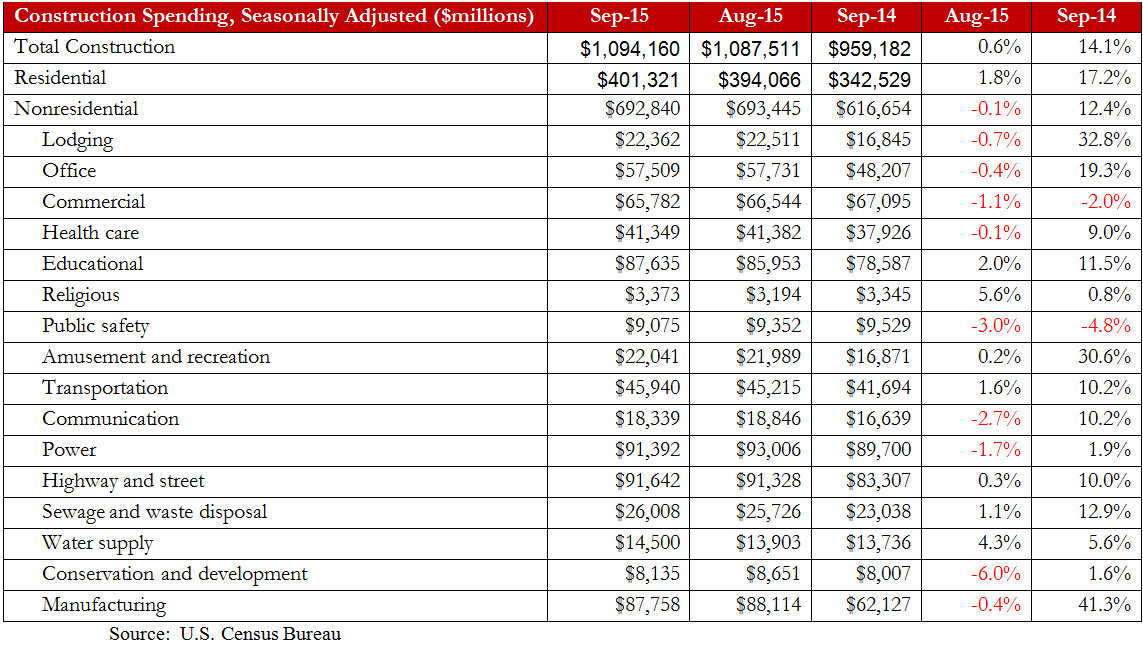

Nonresidential construction spending fell in September for the first time in eight months, the U.S. Census Bureau reported, but the monthly drop in spending is not a cause for concern according to analysis by Associated Builders and Contractors (ABC). Nonresidential construction spending fell by 0.1% from August, totaling $692.8 billion on a seasonally adjusted annualized basis.

September's year-over-year increase of 12.4% is the largest increase since April 2008. After falling in two consecutive months, public nonresidential construction spending grew by 0.7% in September while private sector construction spending fell by 0.7% for the month.

"The last several months have generally been associated with sizable increases in nonresidential construction," said ABC Chief Economist Anirban Basu. "Today's release, while not particularly upbeat, does not alter the fact that nonresidential construction spending continues to recover and that most contractors are busier than they were a year ago.

"Although there are many potential forces at work that resulted September's monthly construction spending decline, most are not alarming. With construction materials prices falling, contractors may be able to offer somewhat lower prices for their services, helping to suppress growth in construction value put in place. It is also conceivable that some construction work is being slowed by an ongoing lack of available skilled personnel. This factor has certainly helped to slow residential construction, and it seems reasonable to presume that some nonresidential contractors would face similar issues.

Seven nonresidential construction sectors experienced spending increases in September on a monthly basis:

- Educational-related spending expanded by 2% for the month and 11.5% for the year.

- Spending in the religious category grew by 5.6% on a monthly basis and 0.8% year-over-year.

- Amusement and transportation-related spending rose by 0.2% from August and 30.6% from September of last year.

- Transportation-related spending expanded by 1.6% from a month ago and 10.2% from a year ago.

- Highway and street-related construction spending inched 0.3% higher for the month and is up 10% from the same time last year.

- Sewage and waste disposal-related spending rose by 1.1% from August and 12.9% from September of last year.

- Spending in the water supply category gained 4.3% from the previous month and 5.6% on a year-ago basis.

Spending in nine nonresidential construction subsectors fell in September on a monthly basis:

- Spending in the lodging category fell by 0.7% for the month but is up 32.8% from September 2014.

- Office-related spending dipped 0.4% from August but is 19.3% higher than at the same time last year.

- Spending in the commercial category fell by 1.1% on a monthly basis and by 2% on a yearly basis.

- Health care-related spending inched 0.1% lower for the month but is up 9% on a year-ago basis.

- Public safety-related spending fell 3% month-over-month and 4.8% year-over-year.

- Spending in the communication-category declined 2.7% from August but is up 10.2% from the same time last year.

- Power-related construction spending fell 1.7% on a monthly basis but expanded 1.9% over the previous twelve months.

- Conservation and development-related spending lost 6% for the month but is still 1.6% higher than at the same time last year.

- Manufacturing related spending fell 0.4% for the month but is still up 41.3% from September 2014.

To view the previous spending report, click here.

Related Stories

Giants 400 | Feb 5, 2024

Top 40 Entertainment Center, Cineplex, and Theme Park Construction Firms for 2023

ARCO Construction, Turner Construction, Whiting-Turner, PCL Construction Enterprises, and Balfour Beatty US top BD+C's ranking of the nation's largest entertainment center, cineplex, and theme park general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Feb 5, 2024

Top 60 Shopping Mall, Big Box Store, and Strip Center Construction Firms for 2023

Whiting-Turner, Schimenti Construction, VCC, Ryan Companies US, and STO Building Group top BD+C's ranking of the nation's largest shopping mall, big box store, and strip center general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Laboratories | Feb 5, 2024

DOE selects design-build team for laboratory focused on clean energy innovation

JE Dunn Construction and SmithGroup will construct the 127,000-sf Energy Materials and Processing at Scale (EMAPS) clean energy laboratory in Colorado to create a direct path from lab-scale innovations to pilot-scale production.

Giants 400 | Feb 1, 2024

Top 40 Restaurant Construction Firms for 2023

Swinerton, Shawmut Design and Construction, Gray Construction, CM&B, and Andersen Construction top BD+C's ranking of the nation's largest restaurant general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Luxury Residential | Feb 1, 2024

Luxury 16-story condominium building opens in Chicago

The Chicago office of architecture firm Lamar Johnson Collaborative (LJC) yesterday announced the completion of Embry, a 58-unit luxury condominium building at 21 N. May St. in Chicago’s West Loop.

Products and Materials | Jan 31, 2024

Top building products for January 2024

BD+C Editors break down January's top 15 building products, from SloanStone Quartz Molded Sinks to InvisiWrap SA housewrap.

Giants 400 | Jan 29, 2024

Top 140 Office Core and Shell Architecture Firms for 2023

Gensler, Stantec, Page Southerland Page, Perkins&Will, and NBBJ top BD+C's ranking of the nation's largest office core and shell architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 29, 2024

Top 80 Workplace Interior Construction Firms for 2023

STO Building Group, HITT Contracting, Clune Construction, Hensel Phelps, and JRM Construction Management top BD+C's ranking of the nation's largest workplace interior and interior fitout general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 29, 2024

Top 100 Office Core and Shell Construction Firms for 2023

Turner Construction, AECOM, DPR Construction, Clark Group, and Clayco top BD+C's ranking of the nation's largest office core and shell general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Mixed-Use | Jan 29, 2024

12 U.S. markets where entertainment districts are under consideration or construction

The Pomp, a 223-acre district located 10 miles north of Fort Lauderdale, Fla., and The Armory, a 225,000-sf dining and entertainment venue on six acres in St Louis, are among the top entertainment districts in the works across the U.S.