Despite their planning and risk management efforts, owners are still finding that a sizable percentage of their projects are either failing or aren’t coming in anywhere near on time or on budget.

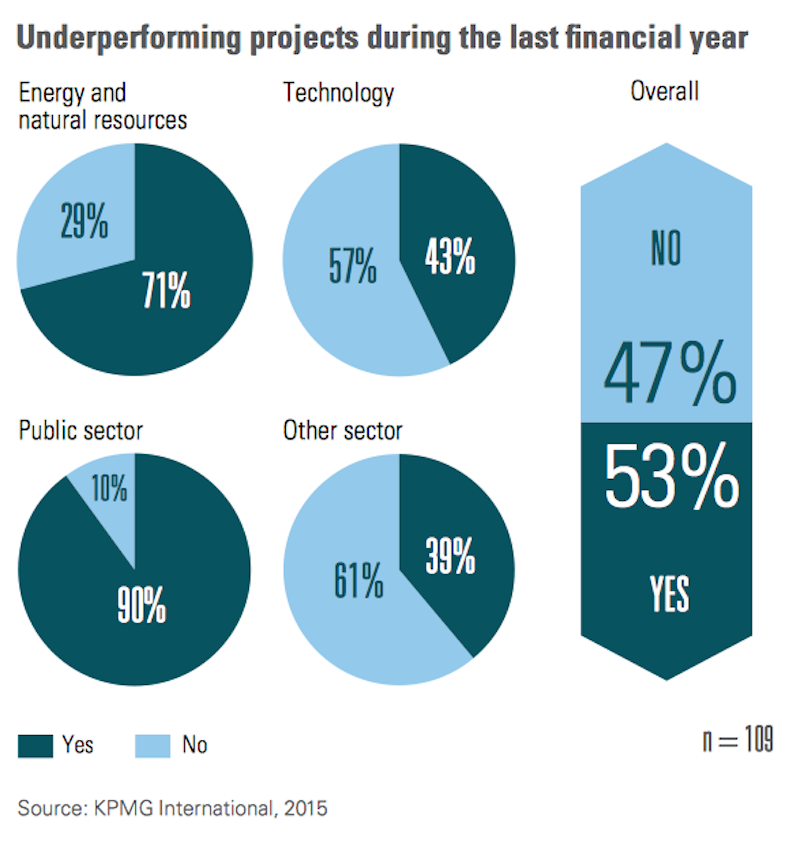

More than half—53%—of owners say they suffered one or more underperforming projects in the previous year, a number that rises to 61% for larger organizations, according to KPMG International’s ninth annual Global Construction Survey 2015, based on interviews with 109 senior leaders from private and public organizations around the world that conduct construction activity.

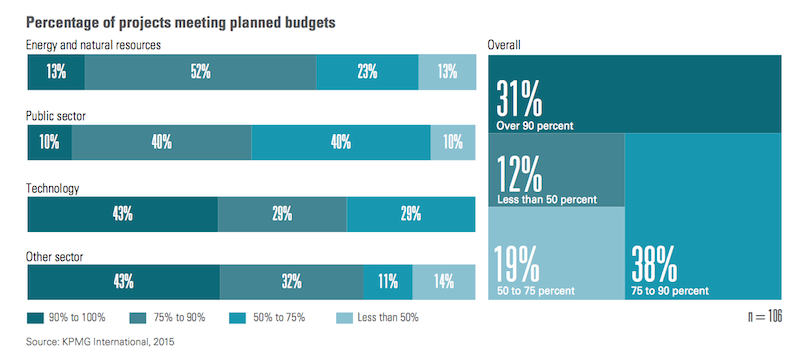

Only 31% of respondents’ projects over the past three years came in within 10% of their budgeted cost. And only one quarter of projects over that period came in within 10% of their original deadlines.

The owners imply that these failures, delays, and overruns are less the result of poor project oversight than of talent shortages and the lack of integration of project management information systems into these companies’ accounting and procurement software programs.

Most owners polled assert that their companies use formal screening, prioritizing, and approval processes for projects, including financial and risk analysis (84%). More than 80% of respondents state that the majority of their capital projects are planned. Thirty percent of respondents use a design-bid-build project delivery strategy, while 32% use engineer-procure-construct.

“All potential projects should be systematically identified, classified, screened, prioritized, evaluated and selected,” writes Jeff Shaw, Director-KPMG in South Africa. “This process must be supported by an appropriate budget allocation and monitoring process. Throughout the capital allocation process, alignment between strategic objectives and the capital project portfolio must be tested.”

The report notes, however, that owners are challenged finding qualified project management personnel. Forty-five percent of respondents say they struggle to attract qualified craft labor, planners and project management professionals.

While 64% of respondents believe their management controls are either “optimized” or “monitored,” nearly one-third concede that their controls are “standardized,” with no testing or reporting or reporting to management and only limited staff training.

Most construction companies rely heavily on software to manage projects. Fifty-five percent of respondents say they are “satisfied” or “mostly satisfied” about the return on investment from project management tools and training. And 73% say they are confident about the accuracy and timeliness of reports they receive from managers and contractors.

However, only about half of respondents say their organizations have introduced an integrated project management information system (PMIS). Consequently, less than one-fifth of respondents could answer “yes” definitively when asked if investments in project governance and controls have reduced project costs.

In planning for delays and cost overruns, senior executives polled identify a range of methods to calculate contingency levels. The two most popular are setting aside an specific amount of contingency for all projects (e.g., 10%), and quantitative risk analysis. “The relative sophistication of the latter suggests that owners are trying to become more accurate in their forecasting,” the report states.

Sixty-nine percent of owners polled say that “poor contractor performance” is one of the biggest reasons for failing projects, delays, or cost overruns. And there’s definitely something negative going when only one-third could say they have a “high” level of trust with pros.

More than eight in 10 respondents expect greater collaboration with contractors over the next five years. How much these relationships actually change, though, remains to be seen. The report suggests that lump-sum, fixed-price contracts, which dominate among the survey’s respondents, are one reason for the fragile state of owner-contractor relationships, primarily because they defer risk onto the contractor. And owners believe the balance of power is shifting toward them; nearly half expect to have more negotiating strength when delivering capital projects over the next five years.

KPMG International offers five steps for owners to improve the performance of their projects:

- Take a fresh approach to talent management through more effective recruitment, development, and retention strategies;

- Execute a fully integrated PMIS for swift coordination and real-time reporting;

- Demand practical targets from contractors based on realistic expectations of what can go wrong;

- Use contingency planning to control costs rather than excuse overruns; and

- Invest in relationships with contractors by creating integrated project teams.

Related Stories

Giants 400 | Feb 8, 2024

Top 30 Public Library Engineering Firms for 2023

KPFF Consulting Engineers, Tetra Tech High Performance Buildings Group, Thornton Tomasetti, WSP, and Dewberry top BD+C's ranking of the nation's largest public library engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 8, 2024

Top 35 Performing Arts Center and Concert Venue Construction Firms for 2023

The Whiting-Turner Contracting Company, Holder Construction, McCarthy Holdings, Clark Group, and Gilbane Building Company top BD+C's ranking of the nation's largest performing arts center and concert venue general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 8, 2024

Top 40 Museum Construction Firms for 2023

Turner Construction, Clark Group, Bancroft Construction, STO Building Group, and Alberici-Flintco top BD+C's ranking of the nation's largest museum and gallery general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Giants 400 | Feb 6, 2024

Top 40 Religious Facility Construction Firms for 2023

Crossland Construction, Haskell, Big-D Construction, Whiting-Turner, and JE Dunn Construction top BD+C's ranking of the nation's largest religious facility general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Feb 5, 2024

Top 40 Entertainment Center, Cineplex, and Theme Park Construction Firms for 2023

ARCO Construction, Turner Construction, Whiting-Turner, PCL Construction Enterprises, and Balfour Beatty US top BD+C's ranking of the nation's largest entertainment center, cineplex, and theme park general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Feb 5, 2024

Top 60 Shopping Mall, Big Box Store, and Strip Center Construction Firms for 2023

Whiting-Turner, Schimenti Construction, VCC, Ryan Companies US, and STO Building Group top BD+C's ranking of the nation's largest shopping mall, big box store, and strip center general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Laboratories | Feb 5, 2024

DOE selects design-build team for laboratory focused on clean energy innovation

JE Dunn Construction and SmithGroup will construct the 127,000-sf Energy Materials and Processing at Scale (EMAPS) clean energy laboratory in Colorado to create a direct path from lab-scale innovations to pilot-scale production.

Giants 400 | Feb 1, 2024

Top 40 Restaurant Construction Firms for 2023

Swinerton, Shawmut Design and Construction, Gray Construction, CM&B, and Andersen Construction top BD+C's ranking of the nation's largest restaurant general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Luxury Residential | Feb 1, 2024

Luxury 16-story condominium building opens in Chicago

The Chicago office of architecture firm Lamar Johnson Collaborative (LJC) yesterday announced the completion of Embry, a 58-unit luxury condominium building at 21 N. May St. in Chicago’s West Loop.