Retailers went through another tough year in 2017, during which store closings included 1,430 Radio Shacks, 808 Payless ShoeSource outlets, 667 Ascentas (which sell nutritional supplements), and 600 Walgreens.

That brick-and-mortar attrition continued in the first month of 2018, when Sears announced it would close another 103 Sears and Kmart outlets, and Toys ‘R’ Us—whose debt now totals about $5 billion—said it would close up to 182 units, reducing its total in the U.S. by one fifth. The carnage this year will also eliminate 379 Teavanas (Starbucks’ struggling tea retail outlets), 200 Gaps and Banana Republics, 63 Sam’s Clubs, 11 Macy’s, 40 Bon-Tons, 50 J. Crews, and between 100 and 150 Michael Kors boutiques.

Physical stores continue to get hammered by online shopping that accounted for more than 9% of total U.S. retail sales last year. However, not every physical vestige of retailing is collapsing under the pressure from eCommerce. 7-Eleven this month made the biggest acquisition in its history when it paid $3.2 billion to buy 1,030 convenience stores in 17 states owned by Sunoco LP, raising its total store count in North America to close to 9,700.

Earlier this month, the New York Post ran an article under the headline “There’s never been a better time to open retail stores in NYC.” The story pointed out how retailers from several countries are scouring New York for real estate. Levi’s will soon relocate its flagship store into a larger, 17,250-sf space in Vornado Realty Trust’s 1535 Broadway. Other retail chains looking for more space in the Big Apple include Target and Lord & Taylor.

That retailers come and go is hardly news to anyone who follows this sector or, for that matter, shops. But the constant drumbeat about a “retail apocalypse” is still premature, according to a report released this month by the research and consulting firm Fung Global Retailing & Technology (FGRT).

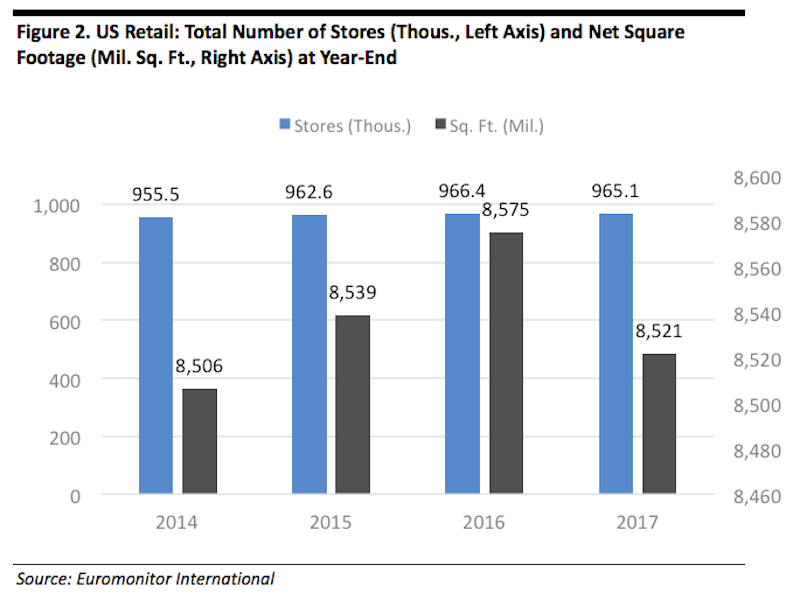

Despite weaker foot traffic, there was only a slight net decline in total U.S. retail stores last year, the first dropoff since 2009.

The report acknowledges that shopper traffic dropped off by 7.9% last year. And 6,995 stores closed in the U.S. in 2017 representing a net decline of 0.1%, according to Euromonitor International, which also estimated a 0.6% decrease in total retail selling space to 8.52 billion sf.

But the store-count reduction was the first since 2009, and it seemed to hit the apparel, mass merchant, and electronics and appliance sectors the hardest.

The grocery and dollar-store sectors, on the other hand, expanded “significantly” last year, with major dealers in those sectors opening a net 1,785 outlets. Other retailers, like the supermarket chain Aldi and the department store T. J. Maxx, are actively opening stores in off-mall and strip-mall locations.

Indeed, selling space for variety stores rose by 4.4% last year, by 1.3% for grocery stores, and by 1% for warehouse clubs.

FGRT points out that while brick-and-mortar retailers are getting more business from online sales, their in-store business continued to expand last year. Nearly 88% of all U.S. retail sales were transacted in physical stores in 2017, according the Census Bureau data. Offline retail sales grew by about 2.5%, and contributed to total U.S. retail sales increasing by 4%.

The study also notes that if online sales were taken out of the equation, the average sales per retail store rose 2.4% to $3.13 million, and average sales per square foot increased by 2.6% to $353.

It’s been conventional wisdom for a while that regional malls have been fast approaching their expiration dates. But FGRT states that superregional malls—defined by having at least 800,000 sf of selling space—were the only major shopping-center segment to grow its occupancy rates last year. FGRT also notes that open-air centers have proven to be a resilient real-estate segment, primarily because they typically have few apparel tenants and often include a strong grocery component.

Mall owners in general are diversifying their mix to incorporate more centers with premium tenants like Apple and even Tesla (which currently operates 109 retail showrooms nationwide). David Simon, CEO and Chairman of Simon Property Group, the country’s largest retail developer, says his company sees “significant opportunity” in densification of its shopping centers with the addition of mixed-use elements such as hotels, multifamily, and offices.

Another developer, Kimco, which was negatively affected by Sports Authority’s liquidation, sees future tenant mixes including more nascent retail chains such as Lidl and HomeSense from TJX. “Kimco is adapting to [the] evolving landscape by working hard to deliver both the product and an experience to tenants and shoppers commensurate with this new world order,” says CEO Conor Flynn. “That is why at many of [our] sites, you’ll see more health and wellness, more service providers, more food and restaurants, more entertainment and more experiential retailing.”

Related Stories

Warehouses | Nov 9, 2020

Lowe’s rides ecommerce wave by expanding its distribution and delivery capacities

The retail giant will also open four more bulk warehouses, including a 1.2-million-sf DC in Alabama it is building with Clayco.

Retail Centers | Nov 2, 2020

Chick-fil-A introduces modular building program for rebuilding and remodeling existing restaurants

The first location to use this rebuild style reopens on Oct. 15 near Atlanta.

Adaptive Reuse | Oct 26, 2020

Mall property redevelopments could result in dramatic property value drops

Retail conversions to fulfillment centers, apartments, schools, or medical offices could cut values 60% to 90%.

Retail Centers | Sep 17, 2020

The Weekly show: Breaking the rules of retail, and the Household Model for assisted living facilities

This week on The Weekly, BD+C editors spoke with leaders from CallisonRTKL, MBH Architects, and McMillan Pazdan Smith on three topics: breaking the rules of retail, the Household Model for assisted living facility design, and designing labs to address the coronavirus and future health events.

Airports | Sep 10, 2020

The Weekly show: Curtis Fentress, FAIA, on airport design, and how P3s are keeping university projects alive

The September 10 episode of BD+C's "The Weekly" is available for viewing on demand.

Giants 400 | Aug 28, 2020

2020 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

The 2020 Giants 400 Report features more than 130 rankings across 25 building sectors and specialty categories.

Coronavirus | Aug 25, 2020

Video: 5 building sectors to watch amid COVID-19

RCLCO's Brad Hunter reveals the winners and non-winners of the U.S. real estate market during the coronavirus pandemic.

Retail Centers | Aug 19, 2020

How has shopping changed over the past 100 years? A look at the evolution of retail

From malls and big-box stores to online delivery and mall redevelopment: Here’s how the retail landscape has evolved—and where it’s likely headed.

Retail Centers | Aug 12, 2020

Apple Central World welcomes first visitors in Bangkok

Foster + Partners designed the building.

Retail Centers | Jul 30, 2020

The future is a numbers game for retail and restaurants

Brick-and-mortar retailers, already gasping for air under pressure from ecommerce, were dealt a critical blow by the spread of the coronavirus that forced most stores and restaurants to close, or at best operate as carryout- or delivery-only providers.