In recent years, innovations in energy efficiency technology has opened many new avenues to reduce electric consumption in buildings.

But it is hard for building owners to keep up with these developments, analyze which options are most cost effective, and decide how best to invest their money. An increasingly popular method to implement energy efficiency technology is called “energy efficiency as a service.”

A typical arrangement consists of a building owner and a provider striking an agreement that pays for energy efficiency projects. The building owner does not pay anything upfront. The owner makes payments in installments within a certain timeframe. Payments are in the form of savings in energy costs realized from the improvements.

Bentley Mills, a manufacturer of commercial carpet products, employed this technique to fund a $1.5 million energy efficiency project. The contract stated that over the course of the 8-year term, Bentley would save over 12.8 million kWh. One year after the project was completed, the plant measured a 21% decrease in the kWh per square yard manufactured while increasing sales growth by 9% during the same time.

Related Stories

| Nov 18, 2011

New OSHA fall safety rule could save contractors money on insurance premiums

The new Occupational Safety and Health Administration rule requiring employers operating in the residential construction industry to use the same methods of fall protection that historically have been used in the commercial construction industry could save them money.

| Nov 18, 2011

Some believe new Austin building code will help mom and pop shops

Austin, Texas has proposed building codes that require wider sidewalks and call for buildings to be closer to sidewalks along a 3.5-mile stretch of highway.

| Nov 11, 2011

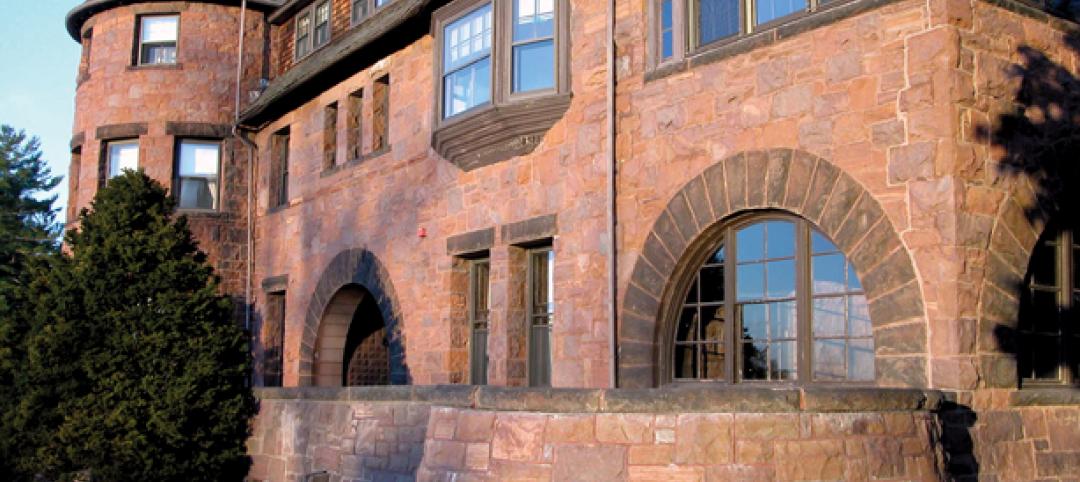

AIA: Engineered Brick + Masonry for Commercial Buildings

Earn 1.0 AIA/CES learning units by studying this article and successfully completing the online exam.

| Nov 10, 2011

WaterSense standard for weather-based irrigation controllers unveiled

The U.S. Environmental Protection Agency’s (EPA) WaterSense program has released a final specification for weather-based irrigation controllers—the first outdoor product category eligible to earn the WaterSense label.

| Nov 10, 2011

Advocate seeks noise reduction measures in California building codes

A former chief building inspector for San Francisco wants to enact building codes that would limit noise levels in restaurants and other spaces open to the public.

| Nov 10, 2011

California seismic codes spur flurry of hospital projects

New seismic requirements in California are helping to drive a flurry of new projects and retrofits in the state’s health care sector.

| Nov 10, 2011

Senate ready to repeal 3% withholding on government contracts

The U.S. Senate is set to approve legislation that would eliminate a law requiring federal, state, and local governments to withhold 3% of their payments to contractors and companies doing business with the government.

| Nov 10, 2011

New legislation aimed at improving energy efficiency in federal buildings

Recently introduced legislation, the “High-Performance Federal Buildings Act,” would help federal agencies save energy and money by improving building performance.

| Nov 4, 2011

CSI and ICC Evaluation Service agree to reference GreenFormat in ICC-ES Environmental Reports?

ICC-ES currently references CSI's MasterFormat and other formats in all of its evaluation reports. The MOU will add GreenFormat references.

| Nov 3, 2011

House Votes to Kill 3% Withholding Requirement; Senate Yet to Vote

The U.S. House of Representatives voted last week to repeal a 3% IRS withholding tax on businesses that do work for the government.