Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

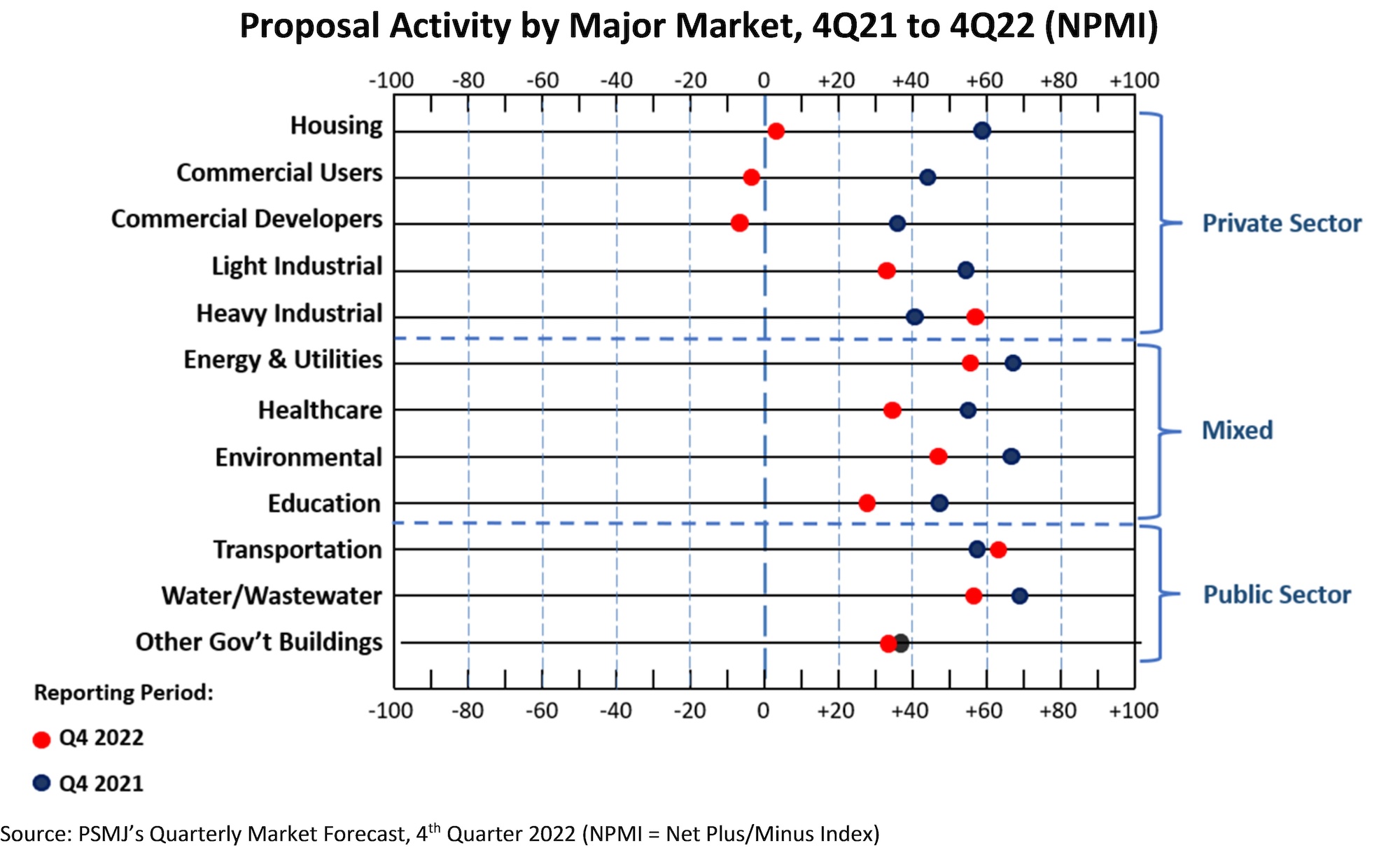

PSMJ’s latest Quarterly Market Forecast survey of 115 A/E/C executives (collected between December 28, 2022 and January 10, 2023) revealed an overall proposal activity Net Plus/Minus Index (NPMI) value of just 8.0. Any NPMI value above zero indicates that more respondents are seeing an increase in proposal activity compared to the prior quarter (+100 indicates all respondents are seeing an increase in proposal activity, -100 indicates all respondents are seeing a decrease in proposal activity). Since proposal activity is a leading indicator for backlog, revenue, and — ultimately — cash flow, the latest NPMI values provide a valuable glimpse into cash flow over the next 12 to 24 months.

While still barely clinging on to positive territory, this latest index value marks a continued decline from the record-setting 2022 Q1 value of 60.2 and a significant slide from the previous quarter value of 25.0. According to PSMJ President Gregory Hart, A/E/C firms’ marketing horsepower will be tested in the months ahead. “Huge streams of funding to support infrastructure projects are keeping the public-sector markets in pretty good shape,” states Hart. “But, if you have significant exposure to the private land development markets in your revenue mix, now is the time to act to avoid significant trouble ahead.”

Any index value greater than 20 generally indicates a healthy market. Three of the 12 client markets are now below that threshold and the two commercial markets have entered negative territory.

The Top 5 Markets for the 4th Quarter of 2022 are:

- Transportation: 62.9

- Heavy Industry: 57.9

- Water/Wastewater: 57.1

- Energy/Utilities: 55.2

- Environmental: 46.2

The following chart compares the NPMI values in each client to the same period last year:

Related Stories

| May 6, 2011

Ellerbe Becket now operating as AECOM

*/ The architecture, interiors and engineering firm Ellerbe Becket, which joined AECOM in 2009, has fully transitioned to operating as AECOM as of May 2, 2011.

| May 2, 2011

URS acquires Apptis Holdings, a federal IT service provider

SAN FRANCISCO, CA and CHANTILLY, VA– April 28, 2011 – URS Corporation and Apptis Holdings, Inc., a leading provider of information technology and communications services to the federal government, announced that they have signed a definitive agreement under which URS will acquire Apptis.

| May 2, 2011

Perkins+Will merges with Vermeulen Hind Architects, offically launches Perkins+Will Canada

Ottawa and Hamilton-based Vermeulen Hind Architects, one of Canada’s leading healthcare architectural firms, has merged with Perkins+Will. Vermeulen Hind joins Toronto-based Shore Tilbe Perkins+Will and Vancouver-based Busby Perkins+Will to create Perkins+Will Canada. The combination marks the official launch of Perkins+Will Canada, a merge that will establish the firm as among the pre-eminent interdisciplinary design practices in Canada.

| Apr 26, 2011

Ed Mazria on how NYC can achieve carbon neutrality in buildings by 2030

The New York Chapter of the American Institute of Architects invited Mr. Mazria to present a keynote lecture to launch its 2030 training program. In advance of that lecture, Jacob Slevin, co-founder of DesignerPages.com and a contributor to The Huffington Post, interviewed Mazria about creating a sustainable vision for the future and how New York City's architects and designers can rise to the occasion.

| Apr 26, 2011

Video: Are China's ghost cities a bubble waiting to burst?

It's estimated that 10 new cities are being built in China every year, but many are virtually deserted. Retail space remains empty and hundreds of apartments are vacant, but the Chinese government is more concerned with maintaining economic growth—and building cities is one way of achieving that goal.

| Apr 25, 2011

Earn $300 million by NOT hiring Frank Gehry

An Iowa philanthropist and architecture aficionado—who wishes to remain anonymous—is offering a $300 million “reward” to any city anywhere in the world that’s brave enough to hire someone other than Frank Gehry to design its new art museum.

| Apr 20, 2011

Marketing firm Funtion: to host “Construct. Build. Evolve.”

Function:, an integrated marketing agency that specializes in reaching the architecture, building and design community, is hosting an interactive art event, “Construct. Build. Evolve.” in Atlanta’s Piedmont Park on Thursday April 21, 2011 at 11:00AM EDT. During the event attendees will be asked to answer the question, “how would you build the future?” to rouse dialogue and discover fresh ideas for the future of the built environment.

| Apr 20, 2011

Architecture Billings Index: new projects inquiry index up significantly from February

The American Institute of Architects (AIA) reported the March ABI score was 50.5, a negligible decrease from a reading of 50.6 the previous month. This score reflects a modest increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.7, up significantly from a mark of 56.4 in February.

| Apr 19, 2011

What are the 15 most-watched construction and engineering stocks?

According to Motley Fool, a multimedia financial services company, the most-watched construction and engineering stock is Fluor (NYSE: FLR), which ranks #1 on BD+C’s Giants 300 engineering list with $1.994 billion in revenue in 2009. Check out the 14 other most-watched A/E stocks.