Demand for different types of construction continued to diverge in June as residential construction increased for the month and the year while nonresidential construction spending fell again, according to a new analysis of federal construction spending data the Associated General Contractors of America released today. Officials noted the nonresidential declines include a steep drop in spending on highway and street projects and urged Congress to quickly pass a new, bipartisan infrastructure measure.

“The pandemic has created a tale of two construction industries, a residential market where demand continues to surge and a nonresidential market that is struggling to gain traction,” said Stephen E. Sandherr, the association’s chief executive officer. “The federal government has a real opportunity to boost nonresidential construction by passing the bipartisan infrastructure measure as quickly as possible.”

Construction spending in June totaled $1.55 trillion at a seasonally adjusted annual rate, an increase of 0.1% from May, and 8.2% higher than the pandemic-depressed rate in June 2020. Once again, residential construction saw monthly and year-over-year gains while non-residential construction spending lagged. The residential construction segment climbed 1.1% for the month and 28.8% year-over-year. The nonresidential construction segment fell by 0.9% compared to May and 6.6% compared to June 2020.

Private nonresidential construction spending fell 0.7% from May to June and 6.0% since June 2020, with year-over-year decreases in all 11 subsegments. The largest private nonresidential category, power construction, fell 1.9% year-over-year and 1.2% from May to June. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—retreated 2.1% year-over-year and 0.2% for the month. Manufacturing construction fell 0.7% from a year earlier and 1.1% from May. Office construction decreased 9.1% year-over-year and by 0.1% compared to May.

Public construction spending plunged 7.5% year-over-year and 1.2% for the month. Among the largest segments, highway and street construction declined 7.6% from a year earlier and 5.3% compared to May 2021. Public educational construction decreased 9.1% year-over-year and 0.8% in June. Spending on transportation facilities fell 5.7% over 12 months but was up 1.1% in June.

Association officials said the new bipartisan infrastructure measure would invest more than $1.2 trillion to build the nation’s roads, bridges, transit systems, airports, ports, and waterways, drinking water and wastewater systems, energy infrastructure and more. They added that Congress should pass the measure as quickly as possible to have the broadest impact on creating new construction career opportunities.

“It would be a shame if certain members of Congress were to hold new infrastructure investments, and the job opportunities they create, hostage to impose unrelated partisan measures that would undermine the economic recovery,” Sandherr said.

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

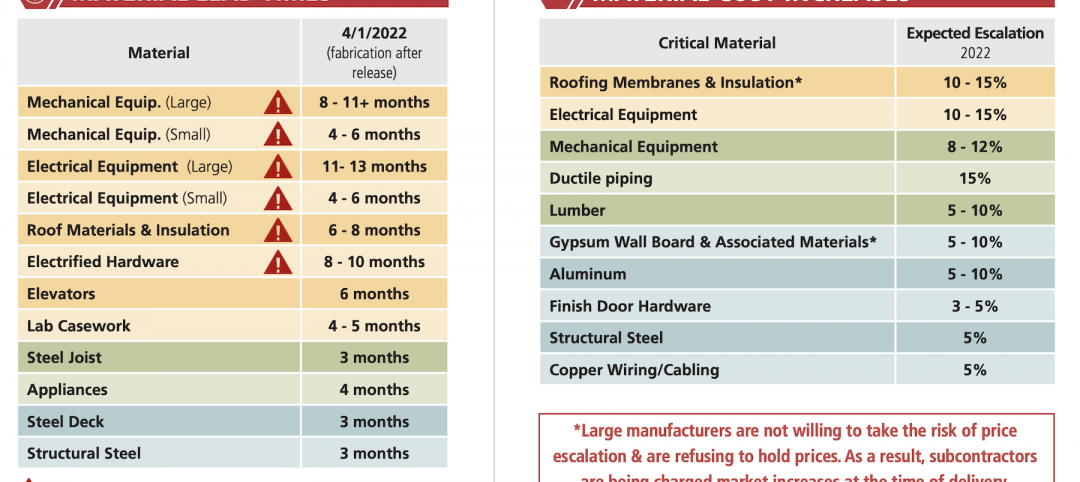

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

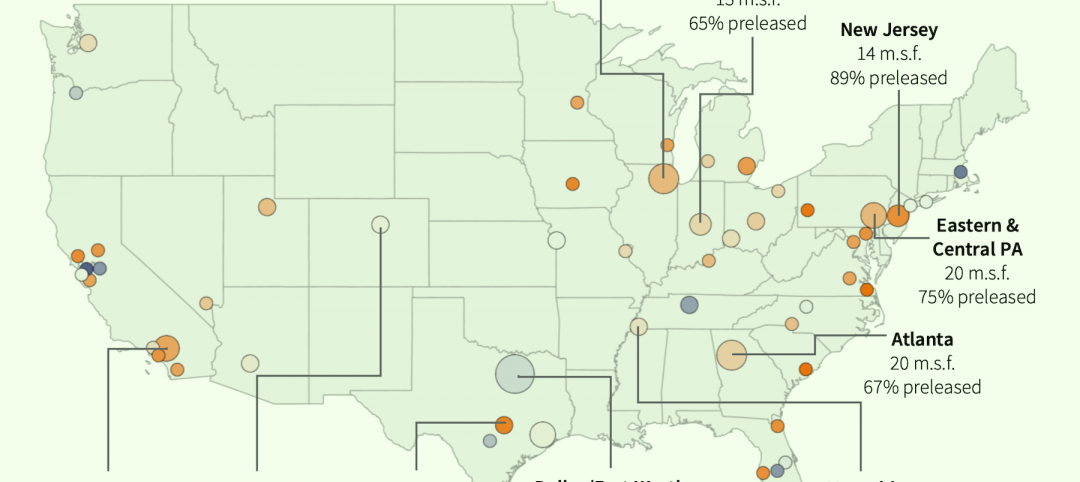

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment