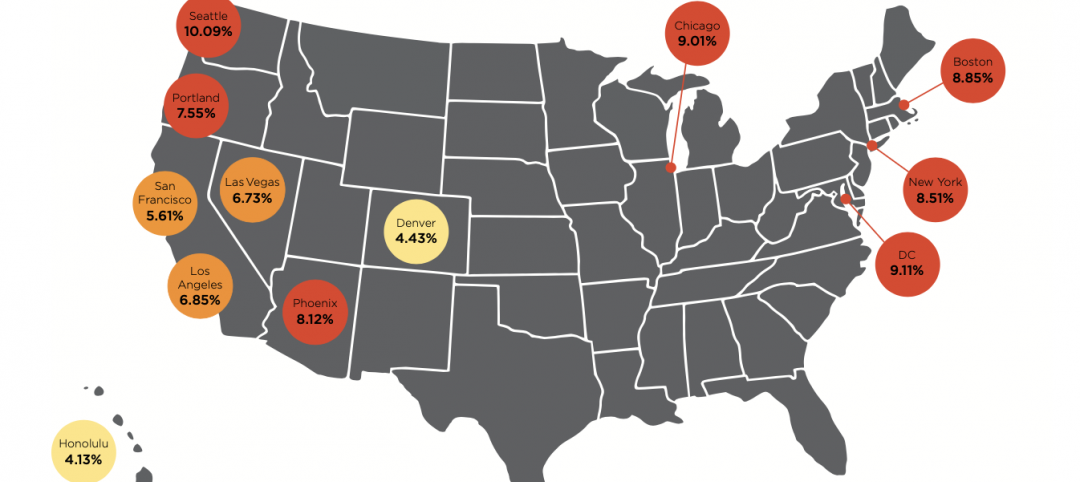

The war in Ukraine, global port congestion, and the persistent spread of COVID variants will conspire to raise prices on equipment and key building products by 7-9 percent this year, according to the general contractor Consigli’s latest market update, which it released a few days ago.

Authors Peter Capone and Jared Lachapelle, Consigli’s director of construction and vice president of preconstruction, respectively, wrote that while the nonresidential construction industry continues to be resilient, it can’t completely alleviate forces that are reducing or delaying the supply of raw materials and finished goods.

Russia’s invasion of Ukraine has reduced the supply of manufacturing materials such as aluminum and copper, and is putting a strain on production and delivery across Europe. Meanwhile shipping congestion “is showing little sign of improvement” worldwide, especially at ports in Asia.

Other factors contributing to rising construction prices include spikes in fuel costs, and wage increases that are jacking up labor costs. “Acquiring workforce, [in] the Northeast in particular, remains an area of concern,” the authors state. Union and non-union subcontractors “are booking up to capacity for 2022,” and are already focused on next year and beyond.

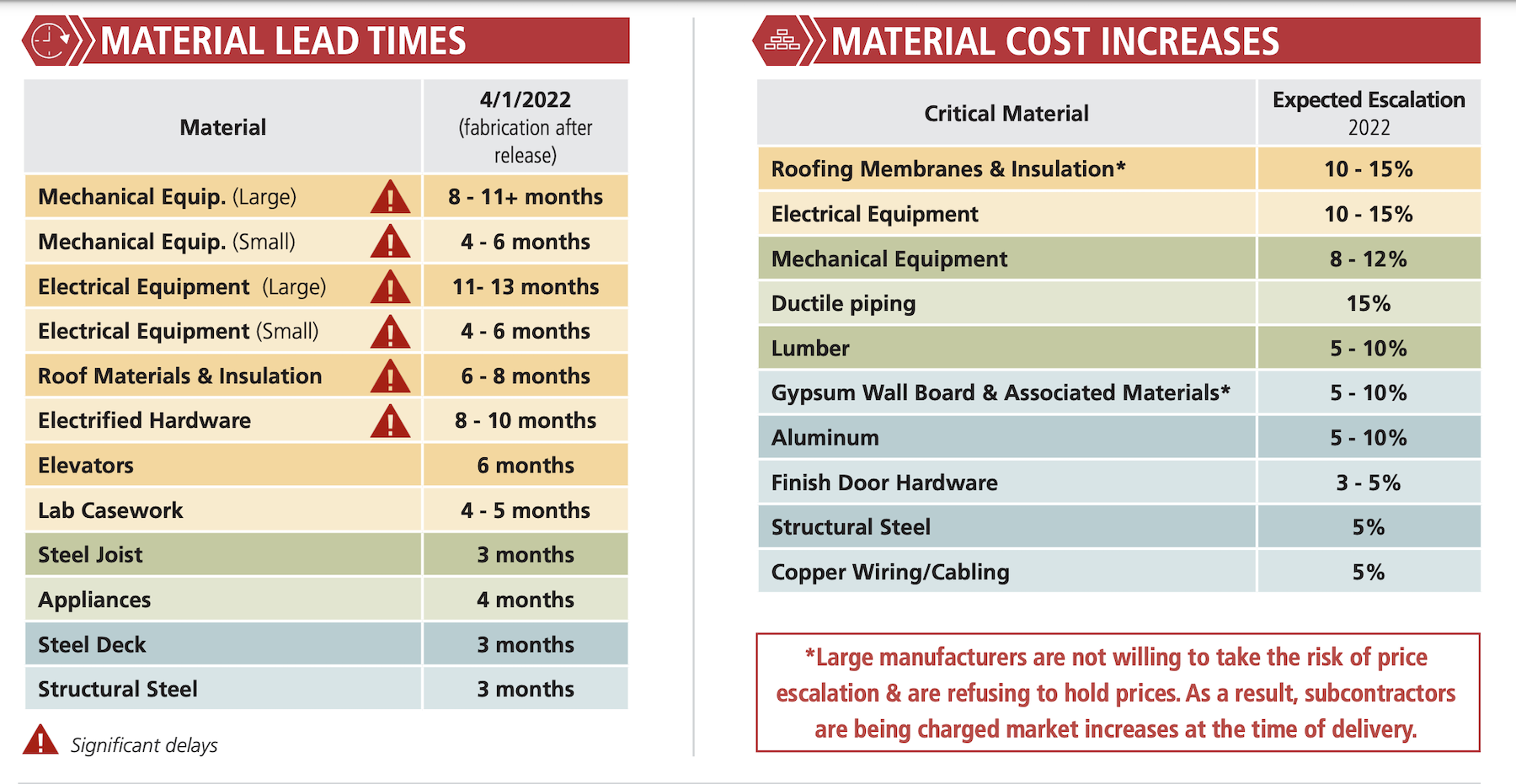

Electrical equipment and hardware, and roofing materials, are stalled in long lead times. As a result, price inflation for these products is expected to be double digit this year.

Consigli is also keeping an eye on a few things that could affect prices, such as contract negotiations with the International Longshoreman Warehouse Union that are scheduled for this July and will impact 22,000 workers at 79 ports.

The federal infrastructure bill, as it rolls out, will place more stress on an already tight labor market. Consigli notes that half of its larger subcontractors have secured 85 percent of their backlog for this year, and are “quickly filling” their projected backlog for 2023.

Related Stories

Market Data | Jan 6, 2022

Inflation tempers optimism about construction in North America

Rider Levett Bucknall’s latest report cites labor shortages and supply chain snags among causes for cost increases.

Market Data | Jan 6, 2022

A new survey offers a snapshot of New York’s construction market

Anchin’s poll of 20 AEC clients finds a “growing optimism,” but also multiple pressure points.

Market Data | Jan 3, 2022

Construction spending in November increases from October and year ago

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate.

Market Data | Dec 22, 2021

Two out of three metro areas add construction jobs from November 2020 to November 2021

Construction employment increased in 237 or 66% of 358 metro areas over the last 12 months.

Market Data | Dec 17, 2021

Construction jobs exceed pre-pandemic level in 18 states and D.C.

Firms struggle to find qualified workers to keep up with demand.

Market Data | Dec 15, 2021

Widespread steep increases in materials costs in November outrun prices for construction projects

Construction officials say efforts to address supply chain challenges have been insufficient.

Market Data | Dec 15, 2021

Demand for design services continues to grow

Changing conditions could be on the horizon.

Market Data | Dec 5, 2021

Construction adds 31,000 jobs in November

Gains were in all segments, but the industry will need even more workers as demand accelerates.

Market Data | Dec 5, 2021

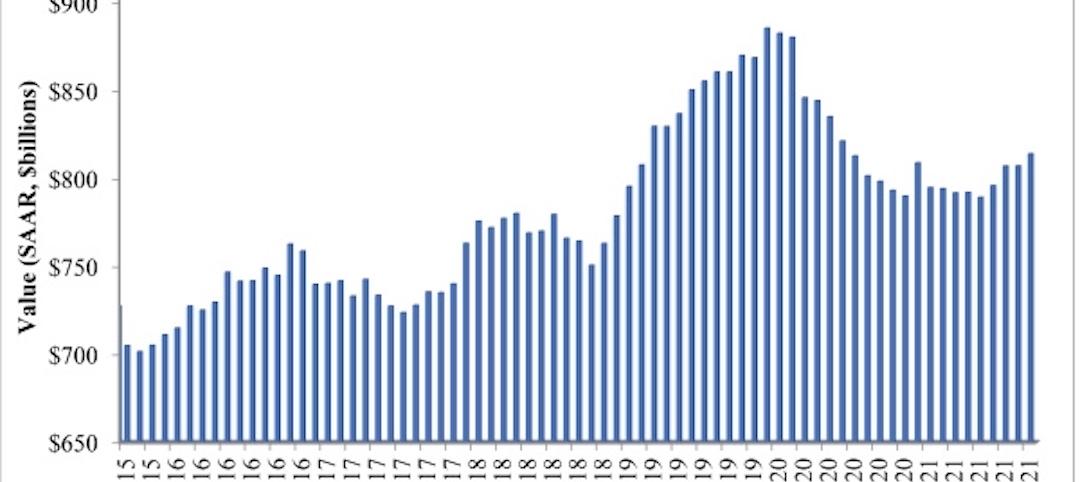

Construction spending rebounds in October

Growth in most public and private nonresidential types is offsetting the decline in residential work.

Market Data | Dec 5, 2021

Nonresidential construction spending increases nearly 1% in October

Spending was up on a monthly basis in 13 of the 16 nonresidential subcategories.