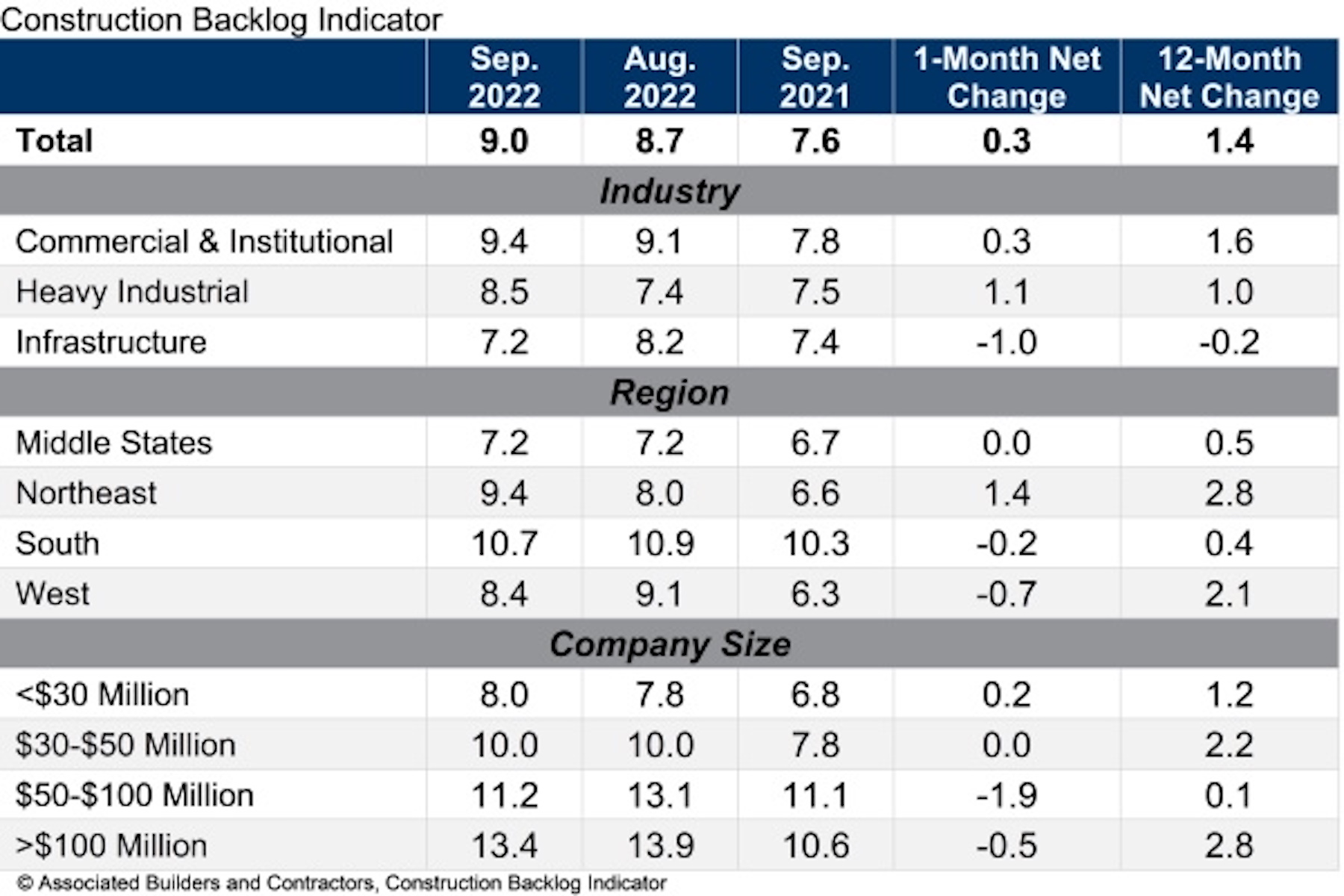

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to 9.0 months in September, according to an ABC member survey conducted Sept. 20 to Oct. 5. The reading is 1.4 months higher than in September 2021.

View ABC’s Construction Backlog Indicator and Construction Confidence Index tables for September 2022.

Backlog reached its highest level since May 2022 and is once again above the level observed at the start of the pandemic (8.9 months in February 2020). Backlog in heavy industrial increased sizably in September, spurred by a 21.5% year-over-year increase in manufacturing-related construction spending.

ABC’s Construction Confidence Index readings for profit margins and staffing levels increased in September, while the reading for sales moved slightly lower. All three readings remain above the threshold of 50, indicating expectations of growth over the next six months.

“The construction confidence and backlog metrics appear strong despite the U.S. economy facing headwinds like inflation, financial market volatility and rapidly rising borrowing costs,” said ABC Chief Economist Anirban Basu. “Contractors remain decidedly upbeat, with backlog expanding and expectations for rising sales, employment and profit margins over the next six months.

“One would think the recent surge in interest rates would be enough to dampen contractor confidence,” said Basu. “Instead, project owners continue to move forward with a significant number of projects. Faced with high demand for their services, contractors continue to show pricing power, helping to offset rising compensation and other construction delivery costs.”

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12, 2020, to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months.

Related Stories

Codes and Standards | Mar 1, 2022

Engineering Business Sentiment study finds optimism despite growing economic concerns

The ACEC Research Institute found widespread optimism among engineering firm executives in its second quarterly Engineering Business Sentiment study.

Codes and Standards | Feb 24, 2022

Most owners adapting digital workflows on projects

Owners are more deeply engaged with digital workflows than other project team members, according to a new report released by Trimble and Dodge Data & Analytics.

Market Data | Feb 23, 2022

2022 Architecture Billings Index indicates growth

The Architectural Billings Index measures the general sentiment of U.S. architecture firms about the health of the construction market by measuring 1) design billings and 2) design contracts. Any score above 50 means that, among the architecture firms surveyed, more firms than not reported seeing increases in design work vs. the previous month.

Market Data | Feb 15, 2022

Materials prices soar 20% between January 2021 and January 2022

Contractors' bid prices accelerate but continue to lag cost increases.

Market Data | Feb 4, 2022

Construction employment dips in January despite record rise in wages, falling unemployment

The quest for workers intensifies among industries.

Market Data | Feb 2, 2022

Majority of metro areas added construction jobs in 2021

Soaring job openings indicate that labor shortages are only getting worse.

Market Data | Feb 2, 2022

Construction spending increased in December for the month and the year

Nonresidential and public construction lagged residential sector.

Market Data | Jan 31, 2022

Canada's hotel construction pipeline ends 2021 with 262 projects and 35,325 rooms

At the close of 2021, projects under construction stand at 62 projects/8,100 rooms.

Market Data | Jan 27, 2022

Record high counts for franchise companies in the early planning stage at the end of Q4'21

Through year-end 2021, Marriott, Hilton, and IHG branded hotels represented 585 new hotel openings with 73,415 rooms.

Market Data | Jan 27, 2022

Dallas leads as the top market by project count in the U.S. hotel construction pipeline at year-end 2021

The market with the greatest number of projects already in the ground, at the end of the fourth quarter, is New York with 90 projects/14,513 rooms.