Retail health clinics, which have been around since 2001, and until recently have been profit question marks, are having their moment in the sun.

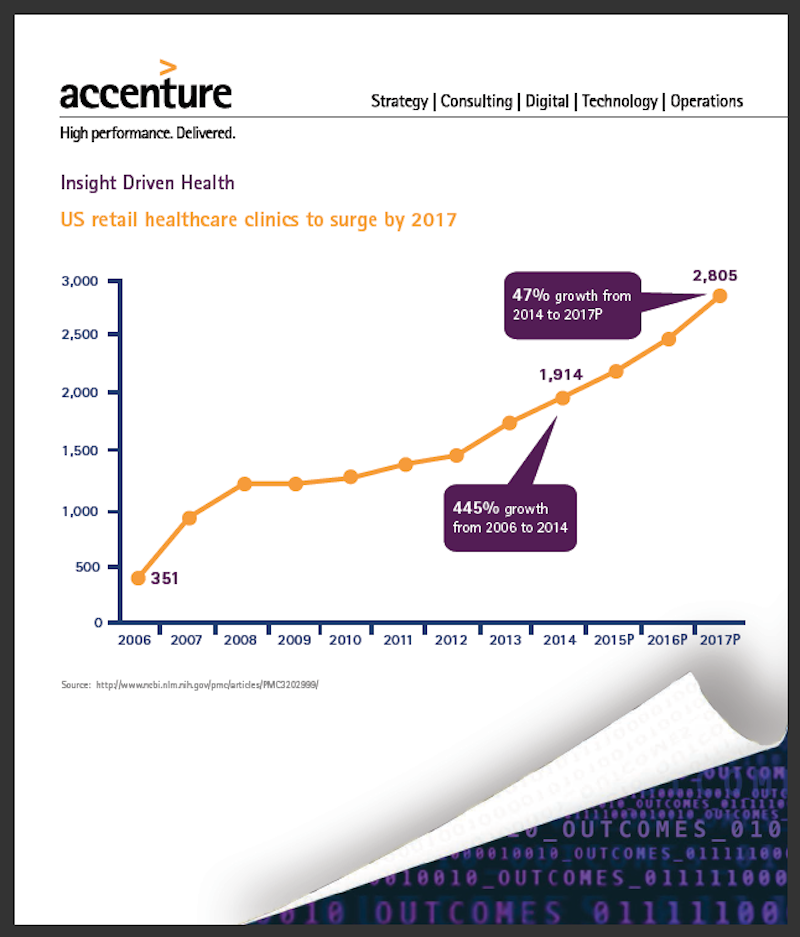

A recent report by Accenture Consulting predicts that the clinics sector will grow at an average annual rate of 14% through 2017, when their numbers will exceed 2,800, compared to 1,914 in 2014.

“Retail health clinics are impacting the broader U.S. landscape by offering a new, lower-cost peer channel,” said Alan Nalle, Accenture’s Senior Manager-Retail Strategy, in a video clip that accompanied the release of the report.

Accenture Consulting predicts that retail health clinics will exceed 2,800 in the U.S. in 2017. Insurers favor these clinics over more expensive urgent care or emergency room options. Image: Accenture Consulting.

Accenture Consulting predicts that retail health clinics will exceed 2,800 in the U.S. in 2017. Insurers favor these clinics over more expensive urgent care or emergency room options. Image: Accenture Consulting.

Accenture says that retail health clients have been closing their “profitability gap” by shifting their focus from “retail” elements, and emphasizing the clinical in three distinct ways:

• Clinics are expanding their services to broaden appeal: More retail stores are bringing the pharmacist out from behind the counter to interact directly with patients—“something many in the industry see as a clear differentiator,” Accenture points out.

Other new services include primary and preventive care, pediatrics and wellness, health screening and testing, chronic disease monitoring and management, and transitional care. Walgreens’ Health Clinics now offer chronic care assessments and medication reconciliation. Walmart recently launched new primary care clinics that offer more sophisticated services—like chronic disease management—than patients can receive at the retailer’s other health centers.

• Retail clinics are investing in healthcare IT to expand their roles: Leading organizations are purchasing more advanced medical equipment and records management systems. For example, CVS Health’s MinuteClinics have been installing a proven electronic health record system nationwide, which makes it easier to transmit clinical data to regional health information exchanges.

• Clinics are working with partners to coordinate care: Target, for one, is partnering with Kaiser Permanente to launch a number of retail clinics in California that provide greater levels of service and information sharing between clinics and the integrated delivery network. Services include pediatric and adolescent care, family planning, wellness for women and the management of chronic conditions such as high blood pressure and diabetes.

Likewise, Walgreens is collaborating with one of the largest health systems in the U.S., Trinity Health, to coordinate patient care to improve outcomes and increase access to care while reducing overall costs.

Some healthcare providers are teaming with clinics, and exchanging files electronically, to provide their patients with after-hours care. Image: Accenture Consulting.

Some healthcare providers are teaming with clinics, and exchanging files electronically, to provide their patients with after-hours care. Image: Accenture Consulting.

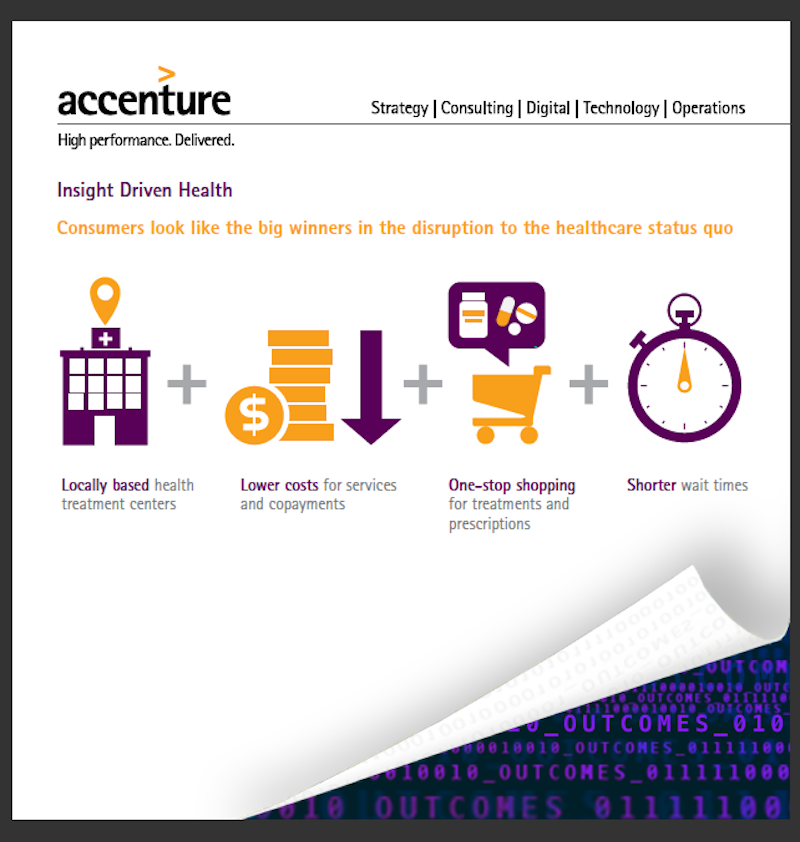

Nalle noted that all of these changes have been wins for consumers, who now have greater healthcare convenience and access.

Payers have also found the expansion of retail health clinics to their liking, said Nalle. “Increasingly we’re seeing our payer clients offer lower copay or waive copays for clinic visits,” to redirect volumes of patients who might otherwise go to more-expensive urgent care or emergency room care.

For providers, the expansion of retail health clinics is a double-edged sword. On the positive side, some providers are using retail clinics as a way to offer after-hours access to patients. “But some might view clinics as competition,” says Nalle. So providers have two choices: to partner with clients via electronic record exchanges, or to compete, with extended office hours, or extended coverage.

There is no question, however, that retailers see clinics in more in terms of growth and profit. During a speech they delivered at America’s Health Insurance Plans Institute and Expo in Las Vegas earlier this month, Larry Merlo, CVS Health’s CEO, and Dr. Troyen Brennan, its Chief Medical Officer, noted that the cumulative cost of chronic illness alone is expected to increase to $42 billion by 2030.

“I believe the way to find solutions is to look at the problems through the eyes of your customers, and at CVS Health, we are working to do just that by collaborating with stakeholders across the health care continuum including patients, caregivers, providers and payers to provide better, more cost-effective care.”

Last December, CVS Health acquired all of Target’s pharmacies and retail clinics in 47 states, and a CVS Pharmacy will be included in all new Target stores. This acquisition expanded CVS Health’s pharmacy footprint by approximately 20% and its clinic footprint by about 8%.

Related Stories

Giants 400 | Jan 22, 2024

Top 100 Outpatient Facility Architecture Firms for 2023

HDR, CannonDesign, Stantec, Perkins&Will, and ZGF top BD+C's ranking of the nation's largest outpatient facility architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report. Note: This ranking includes design revenue for work related to outpatient medical buildings, including cancer centers, heart centers, urgent care facilities, and other medical centers.

Giants 400 | Jan 22, 2024

Top 40 Outpatient Facility Engineering Firms for 2023

Jacobs, IMEG, TLC Engineering Solutions, KPFF Consulting Engineers, and Syska Hennessy Group head BD+C's ranking of the nation's largest outpatient facility engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report. Note: This ranking includes design revenue for work related to outpatient medical buildings, including cancer centers, heart centers, urgent care facilities, and other medical centers.

Giants 400 | Jan 22, 2024

Top 60 Outpatient Facility Construction Firms for 2023

DPR Construction, PCL Construction Enterprises, The Whiting-Turner Contracting Company, Skanska USA, and Power Construction top BD+C's ranking of the nation's largest outpatient facility general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report. Note: This ranking includes construction revenue for work related to outpatient medical buildings, including cancer centers, heart centers, urgent care facilities, and other medical centers.

Sponsored | BD+C University Course | Jan 17, 2024

Waterproofing deep foundations for new construction

This continuing education course, by Walter P Moore's Amos Chan, P.E., BECxP, CxA+BE, covers design considerations for below-grade waterproofing for new construction, the types of below-grade systems available, and specific concerns associated with waterproofing deep foundations.

Healthcare Facilities | Jan 16, 2024

A new mental health center in Miami offers alternatives to incarceration

The seven-story building has 208 beds.

Giants 400 | Jan 15, 2024

Top 90 Hospital Facility Construction Firms for 2023

Turner Construction, Brasfield & Gorrie, JE Dunn Construction, McCarthy Holdings, and STO Building Group top BD+C's ranking of the nation's largest hospital facility general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 15, 2024

Top 80 Hospital Facility Engineering Firms for 2023

Jacobs, WSP, BR+A, IMEG, and AECOM head BD+C's ranking of the nation's largest hospital facility engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 15, 2024

Top 130 Hospital Facility Architecture Firms for 2023

HKS, HDR, Stantec, CannonDesign, and Page Southerland Page top BD+C's ranking of the nation's largest hospital facility architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Healthcare Facilities | Jan 7, 2024

Two new projects could be economic catalysts for a central New Jersey city

A Cancer Center and Innovation district are under construction and expected to start opening in 2025 in New Brunswick.

Designers | Jan 3, 2024

Designing better built environments for a neurodiverse world

For most of human history, design has mostly considered “typical users” who are fully able-bodied without clinical or emotional disabilities. The problem with this approach is that it offers a limited perspective on how space can positively or negatively influence someone based on their physical, mental, and sensory abilities.