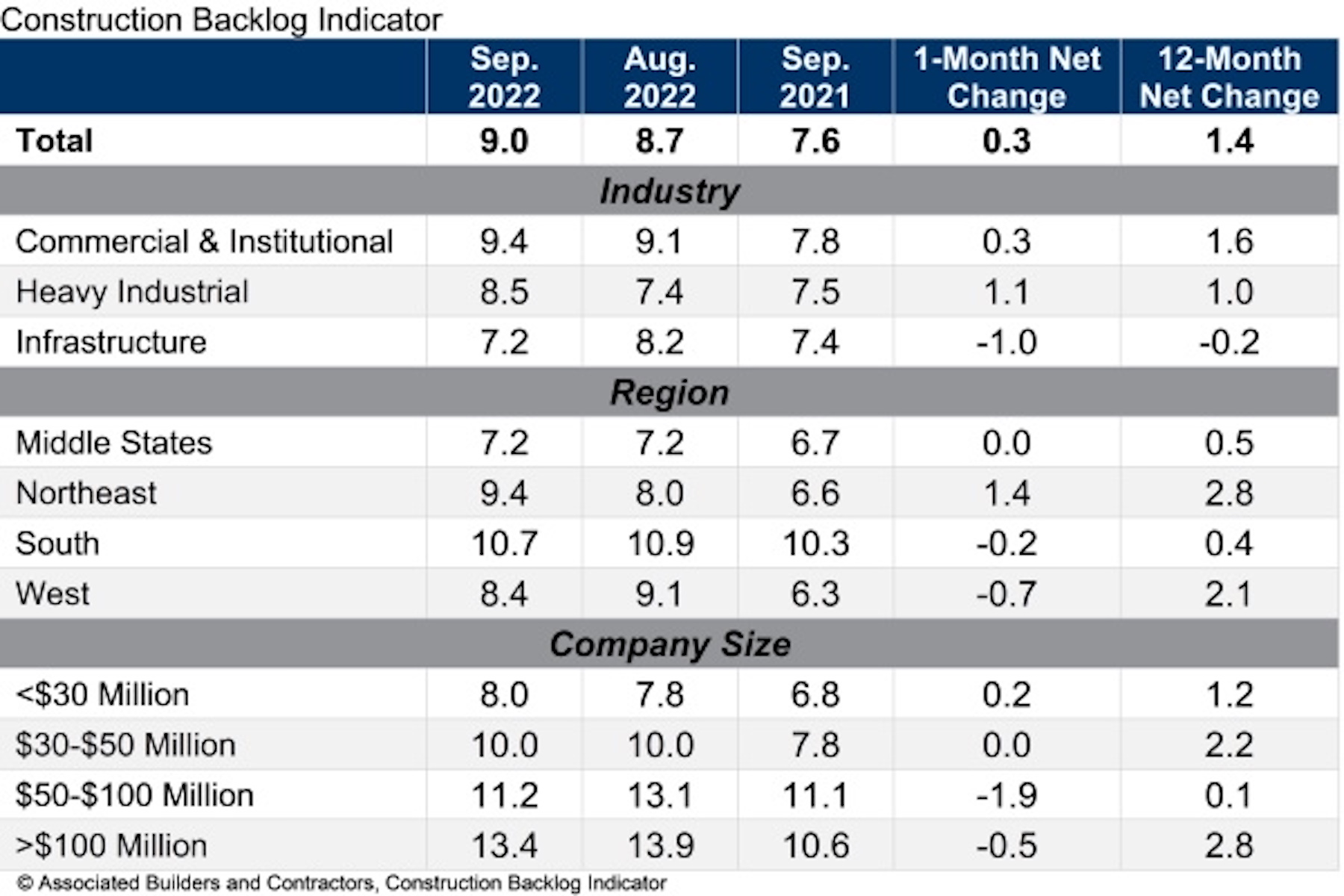

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to 9.0 months in September, according to an ABC member survey conducted Sept. 20 to Oct. 5. The reading is 1.4 months higher than in September 2021.

View ABC’s Construction Backlog Indicator and Construction Confidence Index tables for September 2022.

Backlog reached its highest level since May 2022 and is once again above the level observed at the start of the pandemic (8.9 months in February 2020). Backlog in heavy industrial increased sizably in September, spurred by a 21.5% year-over-year increase in manufacturing-related construction spending.

ABC’s Construction Confidence Index readings for profit margins and staffing levels increased in September, while the reading for sales moved slightly lower. All three readings remain above the threshold of 50, indicating expectations of growth over the next six months.

“The construction confidence and backlog metrics appear strong despite the U.S. economy facing headwinds like inflation, financial market volatility and rapidly rising borrowing costs,” said ABC Chief Economist Anirban Basu. “Contractors remain decidedly upbeat, with backlog expanding and expectations for rising sales, employment and profit margins over the next six months.

“One would think the recent surge in interest rates would be enough to dampen contractor confidence,” said Basu. “Instead, project owners continue to move forward with a significant number of projects. Faced with high demand for their services, contractors continue to show pricing power, helping to offset rising compensation and other construction delivery costs.”

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12, 2020, to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months.

Related Stories

Market Data | Feb 10, 2016

Nonresidential building starts and spending should see solid gains in 2016: Gilbane report

But finding skilled workers continues to be a problem and could inflate a project's costs.

Market Data | Feb 9, 2016

Cushman & Wakefield is bullish on U.S. economy and its property markets

Sees positive signs for construction and investment growth in warehouses, offices, and retail

Market Data | Feb 5, 2016

CMD/Oxford forecast: Nonresidential building growth will recover modestly in 2016

Increased government spending on infrastructure projects should help.

Market Data | Feb 4, 2016

Mortenson: Nonresidential construction costs expected to increase in six major metros

The Construction Cost Index, from Mortenson Construction, indicated rises between 3 and 4% on average.

Contractors | Feb 1, 2016

ABC: Tepid GDP growth a sign construction spending may sputter

Though the economy did not have a strong ending to 2015, the data does not suggest that nonresidential construction spending is set to decline.

Data Centers | Jan 28, 2016

Top 10 markets for data center construction

JLL’s latest outlook foresees a maturation in certain metros.

Market Data | Jan 20, 2016

Nonresidential building starts sag in 2015

CDM Research finds only a few positive signs among the leading sectors.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.

Market Data | Jan 15, 2016

ABC: Construction material prices continue free fall in December

In December, construction material prices fell for the sixth consecutive month. Prices have declined 7.2% since peaking in August 2014.

Market Data | Jan 13, 2016

Morgan Stanley bucks gloom and doom, thinks U.S. economy has legs through 2020

Strong job growth and dwindling consumer debt give rise to hope.