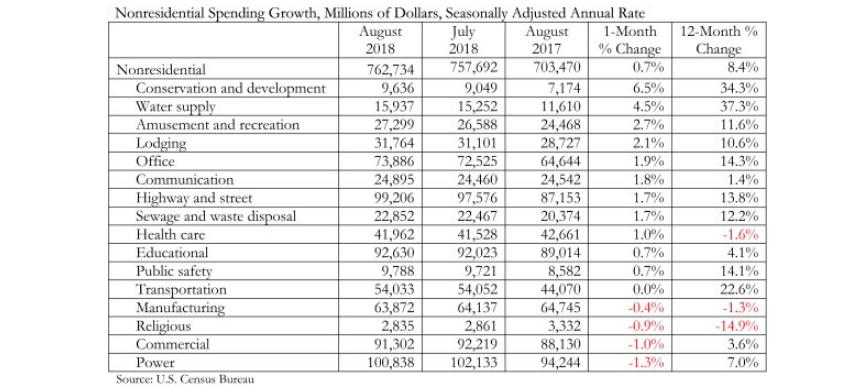

National nonresidential construction spending expanded 0.7% in August to its highest level since the U.S. Census Bureau began the data series in 2002, according to an Associated Builders and Contractors analysis released today.

Total nonresidential spending stood at $762.7 billion on a seasonally adjusted, annualized rate in August, which represents an increase of 8.4% compared to one year ago. Private nonresidential spending fell 0.2% in August largely due to a 1.3% decline in power-related spending, the largest private construction spending category, and public nonresidential spending increased 2%.

“The good news on the nation’s economy and the construction sector just keeps coming,” said ABC Chief Economist Anirban Basu. “The increase in overall nonresidential construction spending was reasonably predictable given the predominance of positive leading indicators such as ABC’s Construction Backlog Indicator, which reported record-setting 9.9 months of backlog in the second quarter of this year, and the Architectural Billings Index. In addition, the recent pattern of stable private construction spending coupled with growing public spending remained in place in August.

“Rising property values, ongoing rapid job creation and a confident consumer translates into rising real estate values, income and retail sales tax collections, which in turn creates additional resources to invest in infrastructure,” said Basu. “That helps explain the chunky year-over-year spending increases in a number of primarily publicly financed categories, including water supply, which increased 37%; conservation and development, 34%; transportation, 23%; and highway/street, 14%.

“It is quite possible that construction spending growth will accelerate from current levels,” said Basu. “Aside from the strong economy, ongoing increases in materials prices and worker compensation is translating into rising project delivery costs, which, all things being equal, produces faster construction spending growth.

“For now, rising construction and borrowing costs are not stifling economic activity,” said Basu. “However, purchasers of construction services may be increasingly inclined to postpone projects if costs continue to rise, which is likely. And while contractors remain concerned about the overall construction workforce shortage negatively affecting project deadlines, the near-term outlook remains robust.”

Related Stories

Contractors | Feb 13, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of January 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator declined to 8.4 months in January, according to an ABC member survey conducted from Jan. 22 to Feb. 4. The reading is down 0.6 months from January 2023.

Codes | Feb 9, 2024

Illinois releases stretch energy code for building construction

Illinois is the latest jurisdiction to release a stretch energy code that provides standards for communities to mandate more efficient building construction. St. Louis, Mo., and a few states, including California, Colorado, and Massachusetts, currently have stretch codes in place.

Giants 400 | Feb 8, 2024

Top 10 Telecommunications Building Construction Firms for 2023

AECOM, LeChase Construction Services, Robins & Morton, and Salas O'Brien top BD+C's ranking of the nation's largest telecommunications building general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 8, 2024

Top 20 Integrated Project Delivery (IPD) Construction Firms for 2023

Barton Malow, DPR Construction, Hensel Phelps, and Whiting-Turner top BD+C's ranking of the nation's largest integrated project delivery (IPD) construction firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 8, 2024

Top 90 Design-Build Construction Firms for 2023

Hensel Phelps, Ryan Companies US, Gray Construction, Haskell, and Burns & McDonnell top BD+C's ranking of the nation's largest design-build construction firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 8, 2024

Top 20 Public Library Construction Firms for 2023

Gilbane Building Company, Skanska USA, Manhattan Construction, McCownGordon Construction, and C.W. Driver Companies top BD+C's ranking of the nation's largest public library general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 8, 2024

Top 30 Public Library Engineering Firms for 2023

KPFF Consulting Engineers, Tetra Tech High Performance Buildings Group, Thornton Tomasetti, WSP, and Dewberry top BD+C's ranking of the nation's largest public library engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 8, 2024

Top 35 Performing Arts Center and Concert Venue Construction Firms for 2023

The Whiting-Turner Contracting Company, Holder Construction, McCarthy Holdings, Clark Group, and Gilbane Building Company top BD+C's ranking of the nation's largest performing arts center and concert venue general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 8, 2024

Top 40 Museum Construction Firms for 2023

Turner Construction, Clark Group, Bancroft Construction, STO Building Group, and Alberici-Flintco top BD+C's ranking of the nation's largest museum and gallery general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.