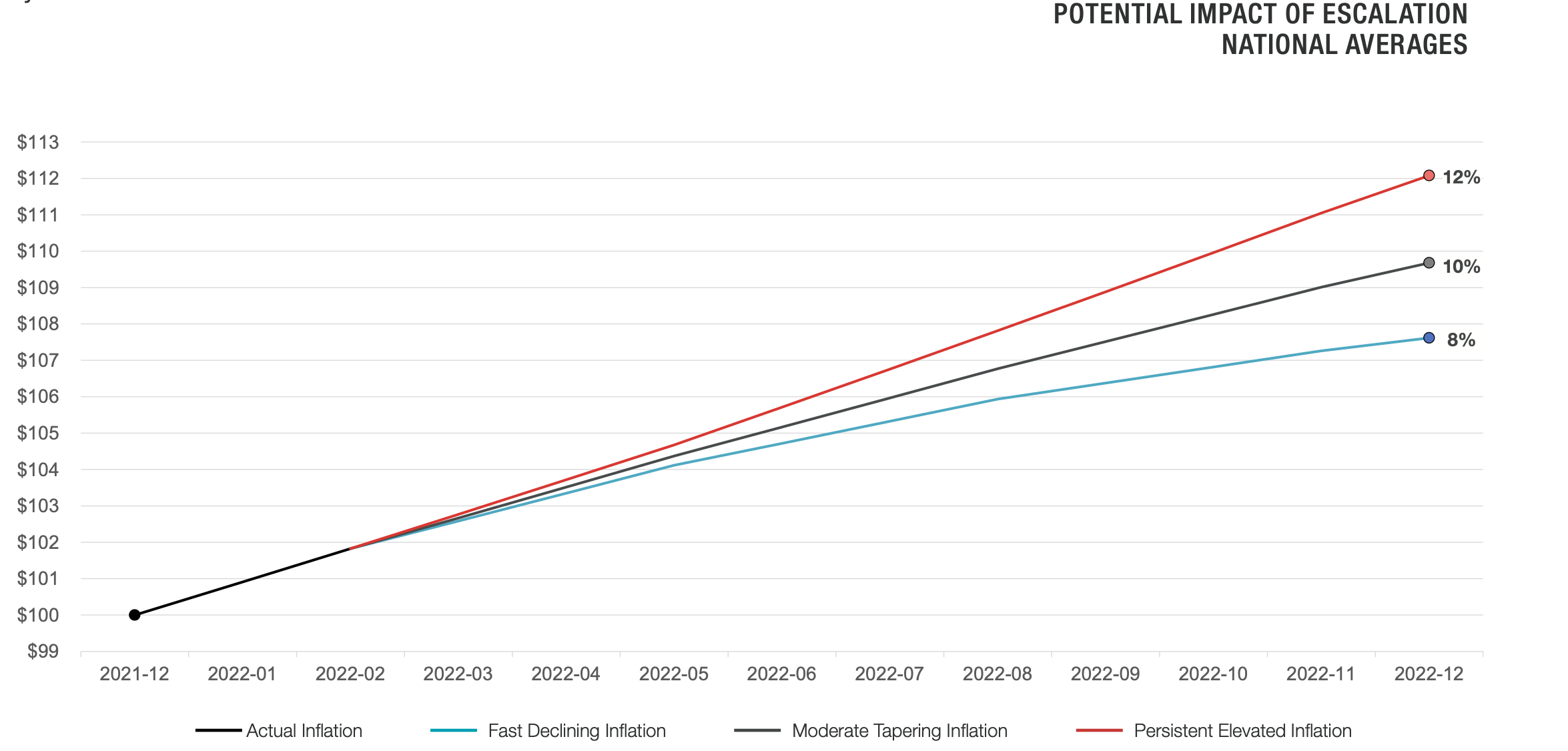

In the first six months of 2022, quarter-to-quarter inflation for construction materials showed signs of easing, but only slightly. “It’s important to clarify that costs are not decreasing; a more accurate description is that [they are] getting expensive less quickly,” stated Dallas-based architecture and construction firm The Beck Group, in its Summer 2022 Biannual Cost Report, which Beck released this week.

Covering January through June of this year, the report combines market data from a variety of sources—including AIA, FMI, McKinsey & Company, Autodesk, Cumming, the Urban Land Institute, and Associated General Contractors of America—with insights from the firm’s preconstruction teams in six markets: Atlanta, Austin, Charlotte, Dallas-Fort Worth, Denver, and the state of Florida.

Market conditions remain challenging nearly everywhere. “Schedule-related constraints are a new norm in today’s market,” The Beck Group contends. “Construction firms are in the middle of suppliers who can’t or won’t commit to pricing longer than 10 days and owners with historically prolonged approval processes. This reality conflicts with the past when it was still possible to hold pricing for upwards of 60 days.”

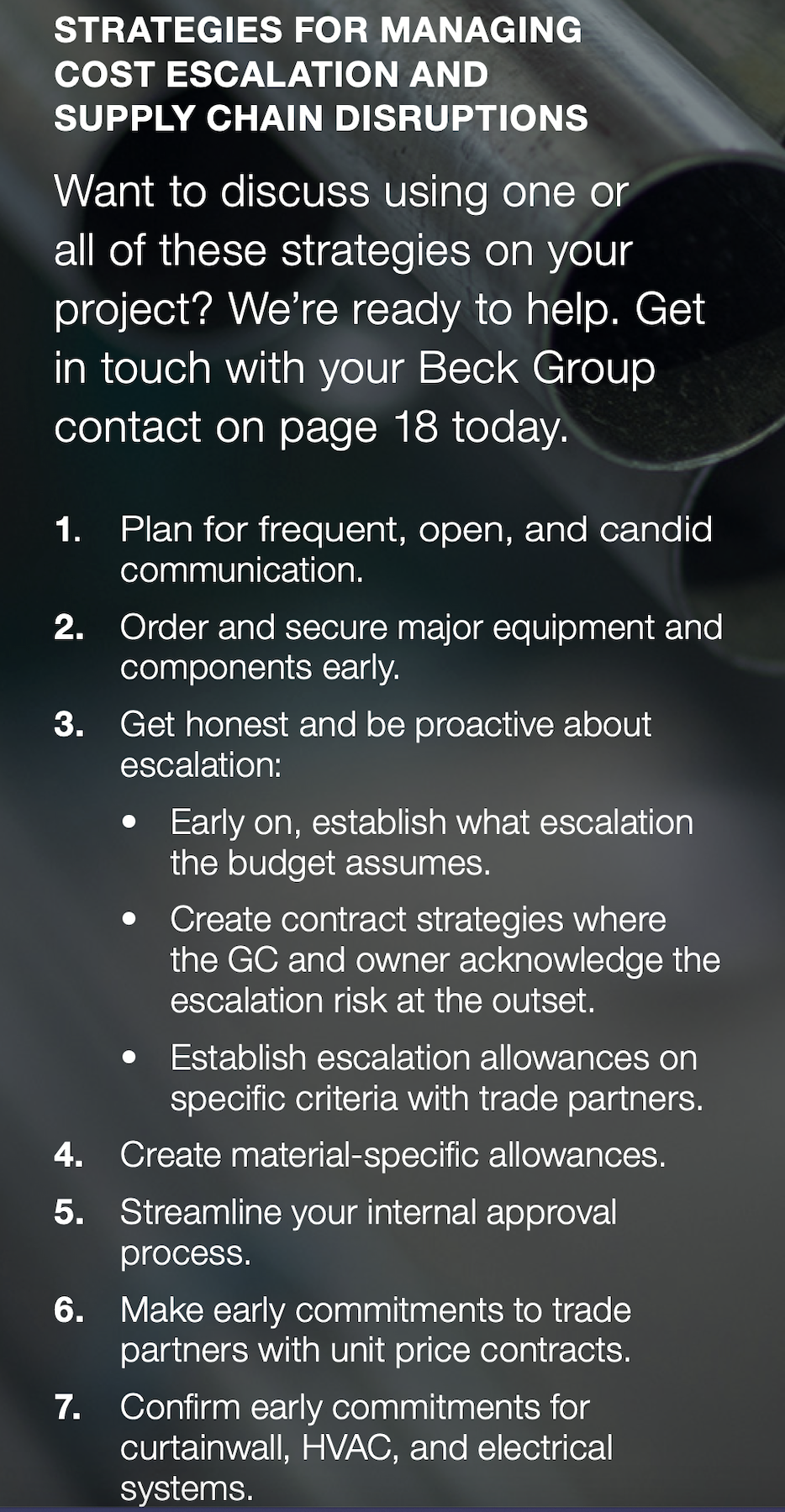

That being said, The Beck Group claims that the industry is on the cusp of a “new era in collaboration to manage costs and schedules.” That is especially true for developers and owners that bring their AEC partners into projects as early as possible. In its report, The Beck Group offers a list of strategies for managing inflation and supply-chain disruptions that mostly revolve around earlier procurement (see box).

Beck itself creates procurement packages for its clients to secure materials and equipment, a service that involves the firm’s design and construction teams.

DENVER AN EXPENSIVE PLACE TO BUILD IN

On the whole, The Beck Group is seeing significant demand and construction activities in the Sun Belt, in line with the “constant migration” of people and businesses to that region. (It points out, for example, that 43 high-rise towers are under development or construction in Austin.) To keep up with that demand, subcontractors in Texas must rely on imported cement (which, ironically, is among the construction materials least affected by current inflation).

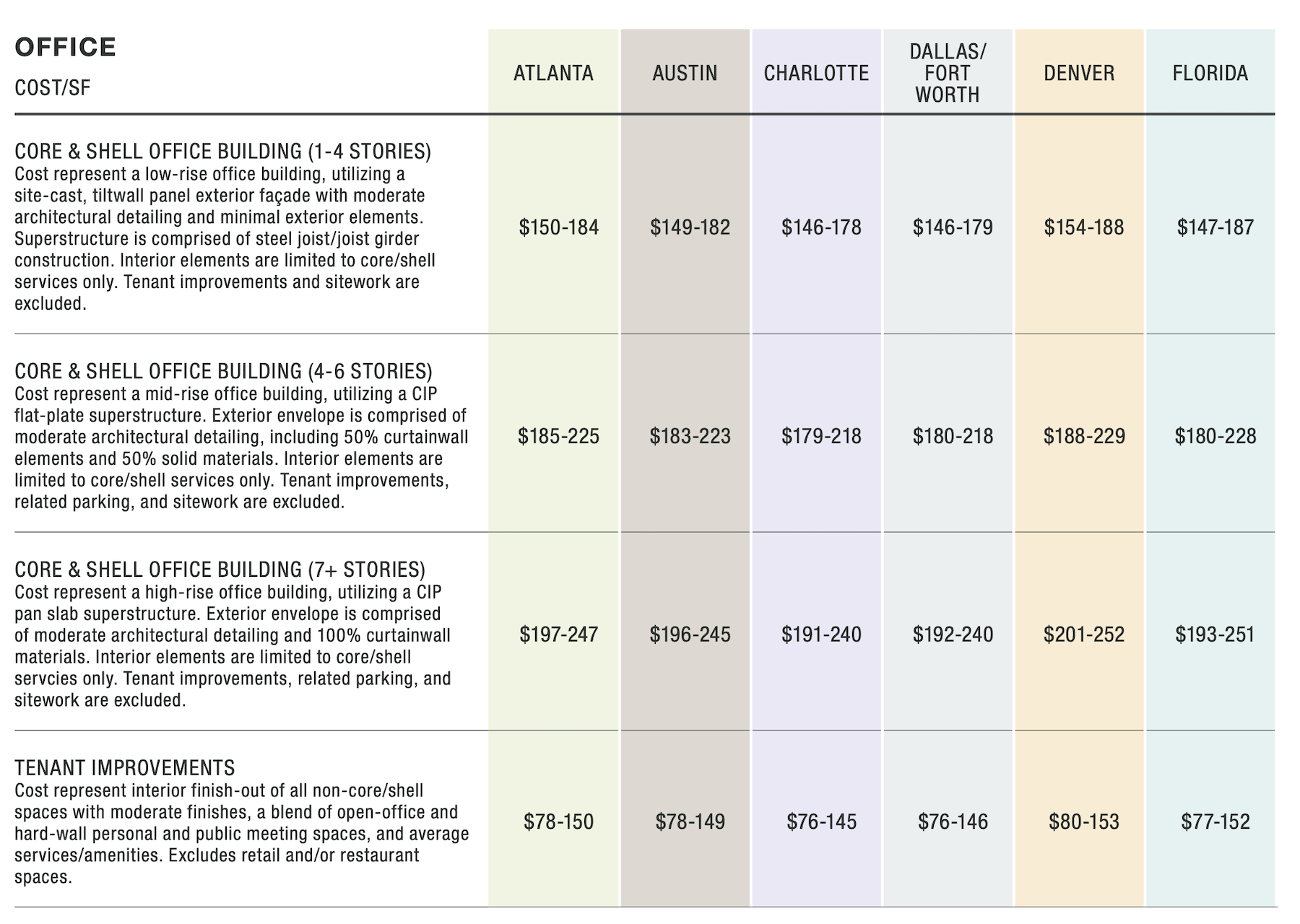

The report takes a deeper dive into the six Sun Belt markets mentioned above, and breaks down project costs by building types—office, healthcare, higher education, faith-based, hospitality, parking, and site work—and their respective sub niches.

The Denver metro is experiencing high demand for multifamily and mixed-use projects. Existing and planned projects are plentiful in the Atlanta market, and subcontractors report substantial backlogs. Building activity in the Florida market remains healthy, bolstered by the state’s economy that is expected to expand by 4 percent between now and 2024. The most significant demand for construction is education, healthcare, and aviation.

Across all building types, it costs more to build or renovate in Denver than in the other five markets, albeit only marginally so in several cases. For example, in healthcare, Denver’s costs per sf for ambulatory surgery centers—ranging from $477 to $583—were around $10 to $25 higher than the other metros. Science and lab buildings cost from $650 to $901 per sf to construct in Denver, versus $631 to $885 in Austin, another S+T hotbed.

The report also compares the cost per key to build or renovate hotels in these six markets, as well as the cost per space for parking and the cost per acre for site development.

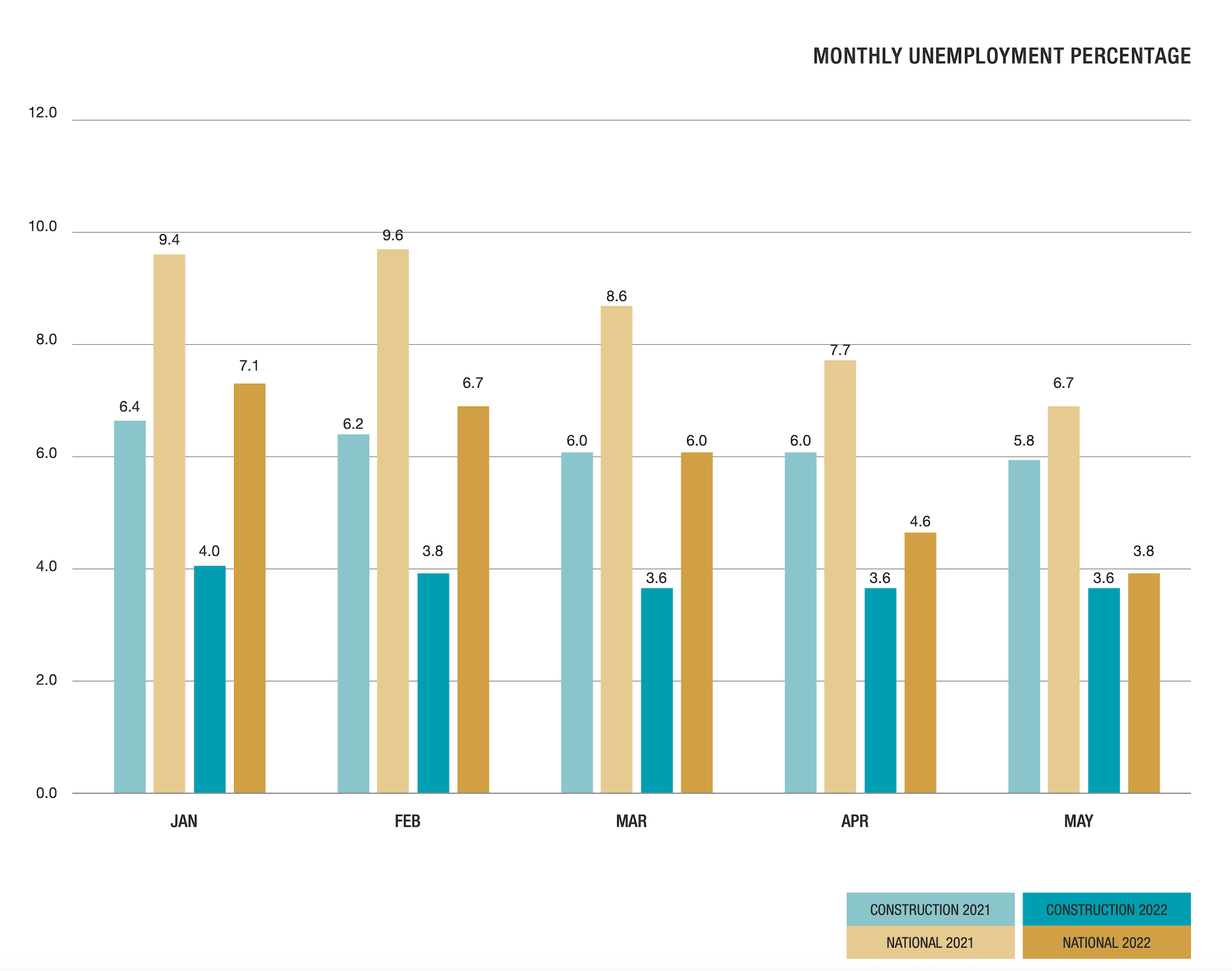

CONSTRUCTION EMPLOYMENT STRENGTHENING

The Beck Group report corroborates what other recent studies have been finding: that the construction employment market, nationally, is improving. Beck predicts this trend to continue as higher wages lure more people into the profession. The employment situation might also explain the slight bump in industry confidence that was evident in the first half of the year.

Related Stories

Market Data | Mar 14, 2018

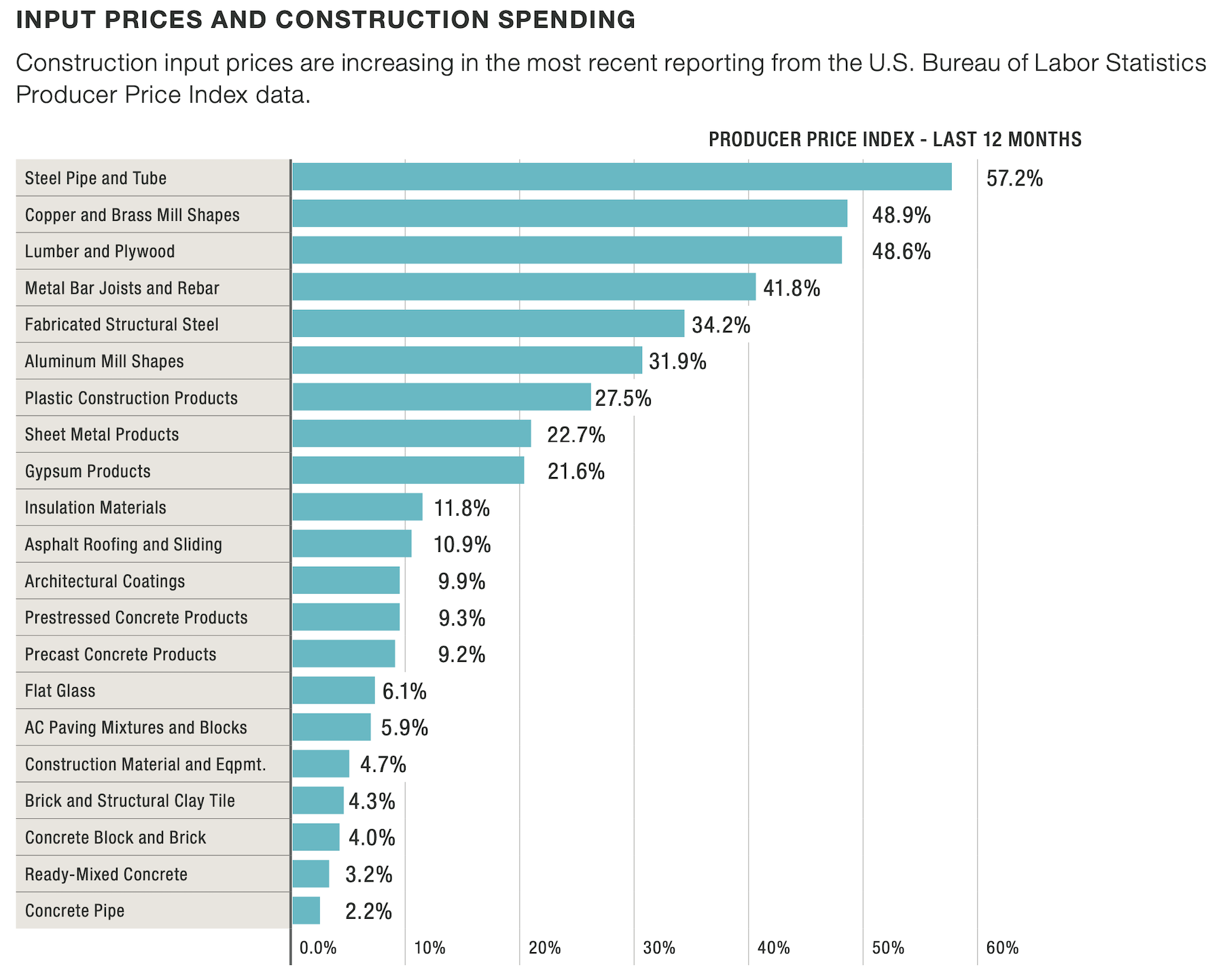

AGC: Tariff increases threaten to make many project unaffordable

Construction costs escalated in February, driven by price increases for a wide range of building materials, including steel and aluminum.

Market Data | Mar 12, 2018

Construction employers add 61,000 jobs in February and 254,000 over the year

Hourly earnings rise 3.3% as sector strives to draw in new workers.

Steel Buildings | Mar 9, 2018

New steel and aluminum tariffs will hurt construction firms by raising materials costs; potential trade war will dampen demand, says AGC of America

Independent studies suggest the construction industry could lose nearly 30,000 jobs as a result of administration's new tariffs as many firms will be forced to absorb increased costs.

Market Data | Mar 8, 2018

Prioritizing your marketing initiatives

It’s time to take a comprehensive look at your plans and figure out the best way to get from Point A to Point B.

Market Data | Mar 6, 2018

Persistent workforce shortages challenge commercial construction industry as U.S. building demands continue to grow

To increase jobsite efficiency and improve labor productivity, increasingly more builders are turning to alternative construction solutions.

Market Data | Mar 2, 2018

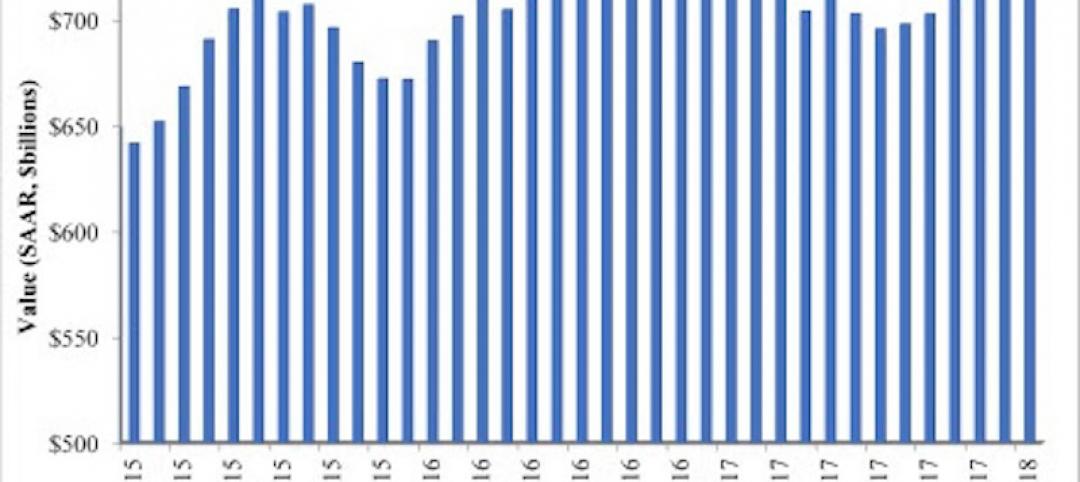

Nonresidential construction spending dips slightly in January

Private nonresidential construction fell 1.5% for the month, while public sector nonresidential spending increased 1.9%.

Market Data | Feb 27, 2018

AIA small firm report: Half of employees have ownership stake in their firm

The American Institute of Architects has released its first-ever Small Firm Compensation Report.

Market Data | Feb 21, 2018

Strong start for architecture billings in 2018

The American Institute of Architects reported the January 2018 ABI score was 54.7, up from a score of 52.8 in the previous month.

Multifamily Housing | Feb 15, 2018

United States ranks fourth for renter growth

Renters are on the rise in 21 of the 30 countries examined in RentCafé’s recent study.

Market Data | Feb 1, 2018

Nonresidential construction spending expanded 0.8% in December, brighter days ahead

“The tax cut will further bolster liquidity and confidence, which will ultimately translate into more construction starts and spending,” said ABC Chief Economist Anirban Basu.