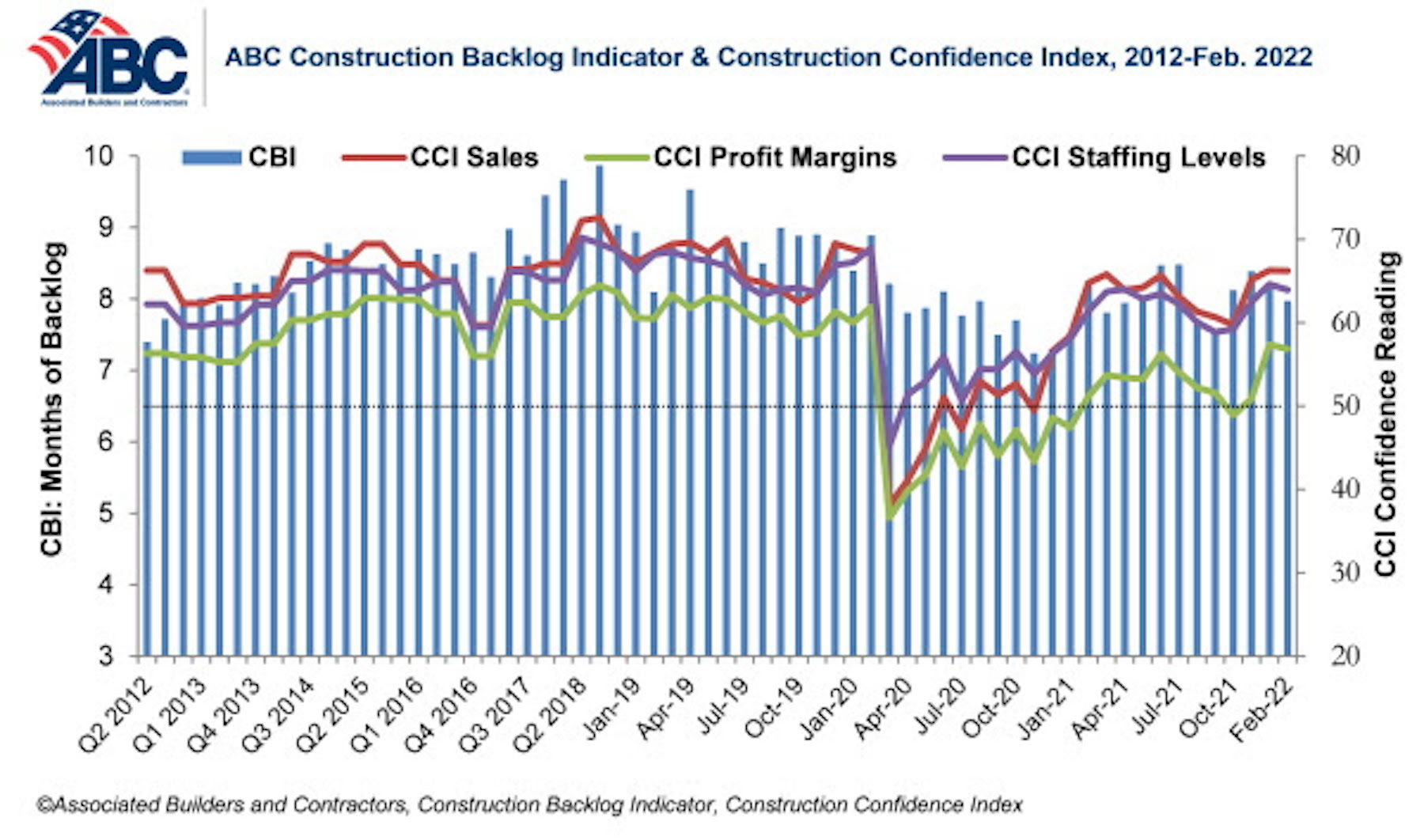

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8. The reading is down 0.2 months from February 2021.

View ABC’s Construction Backlog Indicator and Construction Confidence Index tables for February 2022.

Survey respondents in all four regions cited labor and material availability and costs as the factors chipping away at their backlog, while a few respondents in the Midwest cited winter weather as a frustrating factor.

ABC’s Construction Confidence Index readings for sales and staffing increased in February, while the reading for profit margins inched lower. All three indices remain above the threshold of 50, indicating expectations of growth over the next six months.

“The level of demand for construction services is simply staggering,” said ABC Chief Economist Anirban Basu. “Despite sky-high materials prices, surging compensation costs and attendant impacts on bids, many project owners continue to move forward with projects because they recognize construction costs could rise even further. There is also significant investment capital flowing through the economy in search of yield. Real estate projects often satisfy the need to deploy considerable capital quickly, but only if construction is permitted to move forward.

“Accordingly, despite elevated costs and workforce challenges, construction backlog remains stable,” said Basu. “Backlog would likely be rising rapidly if costs were more stable. Nonetheless, construction confidence indicators continue to improve. Collectively, contractors expect sales and employment to expand over the next six months. But what is far more remarkable is the expectation that profit margins will expand, indicating that demand for construction services remains elevated enough to countervail cost increases as we head into the heart of 2022.”

Related Stories

Market Data | Jul 21, 2022

Despite deteriorating economic conditions, nonresidential construction spending projected to increase through 2023

Construction spending on buildings is projected to increase just over nine percent this year and another six percent in 2023, according to a new report from the American Institute of Architects (AIA).

Building Team | Jul 18, 2022

Understanding the growing design-build market

FMI’s new analysis of the design-build market forecast for the next fives years shows that this delivery method will continue to grow, despite challenges from the COVID-19 pandemic.

Market Data | Jul 1, 2022

Nonresidential construction spending slightly dips in May, says ABC

National nonresidential construction spending was down by 0.6% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Jun 30, 2022

Yardi Matrix releases new national rent growth forecast

Rents in most American cities continue to rise slightly each month, but are not duplicating the rapid escalation rates exhibited in 2021.

Market Data | Jun 22, 2022

Architecture Billings Index slows but remains strong

Architecture firms reported increasing demand for design services in May, according to a new report today from The American Institute of Architects (AIA).

Building Team | Jun 17, 2022

Data analytics in design and construction: from confusion to clarity and the data-driven future

Data helps virtual design and construction (VDC) teams predict project risks and navigate change, which is especially vital in today’s fluctuating construction environment.

Market Data | Jun 15, 2022

ABC’s construction backlog rises in May; contractor confidence falters

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to nine months in May from 8.8 months in April, according to an ABC member survey conducted May 17 to June 3. The reading is up one month from May 2021.

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.