The prices contractors pay for construction materials far outstripped the prices contractors charge in the 12 months ending in September, despite a recent decline in a few materials prices, while delivery problems intensified, according to an analysis by the Associated General Contractors of America of government data released today. Association officials urged Washington officials to end tariffs on key construction materials and take steps to help unknot snarled supply points.

“Construction materials costs remain out of control despite a decline in some inputs last month,” said Ken Simonson, the association’s chief economist. “Meanwhile, supply bottlenecks continue to worsen.”

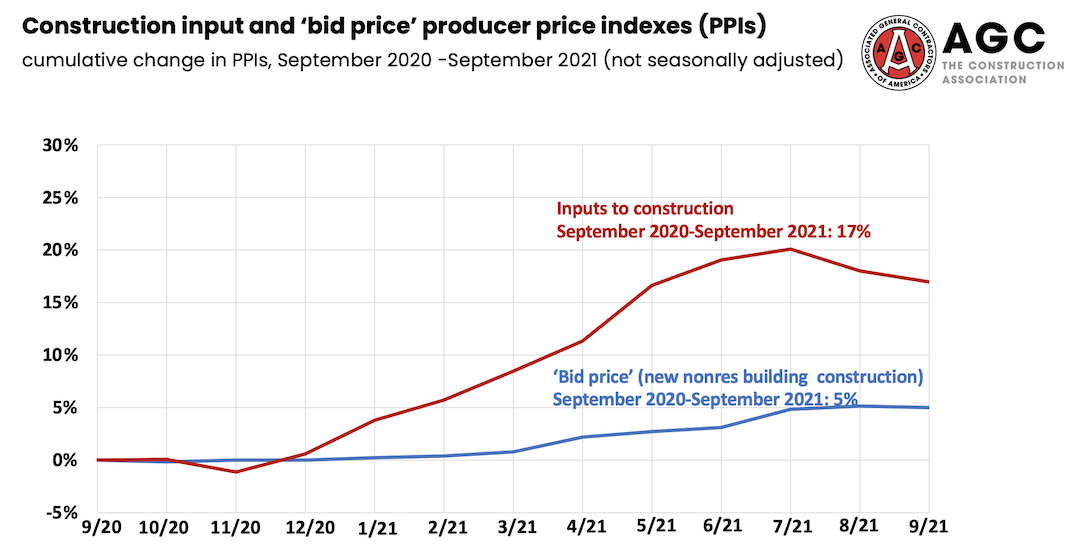

The producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—rose 5.2% over the past 12 months, despite a decline of 0.9% in the latest month. From September 2020 to last month, the prices that producers and service providers such as distributors and transportation firms charged for construction inputs jumped 17%, Simonson noted.

There were double-digit percentage increases in the selling prices of most materials used in every type of construction with the exclusion of lumber and plywood, which fell 12.3% during the past 12 months.

The producer price index for steel mill products increased by 134% compared to last September. The index for copper and brass mill shapes rose 39.5% and the index for aluminum mill shapes increased 35.1%. The index for plastic construction products rose 29.5%. The index for gypsum products such as wallboard climbed 23%. The index for insulation materials rose 19%, while the index for prepared asphalt and tar roofing and siding products rose 13.1%.

In addition to increases in materials costs, transportation and fuel costs also spiked. The index for truck transportation of freight jumped 15%. Fuel costs, which contractors pay directly to operate their own trucks and off-road equipment, as well as through surcharges on freight deliveries, have also jumped.

Association officials added that many contractors are experiencing extreme delays or uncertainty about delivery dates for receiving shipments of many types of construction materials. The association officials urged the Biden administration to immediately end tariffs on key construction materials. In addition, they asked for an all-out effort to help ports and freight transportation businesses move goods more quickly

“The tariffs on lumber, steel, aluminum, and many construction components have added fuel to already overheated prices,” said Stephen E. Sandherr, the association’s chief executive officer. “Ending the tariffs would help immediately, while other steps should be taken to relieve supply-chain bottlenecks.”

View producer price index data. View chart of gap between input costs and bid prices. View the association’s Construction Inflation Alert.

Related Stories

Market Data | Oct 19, 2021

Demand for design services continues to increase

The Architecture Billings Index (ABI) score for September was 56.6.

Market Data | Oct 14, 2021

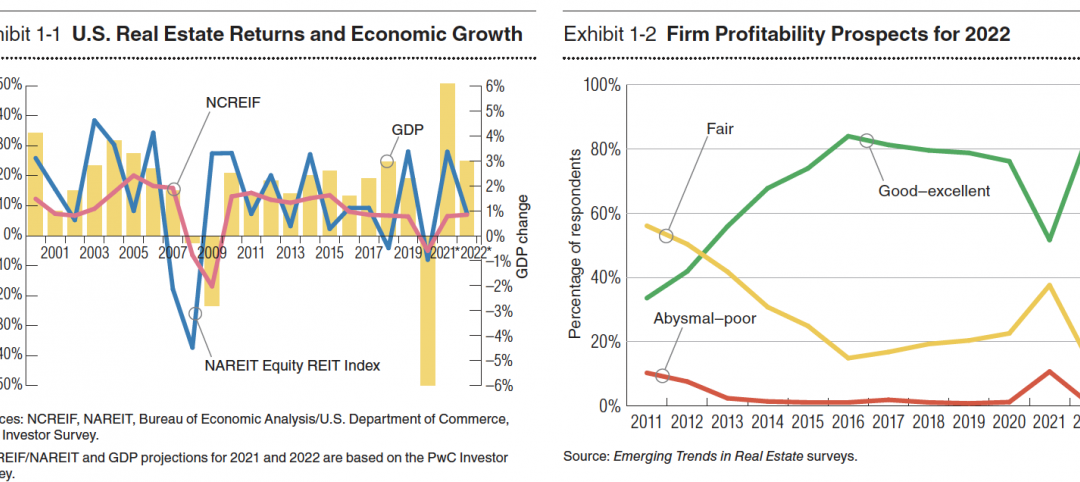

Climate-related risk could be a major headwind for real estate investment

A new trends report from PwC and ULI picks Nashville as the top metro for CRE prospects.

Market Data | Oct 11, 2021

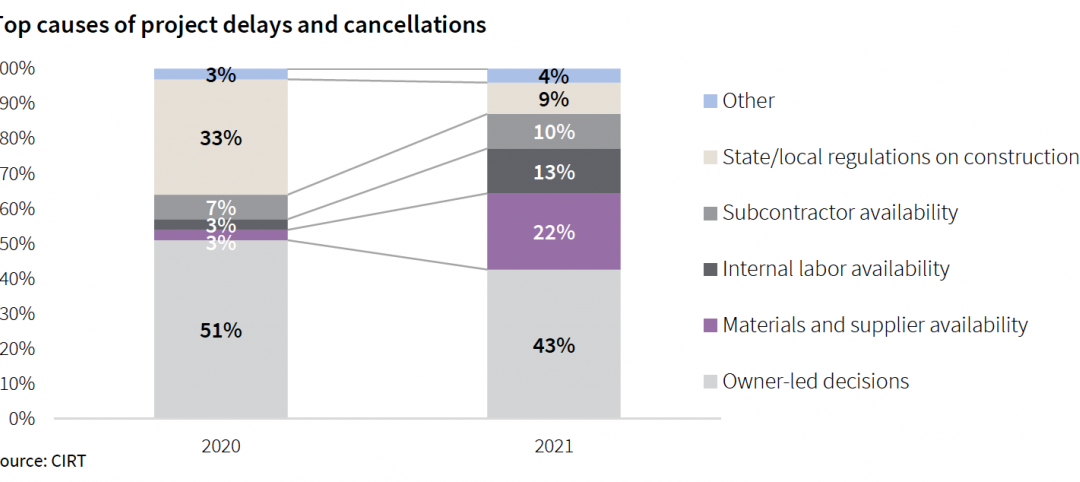

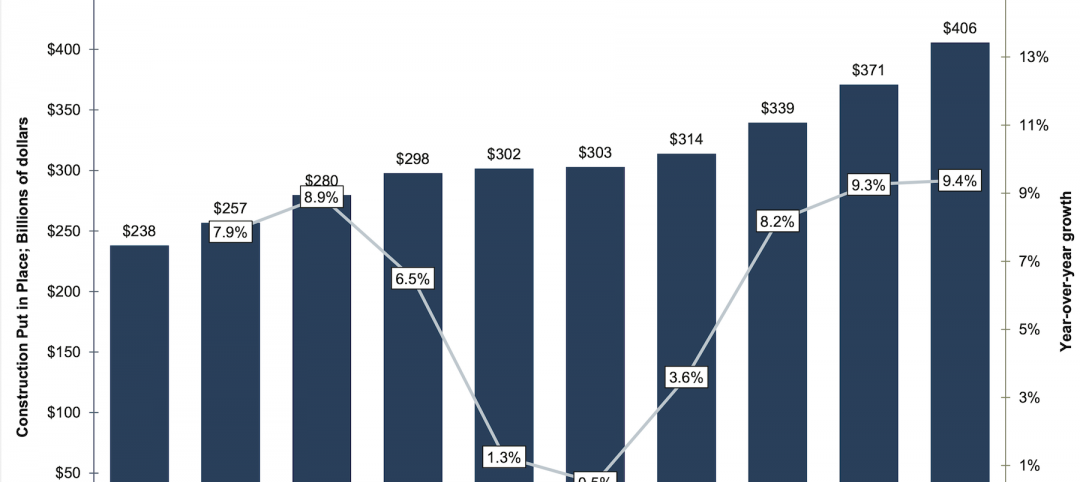

No decline in construction costs in sight

Construction cost gains are occurring at a time when nonresidential construction spending was down by 9.5 percent for the 12 months through July 2021.

Market Data | Oct 11, 2021

Nonresidential construction sector posts first job gain since March

Has yet to hit pre-pandemic levels amid supply chain disruptions and delays.

Market Data | Oct 4, 2021

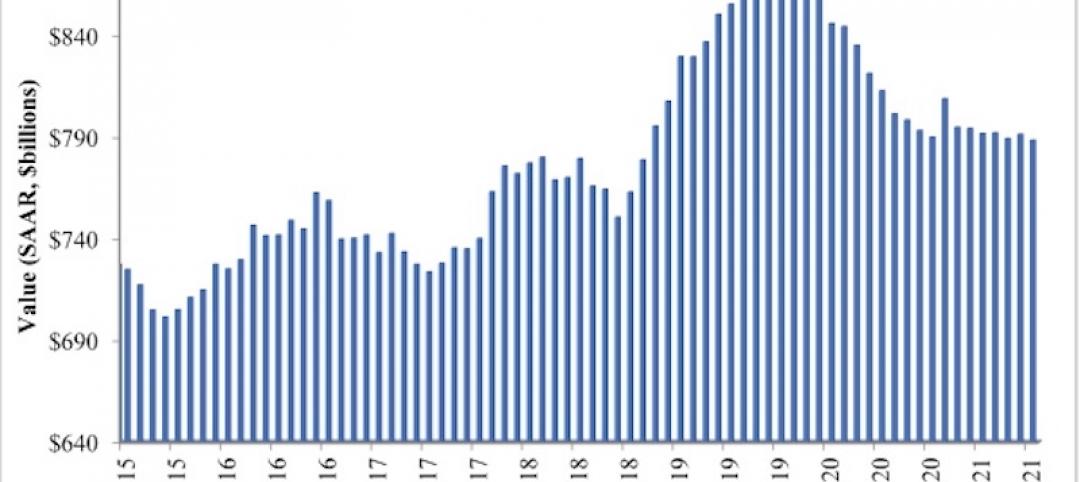

Construction spending stalls between July and August

A decrease in nonresidential projects negates ongoing growth in residential work.

Market Data | Oct 1, 2021

Nonresidential construction spending dips in August

Spending declined on a monthly basis in 10 of the 16 nonresidential subcategories.

Market Data | Sep 29, 2021

One-third of metro areas lost construction jobs between August 2020 and 2021

Lawrence-Methuen Town-Salem, Mass. and San Diego-Carlsbad, Calif. top lists of metros with year-over-year employment increases.

Market Data | Sep 28, 2021

Design-Build projects should continue to take bigger shares of construction spending pie over next five years

FMI’s new study finds collaboration and creativity are major reasons why owners and AEC firms prefer this delivery method.

Market Data | Sep 22, 2021

Architecture billings continue to increase

The ABI score for August was 55.6, up from July’s score of 54.6.

Market Data | Sep 20, 2021

August construction employment lags pre-pandemic peak in 39 states

The coronavirus delta variant and supply problems hold back recovery.