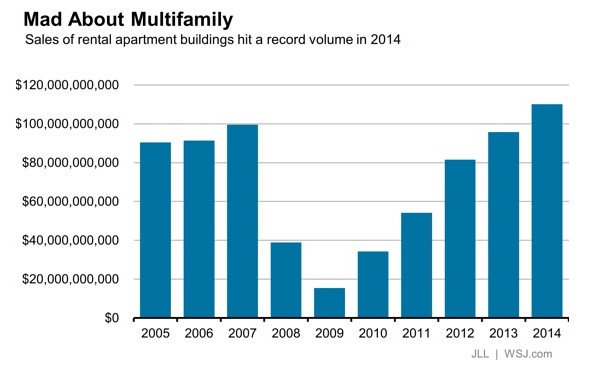

Investors bet big time on demand for rental properties over homeownership in 2014, when sales of apartment buildings hit a record $110.1 billion, or nearly 15% higher than the previous year, according to Jones Lang LaSalle (JLL), a professional services and investment management firm.

Nearly half of those transactions were for buildings in six metros: New York, Los Angeles, Atlanta, Houston, Dallas, and Washington D.C. And the allure of owning rental properties in America’s largest cities continues into 2015, the Wall Street Journal reported.

Blackstone Group, the world’s largest private equity holder of real estate, in late January agreed to pay $1.7 billion for 36 properties with an estimated 11,000 apartment units, half of which are in Washington D.C. and Boston. The seller was Praedium Group, which JLL and Evercore Partners advised. The deal increases to 43,000 the number of apartment units managed by LivCor, Blackstone’s multifamily real estate unit, according to Crain’s Chicago Business.

The multifamily sector “has become the preferred asset class of institutional investors” since the last economic downturn, says Jubeen Vaghefi, managing director of JLL’s capital markets division. That opinion is consistent with what Vaghefi wrote in JLL’s Fall 2014 Multifamily Outlook: “The ability for multifamily starts to occur 3.5 times faster than the overall market is due to the combination of higher oversupply of single-family homes throughout the United States, a marked preference for multi-unit buildings, and residential development in core submarkets, which continue to post high occupancy rates.”

The question now is how long investors will ride this gravy train, especially if increasing supply adversely impacts rent appreciation.

The Census Bureau’s latest data for housing starts, which it released on January 21, 2015, estimates that 456,000 units were under construction in buildings with five or more units at the end of December 2014, or 26% more than in December 2013. The possibility that this market may be overheating, though, is reflected in annualized multifamily starts, which inched up by only 0.3% in December to 339,000 units. Annualized multifamily permits issued stood at 338,000 units in December, down 12.4% from December 2013

On a less ambiguous note, rents increased by 3.6% nationwide in 2014, according to Reis, the real-estate research firm. Apartment vacancy rates, at 4.2%, were near their lowest levels in 2001. And the days of excess demand that has kept rents under control “are likely over,” Ryan Severino, Reis’ senior economist, stated.

JLL contends that with vacancies stabilizing and with the market average of inventory under construction at 4.4% and growing, “the pace of multifamily tightening is softening, with projected rent growth between 2% and 3% over the next 18 months.”

Related Stories

Giants 400 | Oct 25, 2019

Top 50 Airport Sector Architecture Firms for 2019

AECOM, Gensler, HNTB, Corgan, and HOK top the rankings of the nation's largest airport terminal sector architecture and architecture engineering (AE) firms, as reported in Building Design+Construction's 2019 Giants 300 Report.

Giants 400 | Oct 24, 2019

Top 125 Retail Architecture Firms for 2019

CallisonRTKL, Gensler, MG2, NELSON, and Stantec top the rankings of the nation's largest retail sector architecture and architecture engineering (AE) firms, as reported in Building Design+Construction's 2019 Giants 300 Report.

Architects | Oct 11, 2019

SMPS report tracks how AEC firms are utilizing marketing technology tools

With thousands of MarTech tools and apps on the market, design and construction firms are struggling to keep up.

Healthcare Facilities | Oct 4, 2019

Heart failure clinics are keeping more patients out of emergency rooms

An example of this building trend recently opened at Beaumont Hospital near Ann Arbor, Mich.

Giants 400 | Oct 3, 2019

Top 30 Convention Center Sector Architecture Firms for 2019

LMN Architects, Gensler, Populous, Fentress Architects, and Moody Nolan top the rankings of the nation's largest convention center sector architecture and architecture engineering (AE) firms, as reported in Building Design+Construction's 2019 Giants 300 Report.

Giants 400 | Oct 3, 2019

Top 110 Cultural Sector Architecture Firms for 2019

Gensler, Populous, DLR Group, Stantec, and Perkins and Will top the rankings of the nation's largest cultural facility sector architecture and architecture engineering (AE) firms, as reported in Building Design+Construction's 2019 Giants 300 Report.

Giants 400 | Oct 3, 2019

2019 Cultural Facility Giants Report: New libraries are all about community

The future of libraries is less about being quiet and more about hands-on learning and face-to-face interactions. This and more cultural sector trends from BD+C's 2019 Giants 300 Report.

Architects | Oct 3, 2019

LEO A DALY wins Architect of the Capitol contract

The firm will help modernize some of the country’s most significant public buildings.

3D Printing | Sep 17, 2019

Additive manufacturing goes mainstream in the industrial sector

More manufacturers now include this production process in their factories.

Multifamily Housing | Sep 12, 2019

Meet the masters of offsite construction

Prescient combines 5D software, clever engineering, and advanced robotics to create prefabricated assemblies for apartment buildings and student housing.