The good news: the cargo and transportation snags that have encumbered building material availability this year showed signs of finally easing in September.

The bad news: the lack of material supply and increasing demand for labor are keeping prices high, to the point where manufacturers aren’t willing to hold price quotes for more than a week, if at all.

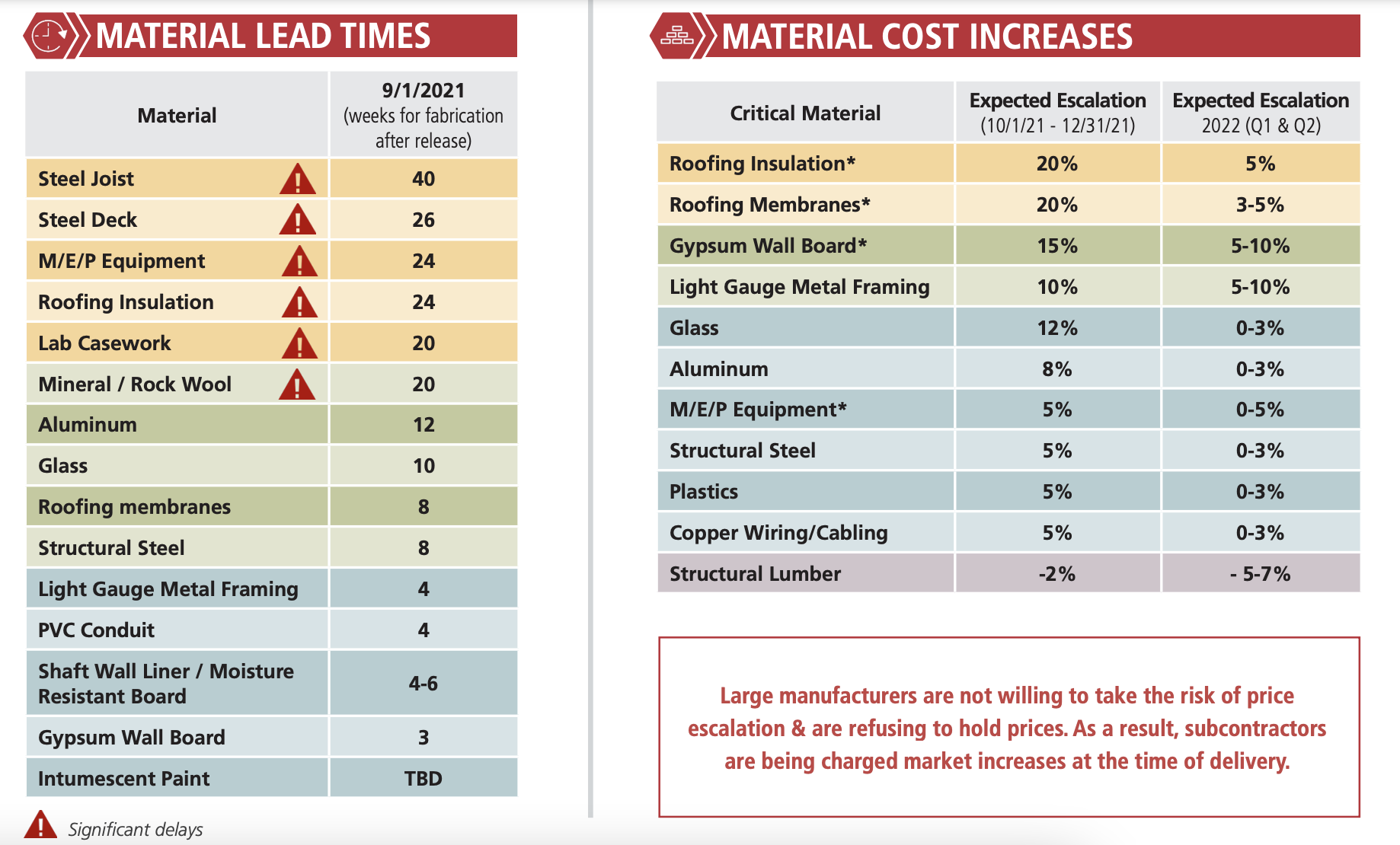

That, in a nutshell, is the state of the construction market, which the general contractor Consigli lays out in its Market Outlook for October 2021. The Outlook, written by the firm’s Director of Purchasing Peter Capone and Vice President of Preconstruction Jared Lachapelle, sends up red alerts about the availability of six product categories—steel joist, steel deck, MEP equipment, roofing insulation, lab casework, and mineral/rock wool—whose lead times for fabrication after release, as of Sept. 1, ranged from 20 to 40 weeks, with steel joists having the longest wait time.

The Outlook reports a 12 percent average price escalation for the 15 building materials tracked, and anticipates another 3 percent bump through the final quarter of this year. Roofing insulation, roofing membranes, gypsum wallboard, light-gauge metal framing, and glass exceed the overall averages.

As a result of large manufacturers not willing to take risks on escalating prices. “subcontractors are being changed market increases at the time of delivery,” states the report.

MANAGING RISK TAKES DISCIPLINE

Consigli’s strategies for risk management include:

•lock in prices with subs that are willing to share risk

•buy in bulk quantities whenever possible

•consider alternative supply sources

•implement stringent quality assurance and control measures

•focus on weekly materials delivery verification

•pre-purchase and warehouse materials

•identify peak manpower needs

•utilize prefabrication that takes labor off site

•partner with trades through design-assist

Consigli thinks labor shortages could get worse in the second half of next year. The severity will depend, in part, on vaccination mandates at a time when a sizable number of construction workers still refuse to be vaccinated. But even a fully vaccinated workforce might struggle to keep pace with construction demand that the pending $1 trillion infrastructure bill, if passed, would further pressure.

The Outlook notes that some manufacturers are focusing their production capacities on commonly used materials like drywall and MEP equipment, which is limiting—and sometimes halting—the production of specialty products. And AEC firms need to be vigilant about maintaining compatibility and quality when manufacturers source products from alternate vendors.

Consigli sees some light at the end of this supply tunnel. Its Outlook notes that steel prices are starting to level off as production increases. But citing the National Roofing Contractors Association, Consigli also cautions that shortages in roofing materials and insulation (whose lead time right now is 24 weeks) will continue through next year because of raw materials supply issues.

Related Stories

| Aug 11, 2010

NAVFAC releases guidelines for sustainable reconstruction of Navy facilities

The guidelines provide specific guidance for installation commanders, assessment teams, estimators, programmers and building designers for identifying the sustainable opportunities, synergies, strategies, features and benefits for improving installations following a disaster instead of simply repairing or replacing them as they were prior to the disaster.

| Aug 11, 2010

Construction employment shrinks in 319 of the nation's 336 largest metro areas in July, continuing months-long slide

Construction workers in communities across the country continued to suffer extreme job losses this July according to a new analysis of metropolitan area employment data from the Bureau of Labor Statistics released today by the Associated General Contractors of America. That analysis found construction employment declined in 319 of the nation’s largest communities while only 11 areas saw increases and six saw no change in construction employment between July 2008 and July 2009.

| Aug 11, 2010

Green consultant guarantees LEED certification or your money back

With cities mandating LEED (Leadership in Energy and Environmental Design) certification for public, and even private, buildings in growing numbers, an Atlanta-based sustainability consulting firm is hoping to ease anxieties over meeting those goals with the industry’s first Green Guaranteed.

| Aug 11, 2010

Skanska, Turner most active in U.S. hotel construction, according to BD+C's Giants 300 report

A ranking of the Top 50 Hotel Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants