Most older Americans don’t reside in “livable” communities that combine safety, security and affordability with appropriate housing and transportation options, and supportive features and services that enhance personal independence, allow residents to remain in their homes as they age, and foster residents’ engagement in civic, economic, and social life.

In a 33-page paper titled “Which Older Adults Have Access to America’s Most Livable Neighborhoods,” the Joint Center for Housing Studies at Harvard University and AARP’s Public Policy Institute draw upon information from the 2017 American Communities Survey (ACS)—whose estimates categorize 217,739 Census neighborhood block groups—as a guide to analyze AARP’s 2018 Livability Index, an online interactive source that scores neighborhoods across the U.S. to shed light on the current livability of a given location and to highlight opportunities for improvement.

The Index derives from more than 4,500 questionnaire respondents and 80 in-depth interviews, as well as input from 30 experts in various fields.

The paper also used ACS microdata to examine profiles of older adults residing in neighborhoods with different levels of livability to suggest opportunities for addressing inequality in access to livable communities, and to the specific elements certain populations lack even in the most livable places.

The paper’s goal is to evaluate whether access to livable communities is evenly distributed across the older adult population, to assess how older adults access livability features, and to understand the characteristics of higher performing communities.

DISCONNECT BETWEEN WHERE PEOPLE LIVE AND WHAT THEY NEED

Some key findings:

•Nearly 146 million Americans of all ages live in neighborhoods at the bottom two quintiles in terms of livability. And older adults are underrepresented in most livable communities; in the least livable quintile, adults age 55 or older made up near one-third of residents.

•Older adults who move tend to relocate to newer places with similar levels of overall livability as their previous neighborhoods. Only 11% move to more livable locations, and 14% actually move to neighborhoods with lower livability scores.

•There is a relationship between different types of livable neighborhoods and income, race/ethnicity characteristics, and homeownership. “At every level of livability, homeownership and income play important roles in accessing features that contribute to high scores in specific livability categories,” the paper’s authors write.

Certain themes also emerged from this research:

•Livability gap. There is a disconnect between what people have and what they need in communities to age in place.

•Housing affordability. Communities that score higher on the Index tend to have higher housing costs. High housing costs can create obstacles to accessing the benefits livable communities can provide.

•Disparities in access to specific livability features. People of color, people with disabilities, and people with lower incomes may not have access to amenities and services that support aging. As the analysis shows, even when living in high scoring communities these groups may not have access to amenities and services related to health, engagement, and opportunity.

•Mobility. People tend to move to places with similar livability levels as their previous neighborhood.

•Neighborhood preferences and location choice. Individual preferences, barriers, and available community amenities may impact people’s decisions on where to live.

POLICY SUGGESTIONS INCLUDE PROMOTING HEALTHIER ENVIRONMENTS

Livable communities tend to have diverse housing types that include more single-person households, where older adults are more likely to reside. This factor might explain why, on average, older renters live in more livable places than do older owners.

The likelihood of living in livable communities shifts somewhat with the person’s age. Among older adults, those ages 50 to 64 as well as those ages 80 and older have a slightly better chance of living in a high livability neighborhood than do those ages 65 to 79. Among those ages 80 and older, 18 percent reside in the top quintile neighborhoods but only 16 percent of those ages 65 to 79 do. In contrast, those ages 65 to 79 are more likely than other age groups to live in lower-livability neighborhoods.

The paper offers policy recommendations that focus on housing affordability and access, creating save neighborhoods that have ample food and culture available, environments that promote healthy, clean and natural places to live; and communities that supporting resident well-being and social lives, and enable economic and educational pursuits.

“By analyzing the Index in conjunction with Census block group data from the ACS, we have revealed specific areas that warrant focused attention,” the paper states. “Housing stock, tenure, and affordability have particular influences on the access older adults have to the most livable communities.” While this analysis could not reveal if the most vulnerable older people residing in livable communities have equal access to every feature, service, and amenity, “one expects they do not.”

Related Stories

Construction Costs | May 16, 2024

New download: BD+C's May 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Contractors | May 15, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of April 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator increased to 8.4 months in April, according to an ABC member survey conducted April 22 to May 6. The reading is down 0.5 months from April 2023, but expanded 0.2 months from the prior month.

Healthcare Facilities | May 6, 2024

Hospital construction costs for 2024

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Contractors | May 1, 2024

Nonresidential construction spending rises 0.2% in March 2024 to $1.19 trillion

National nonresidential construction spending increased 0.2% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.19 trillion.

AEC Tech | Apr 30, 2024

Lack of organizational readiness is biggest hurdle to artificial intelligence adoption

Managers of companies in the industrial sector, including construction, have bought the hype of artificial intelligence (AI) as a transformative technology, but their organizations are not ready to realize its promise, according to research from IFS, a global cloud enterprise software company. An IFS survey of 1,700 senior decision-makers found that 84% of executives anticipate massive organizational benefits from AI.

Hotel Facilities | Apr 24, 2024

The U.S. hotel construction market sees record highs in the first quarter of 2024

As seen in the Q1 2024 U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics (LE), at the end of the first quarter, there are 6,065 projects with 702,990 rooms in the pipeline. This new all-time high represents a 9% year-over-year (YOY) increase in projects and a 7% YOY increase in rooms compared to last year.

Construction Costs | Apr 18, 2024

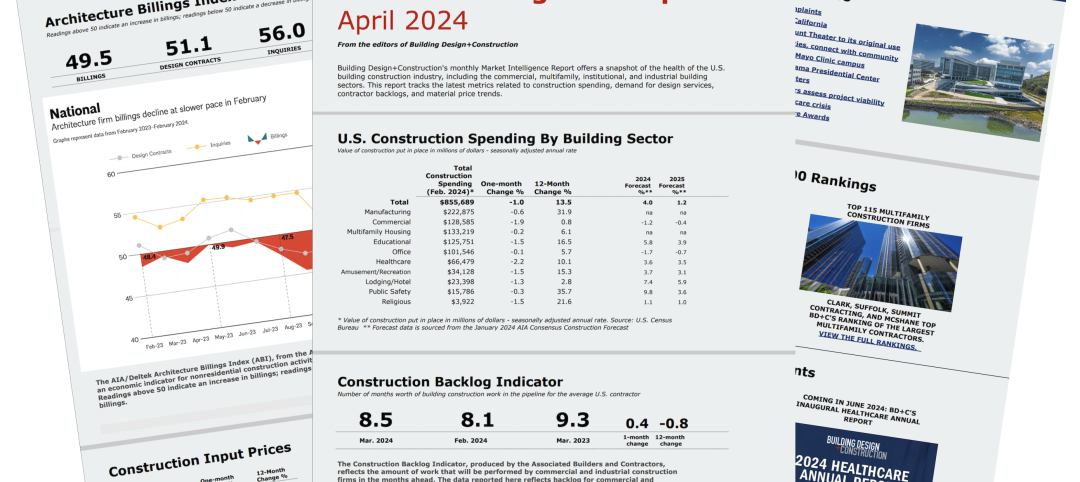

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

K-12 Schools | Apr 10, 2024

Surprise, surprise: Students excel in modernized K-12 school buildings

Too many of the nation’s school districts are having to make it work with less-than-ideal educational facilities. But at what cost to student performance and staff satisfaction?

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.