Esports is the fastest growing theme in the gaming sector. These organized multiplayer video game competitions have enjoyed spectacular growth over the last decade, with thousands of fans filling stadiums to watch live events and millions following them on streaming platforms. Although eSports currently caters to a niche audience – almost 10% of the global online population of around 4.5 billion – its reach is expanding rapidly.

GlobalData’s latest report, ‘Esports – Thematic Research’, states that the industry has proved largely immune to the COVID-19 pandemic due to its prompt transition into online formats and sudden spike in interest from traditional sports organizations, which pushed eSports further into the mainstream and brought it to the attention of a wider audience.

Rupantar Guha, Senior Analyst of Thematic Research at GlobalData, commented: “Brands from a wide range of industries are investing in eSports to reach a young demographic that is typically resistant to traditional advertising channels. The increasing involvement of non-endemic brands such as Coca-Cola and BMW is helping to legitimize eSports, as well as bringing in significant revenue.”

See Also: Erudite eSports: Colleges build their very own eSports arenas

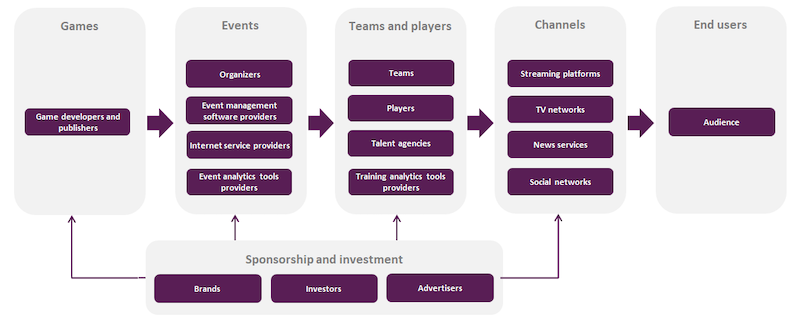

GlobalData splits the eSports value chain into six segments: games, events, teams and players, channels, sponsorship and investment and end users. The report discusses each aspect of the value chain in detail and throws light on how the industry will shape up over the next two to three years.

Related Stories

Market Data | Jan 7, 2022

Construction adds 22,000 jobs in December

Jobless rate falls to 5% as ongoing nonresidential recovery offsets rare dip in residential total.

Market Data | Jan 6, 2022

Inflation tempers optimism about construction in North America

Rider Levett Bucknall’s latest report cites labor shortages and supply chain snags among causes for cost increases.

Market Data | Jan 6, 2022

A new survey offers a snapshot of New York’s construction market

Anchin’s poll of 20 AEC clients finds a “growing optimism,” but also multiple pressure points.

Market Data | Jan 3, 2022

Construction spending in November increases from October and year ago

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate.

Market Data | Dec 22, 2021

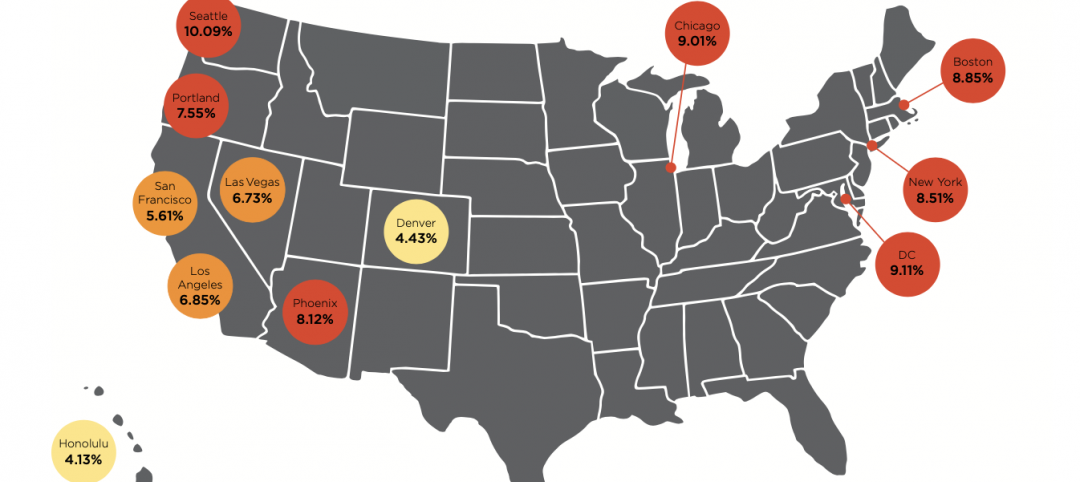

Two out of three metro areas add construction jobs from November 2020 to November 2021

Construction employment increased in 237 or 66% of 358 metro areas over the last 12 months.

Market Data | Dec 17, 2021

Construction jobs exceed pre-pandemic level in 18 states and D.C.

Firms struggle to find qualified workers to keep up with demand.

Market Data | Dec 15, 2021

Widespread steep increases in materials costs in November outrun prices for construction projects

Construction officials say efforts to address supply chain challenges have been insufficient.

Market Data | Dec 15, 2021

Demand for design services continues to grow

Changing conditions could be on the horizon.

Market Data | Dec 5, 2021

Construction adds 31,000 jobs in November

Gains were in all segments, but the industry will need even more workers as demand accelerates.

Market Data | Dec 5, 2021

Construction spending rebounds in October

Growth in most public and private nonresidential types is offsetting the decline in residential work.