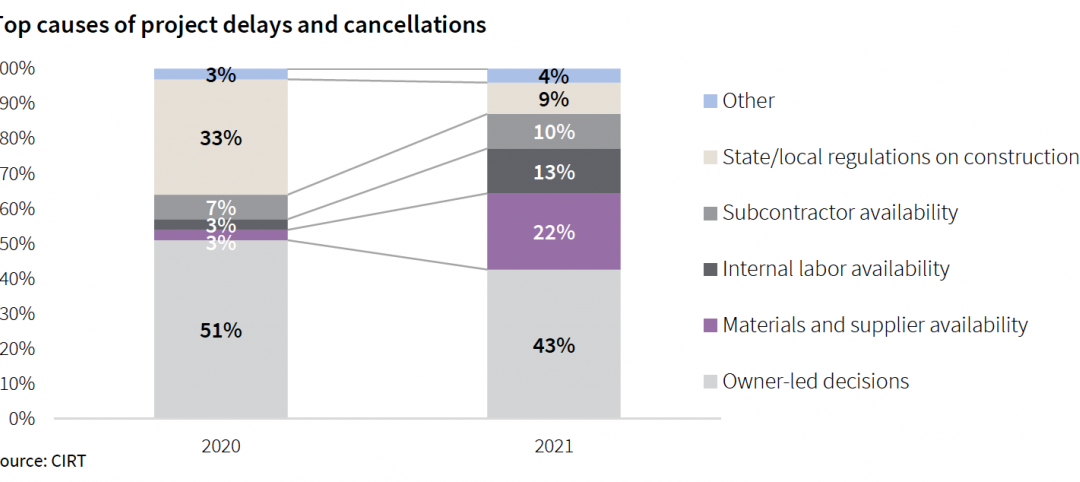

More than 85% of contractors have been negatively impacted by COVID-19, according to the results of an August reader survey conducted by Construction Executive magazine, which is published by Associated Builders and Contractors. Supply chain disruptions, prolonged municipal permitting processes and delayed inspections due to office closures are all factors contributing to the increased rate of postponement and/or cancellation of construction projects.

While many contractors have not yet seen drastic impacts to their business, as construction was in many areas considered an “essential” service, the long-term implications are concerning. Seventy percent of contractors did not expect the construction industry to stabilize until at least 2021, while an additional 10.4% say they believe it may never reach pre-pandemic levels.

“While the survey respondents’ concerns about market viability and the health fears of the virus itself will remain in place for the duration of 2020 and into next year, contractors did report bright spots, such as a widespread adoption of technology after the outbreak of COVID-19,” said Lauren Pinch, editor-in-chief of CE. “That said, as the pandemic continues to change the landscape of the U.S. construction industry and state and local economies, contractors are continuously trying to assess the near- and long-term effects.”

While an uptick in office renovations to meet social distancing guidelines and to implement other COVID-19-related precautions was expected, more than three-quarters of respondents (76.12%) stated that they have not found this to be the case. Concerns over indoor air quality and proper ventilation may have also led people to believe there would also be a large increase in HVAC upgrade projects, but only 31.79% of respondents stated that this was the case.

Looking toward economic recovery, three-quarters of contractors believe that there will be more interest in construction education programs as people seek out new types of work. Specialty trades, apprenticeship programs, project management training and more tech-focused construction jobs were all listed as areas that contractors believe will see high levels of interest.

Read more about the survey results at ConstructionExec.com and subscribe to CE This Week for the latest news, market developments and business issues impacting the construction industry.

Related Stories

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.

Market Data | Oct 19, 2021

Demand for design services continues to increase

The Architecture Billings Index (ABI) score for September was 56.6.

Market Data | Oct 14, 2021

Climate-related risk could be a major headwind for real estate investment

A new trends report from PwC and ULI picks Nashville as the top metro for CRE prospects.

Market Data | Oct 14, 2021

Prices for construction materials continue to outstrip bid prices over 12 months

Construction officials renew push for immediate removal of tariffs on key construction materials.

Market Data | Oct 11, 2021

No decline in construction costs in sight

Construction cost gains are occurring at a time when nonresidential construction spending was down by 9.5 percent for the 12 months through July 2021.

Market Data | Oct 11, 2021

Nonresidential construction sector posts first job gain since March

Has yet to hit pre-pandemic levels amid supply chain disruptions and delays.

Market Data | Oct 4, 2021

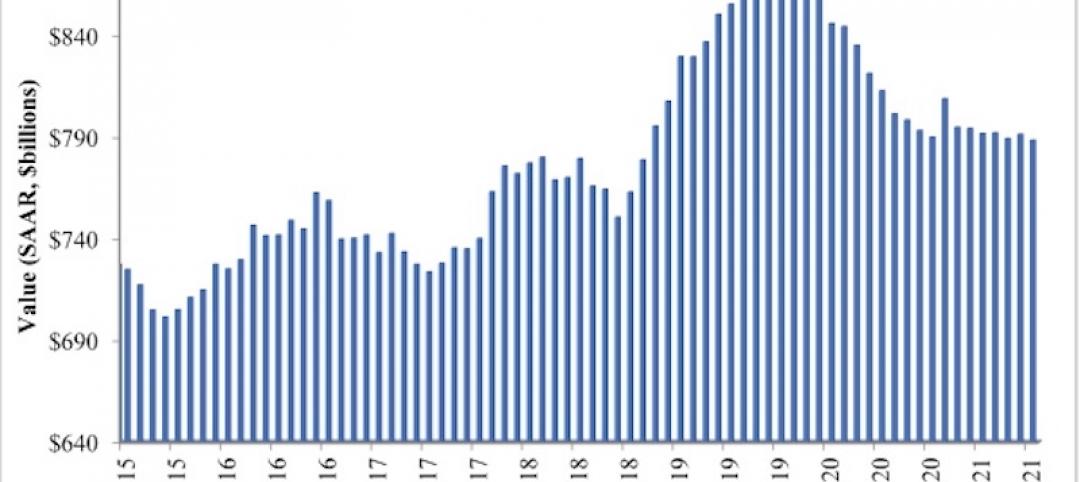

Construction spending stalls between July and August

A decrease in nonresidential projects negates ongoing growth in residential work.

Market Data | Oct 1, 2021

Nonresidential construction spending dips in August

Spending declined on a monthly basis in 10 of the 16 nonresidential subcategories.

Market Data | Sep 29, 2021

One-third of metro areas lost construction jobs between August 2020 and 2021

Lawrence-Methuen Town-Salem, Mass. and San Diego-Carlsbad, Calif. top lists of metros with year-over-year employment increases.