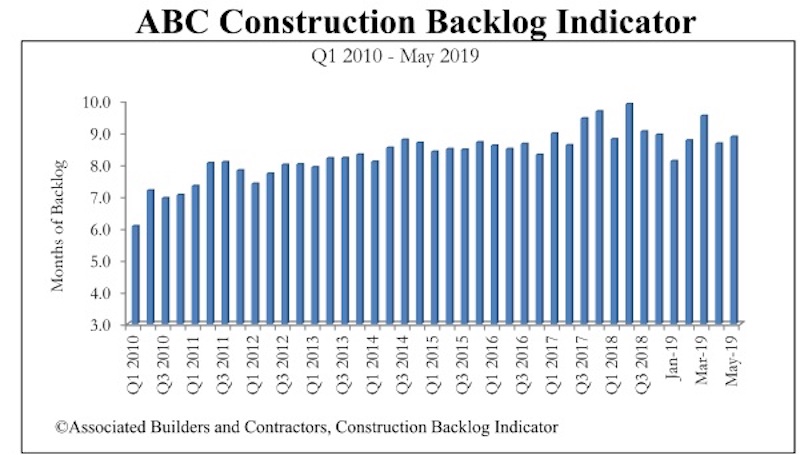

Associated Builders and Contractors reported today that its Construction Backlog Indicator expanded to 8.9 months in May 2019, up 0.2 months or 2.2% since April 2019, when CBI stood at 8.7 months.

“Nonresidential construction spending continues to be a significant source of economic strength in America, and the latest Construction Backlog Indicator strongly suggests that nonresidential construction spending will continue to be a major driver of business revenue growth and employment,” said ABC Chief Economist Anirban Basu. “Despite concerns about the rising costs of material prices and labor impacting construction contracts, demand for nonresidential construction services remains elevated for now.

“In general, nonresidential construction spending patterns lag the broader economy by 12-18 months,” said Basu. “While nonresidential construction doesn’t keep pace with other industry segments during the early stages of an economic recovery, it can continue to see robust growth during the late stages of an economic expansion. With the economy continuing to demonstrate momentum along the dimensions of financial market performance, job creation, income growth and consumer spending, contractors can expect several additional quarters of spending growth.

“That said, infrastructure backlog declined sharply in May, which is likely a statistical aberration,” said Basu. “The infrastructure category is dominated by several very large firms, and changes in their idiosyncratic backlog can have major impacts on the overall reading. There is little reason to expect a meaningful dip in infrastructure spending in the near term given the improving financial health of many states and localities across the nation. Moreover, backlog in the commercial/institutional and heavy industrial segments rose in May. Several construction firms specializing in heavy industrial construction in the Midwest report substantial increases in construction backlog.”

Related Stories

Contractors | Jul 13, 2023

Construction input prices remain unchanged in June, inflation slowing

Construction input prices remained unchanged in June compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices were also unchanged for the month.

Contractors | Jul 11, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of June 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in June 2023, according to an ABC member survey conducted June 20 to July 5. The reading is unchanged from June 2022.

Market Data | Jul 5, 2023

Nonresidential construction spending decreased in May, its first drop in nearly a year

National nonresidential construction spending decreased 0.2% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.06 trillion.

Apartments | Jun 27, 2023

Average U.S. apartment rent reached all-time high in May, at $1,716

Multifamily rents continued to increase through the first half of 2023, despite challenges for the sector and continuing economic uncertainty. But job growth has remained robust and new households keep forming, creating apartment demand and ongoing rent growth. The average U.S. apartment rent reached an all-time high of $1,716 in May.

Industry Research | Jun 15, 2023

Exurbs and emerging suburbs having fastest population growth, says Cushman & Wakefield

Recently released county and metro-level population growth data by the U.S. Census Bureau shows that the fastest growing areas are found in exurbs and emerging suburbs.

Contractors | Jun 13, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of May 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in May, according to an ABC member survey conducted May 20 to June 7. The reading is 0.1 months lower than in May 2022. Backlog in the infrastructure category ticked up again and has now returned to May 2022 levels. On a regional basis, backlog increased in every region but the Northeast.

Industry Research | Jun 13, 2023

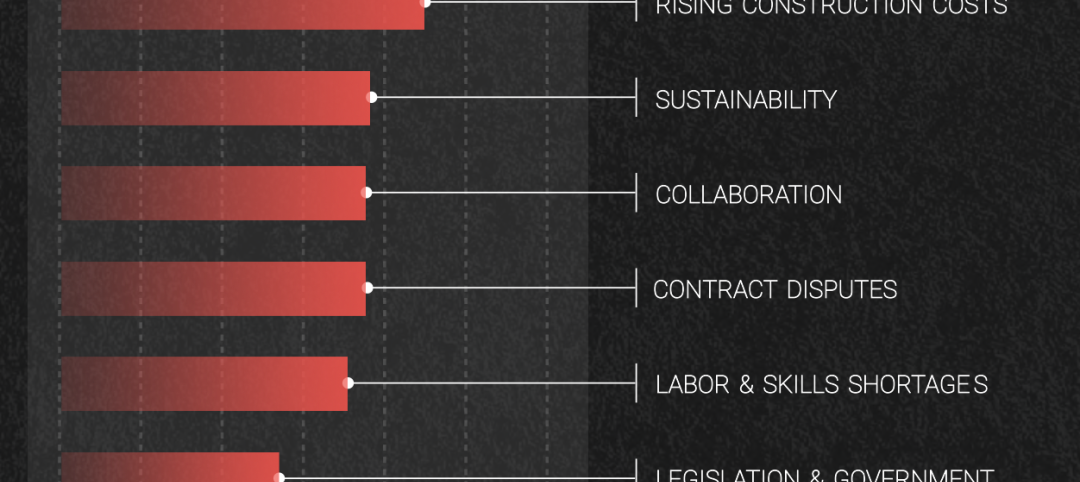

Two new surveys track how the construction industry, in the U.S. and globally, is navigating market disruption and volatility

The surveys, conducted by XYZ Reality and KPMG International, found greater willingness to embrace technology, workplace diversity, and ESG precepts.

| Jun 5, 2023

Communication is the key to AEC firms’ mental health programs and training

The core of recent awareness efforts—and their greatest challenge—is getting workers to come forward and share stories.

Contractors | May 24, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of April 2023

Contractor backlogs climbed slightly in April, from a seven-month low the previous month, according to Associated Builders and Contractors.

Multifamily Housing | May 23, 2023

One out of three office buildings in largest U.S. cities are suitable for residential conversion

Roughly one in three office buildings in the largest U.S. cities are well suited to be converted to multifamily residential properties, according to a study by global real estate firm Avison Young. Some 6,206 buildings across 10 U.S. cities present viable opportunities for conversion to residential use.