Jacobs Engineering Group has entered into a definitive agreement to acquire the outstanding shares of CH2M Hill Companies, an Englewood, Colo.-based consulting and program management firm that is a leader in infrastructure, environmental, and government sectors.

Dallas-based Jacobs will finance this deal, valued at $3.27 billion (including assumption of $416 million of CH2M debt), with 60% cash and 40% stock. The firm has secured financing, including a $1.2 billion three-year term loan.

The acquisition is expected to close by the first quarter of 2018. It is subject to approval by CH2M’s shareholders that would own 15% of Jacobs’ stock upon consummation.

Jacobs is already a major player in the oil and chemicals sectors as a consultant, engineer, and project manager. Its other specialties include construction, aerospace, and defense.

In CH2M, Jacobs is acquiring a 71-year-old firm that is a leader in such areas as water infrastructure, transportation, industrial manufacturing, and environmental services.

CH2M, with more than 20,000 associates, is employee owned. It generates about $4.4 billion in annual revenue, with 73% of its business coming from consulting and program management. More than 70% of its clientele is local, state, or federal governments. Its adjusted cash flow, as of June 2017, was $323 million.

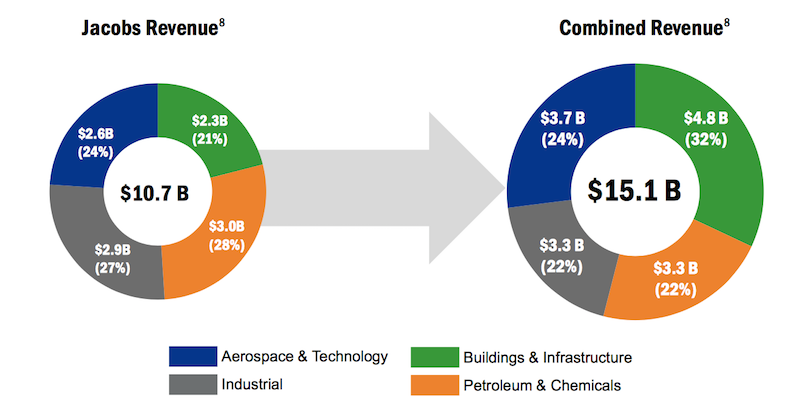

The combined company’s $15.1 billion in revenue could challenge AECOM as the world’s largest engineering firm, at a time when the Trump Administration has proposed, in general terms, an infrastructure construction and repair program in the U.S. that would include $1 trillion in public and private funding over a decade.

The combined company would be more heavily weighted toward building and infrastructure than Jacobs is currently. And the combination would surpass AECOM in global design revenue ($10 billion vs. $7.4 billion).

Buildings & Infratstructure would be a bigger part of Jacobs' portfolio if its merger with CH2M goes through. Image: Jacobs

“This is a major milestone for Jacobs and the industry,” proclaimed Steve Demetriou, Jacobs’ Chairman and CEO, during a webcast to provide analysts with details about the agreement. Demetriou was joined by Bob Pragada, President of Jacobs’ Buildings and Infrastructure & Industrial business unit; and Kevin Berryman, the firm’s EVP and CFO.

None of CH2M’s corporate officials participated in the webcast, and it’s not clear who from CH2M’s C-Suite would be staying on, or whether Jacobs intended to use CH2M’s brand for marketing purposes.

Demetriou did say, though, that one of Jacobs’ top priorities is “retaining talent,” and that the combination would create “career development opportunities” for the combined company’s employees. He also stated that it was not Jacobs’ intention to simply fold CH2M into its operations, but to take advantage of each company’s strengths to become “a premier end-to-end global solutions provider.”

Jacobs has formed an Integration Management Office, led by Gary Mandel and Lisa Glatch, EVPs with Jacobs and CH2M, respectively. The firm has also hired an outside consultant (which it did not identify during the webcast) to assist the merger. Demetriou will chair an executive steering committee set up to ensure a smooth transition and integration.

Another priority is to deliver cost and cost synergies. Jacobs executives made the point several times that there is minimal overlap in Jacobs’ and CH2M’s clientele and markets, and that both companies have pursued relatively low-risk business strategies that focus on profitability and margins. Pragada pointed specifically to Buildings, Infrastructure, Aerospace, and Technology as “higher margin” sectors that the combined company would pursue.

However, there will be streamlining if this deal goes through. Berryman said Jacobs projects this combination to produce $150 million in annual cost savings by its second full year. Berryman said “at least” 50 of the two firms’ locations worldwide present “combination opportunities.”

During the webcast, some analysts expressed skepticism about this merger, based on past AEC deals that didn't pan out as advertised, and on the fact that this deal makes Jacobs more design oriented.

Executives at Jacobs—which during its history has acquired more than 70 companies—countered that this deal has undergone extensive due diligence of all of CH2M’s projects. More to the point, they said the acquisition is a good fit for Jacobs’ broader three-year strategic growth initiative that began last year.

Demetriou assured analysts that his company has “the accountable leadership in place” to execute the CH2M deal, and to “create a new industry leader and stronger partner.”

Related Stories

| Aug 11, 2010

Populous selected to design 'crystalline skin' stadium for 2014 Winter Olympics

Russian officials have selected global architect Populous to design the main stadium for the 2014 Winter Olympic and Paralympic Games in Sochi, Russia. The 40,000-seat stadium will feature a crystalline skin that "engages with its surroundings by day and provides an iconic representation of the color and spectacle of the games when illuminated at night," said Populous senior principal John Barrow.

| Aug 11, 2010

ASHRAE research targets tying together BIM and energy efficiency

Ensuring that a common language of “energy efficiency” is spoken by both building information modeling software used by architects and energy analysis and simulation software used by engineers is the goal of new research funded by ASHRAE.

| Aug 11, 2010

M&A deal volume down 67% in engineering/construction sector: PricewaterhouseCoopers

Global Economic Uncertainty Results in Sluggish Deal Activity in U.S.; China Shows Significant Opportunity for Growth

| Aug 11, 2010

ZweigWhite names its fastest-growing architecture, engineering, and environmental firms

Management consulting and research firm ZweigWhite has identified the 200 fastest-growing architecture, engineering, and environmental consulting firms in the U.S. and Canada for its annual ranking, The Zweig Letter Hot Firm List. This annual list features the design and environmental firms that have outperformed the economy and competitors to become industry leaders.

| Aug 11, 2010

SSOE, Fluor among nation's largest industrial building design firms

A ranking of the Top 75 Industrial Design Firms based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Best AEC Firms of 2011/12

Later this year, we will launch Best AEC Firms 2012. We’re looking for firms that create truly positive workplaces for their AEC professionals and support staff. Keep an eye on this page for entry information. +

| Aug 11, 2010

Report: Building codes and regulations impede progress toward uber-green buildings

The enthusiasm for super green Living Buildings continues unabated, but a key stumbling block to the growth of this highest level of green building performance is an existing set of codes and regulations. A new report by the Cascadia Region Green Building Council entitled "Code, Regulatory and Systemic Barriers Affecting Living Building Projects" presents a case for fundamental reassessment of building codes.