The construction industry gained 22,000 jobs between August and September as nonresidential construction firms added employees for the first time in six months, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said nonresidential construction has been affected by the widespread supply chain problems, which are causing owners already uncertain about future demand for commercial space to delay or even cancel some projects.

“While it is refreshing to see job gains in both residential and nonresidential construction, nonresidential building and infrastructure employment remains far below its pre-pandemic peak,” said Ken Simonson, the association’s chief economist. “It will take more than a few months of gains to match the overall economy.”

Construction employment in September totaled 7,447,000, an increase of 22,000 since August. However, industry employment remained 201,000 below the pre-pandemic peak set in February 2020.

The nonresidential segment, comprising nonresidential building and specialty trade contractors plus heavy and civil engineering construction firms, added 18,600 employees in September. But nonresidential employment is 281,000 below the February 2020 level, as the sector has recovered only 56 percent of the jobs lost in the first two months of the pandemic.

Residential construction--including building contractors such as homebuilders, along with residential specialty trades--added 3,600 employees in September. Residential employment tops the February 2020 mark by 80,000.

Simonson cited an unending series of supply-chain bottlenecks, as well as extreme price increases and long lead times for a variety of construction materials, as threats to further growth of nonresidential construction. He said he had heard about an increasing number of project owners deciding to postpone projects because of excessive cost increases and lead times. He noted that the association has again updated its Construction Inflation Alert, a guide to inform owners, officials, and others about the cost and supply-chain challenges.

Association officials urged the Biden administration to remove tariffs and import quotas on a range of key construction materials to help address supply chain disruptions. They added that Congress can help offset declining nonresidential demand for construction by passing the bipartisan infrastructure bill that has already cleared the Senate.

“Both parties in the House should make passing the infrastructure bill a top priority because it is the best way to create new construction careers and make our economy more efficient,” said Stephen E. Sandherr, the association’s chief executive officer. “If the President acts to address supply chain problems and Congress passes the infrastructure bill, construction employment is likely to surge.”

Related Stories

Market Data | Oct 24, 2018

Architecture firm billings slow but remain positive in September

Billings growth slows but is stable across sectors.

Market Data | Oct 19, 2018

New York’s five-year construction spending boom could be slowing over the next two years

Nonresidential building could still add more than 90 million sf through 2020.

Market Data | Oct 8, 2018

Global construction set to rise to US$12.9 trillion by 2022, driven by Asia Pacific, Africa and the Middle East

The pace of global construction growth is set to improve slightly to 3.7% between 2019 and 2020.

Market Data | Sep 25, 2018

Contractors remain upbeat in Q2, according to ABC’s latest Construction Confidence Index

More than three in four construction firms expect that sales will continue to rise over the next six months, while three in five expect higher profit margins.

Market Data | Sep 24, 2018

Hotel construction pipeline reaches record highs

There are 5,988 projects/1,133,017 rooms currently under construction worldwide.

Market Data | Sep 21, 2018

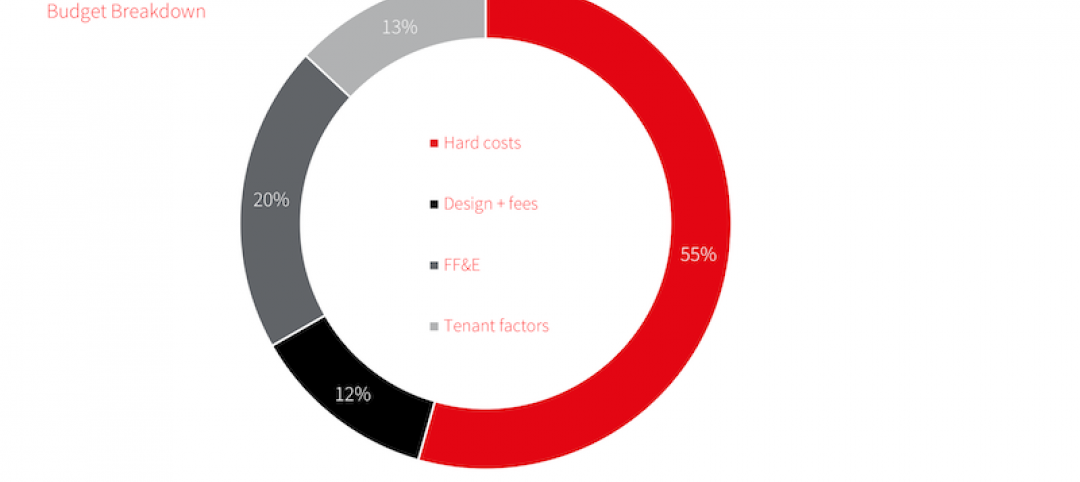

JLL fit out report portrays a hot but tenant-favorable office market

This year’s analysis draws from 2,800 projects.

Market Data | Sep 21, 2018

Mid-year forecast: No end in sight for growth cycle

The AIA Consensus Construction Forecast is projecting 4.7% growth in nonresidential construction spending in 2018.

Market Data | Sep 19, 2018

August architecture firm billings rebound as building investment spurt continues

Southern region, multifamily residential sector lead growth.

Market Data | Sep 18, 2018

Altus Group report reveals shifts in trade policy, technology, and financing are disrupting global real estate development industry

International trade uncertainty, widespread construction skills shortage creating perfect storm for escalating project costs; property development leaders split on potential impact of emerging technologies.