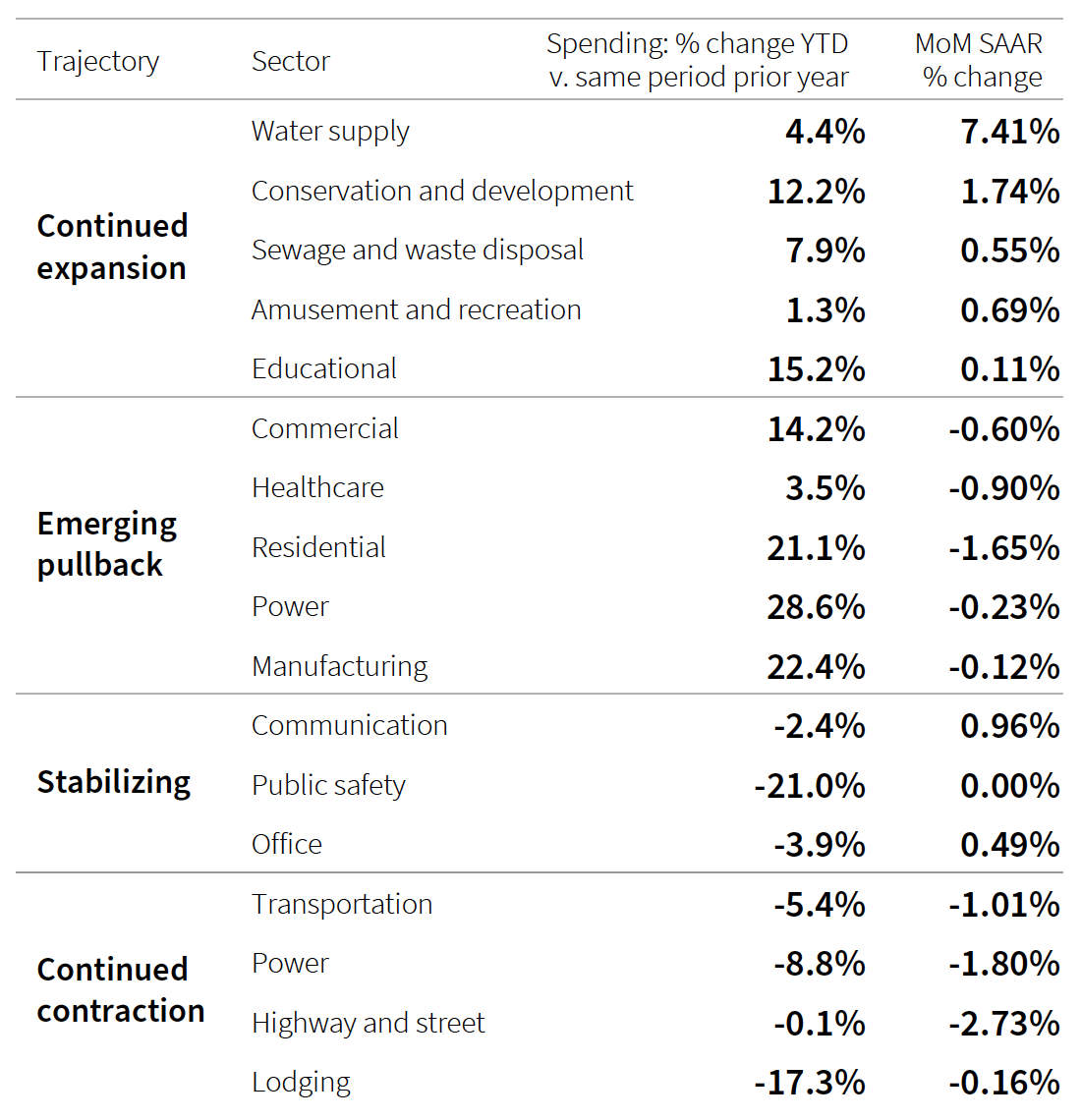

Through the first half of 2022, nonresidential construction spending returned to “nomimal growth.” But JLL, in its Construction Outlook for the second half of the year, foresees nonresidential spending being flat, on an inflation-adjusted basis, and year-over-year growth returning to historical levels in 2024, “as disruptions are likely to persist into 2023.”

Those disruptions include supply-chain issues that contributed to construction materials costs increasing by 42.5 percent from prepandemic levels. Labor costs related to workforce shortages were 10.5 percent higher than they were in March 2020.

“Labor availability remains a deep-set structural challenge for the industry and will be a larger issue as construction demand persists and shifts focus,” JLL observes. “Estimates of future need based on these upcoming expenditures show the gap will only widen, with a particular need for nonbuilding and public workers.”

Too much work, too few workers

Job openings for construction labor have been consistently elevated, even as hiring expanded above prepandemic rates and separations fell to extremely low levels. In June 2022, unemployment fell to 3.7 percent, just 0.1 percent above the national average and job openings finally pulled back, dropping by 109,000 openings to 330,000. As such, the pullback is likely to continue, as firms stabilize backlogs and plan for difficult times.

Wage growth in the first half of 2022 was modest as well, significantly outpaced by inflation. Workers in the construction industry have actually experienced real wage losses of roughly 1.9 percent since the start of the pandemic. That gap widened in the first half of 2022 for construction employees.

“It is unlikely that the pullback will result in significantly lower demand side pressure in the construction labor market, as the current volume and array of work are sufficient to keep demand high for the next several years,” states JLL, especially once spending from the Infrastructure Investment and Jobs Act (IIJA) is in full swing.

The industry’s dilemma, however, is that it doesn’t have the capacity to fill every construction job that’s expected to be added in the next few years. At current forecasts of incoming IIJA funds bumping public spending by 10 percent or more annually from 2024 on, the increased need for construction employment equates to roughly 350,000 jobs from that spending alone —well above capacity identified in the historical record.

The largest impacts could be continued wage pressure and potential delays in projects. JLL predicts that the favorable situation for labor is expected to accelerate wage growth in the second half of the year, continuing to pressure margins. Though outright cancellations have remained limited, delays due to labor shortages are a nearly universal experience “with no relief in sight.”

Uneven price stability

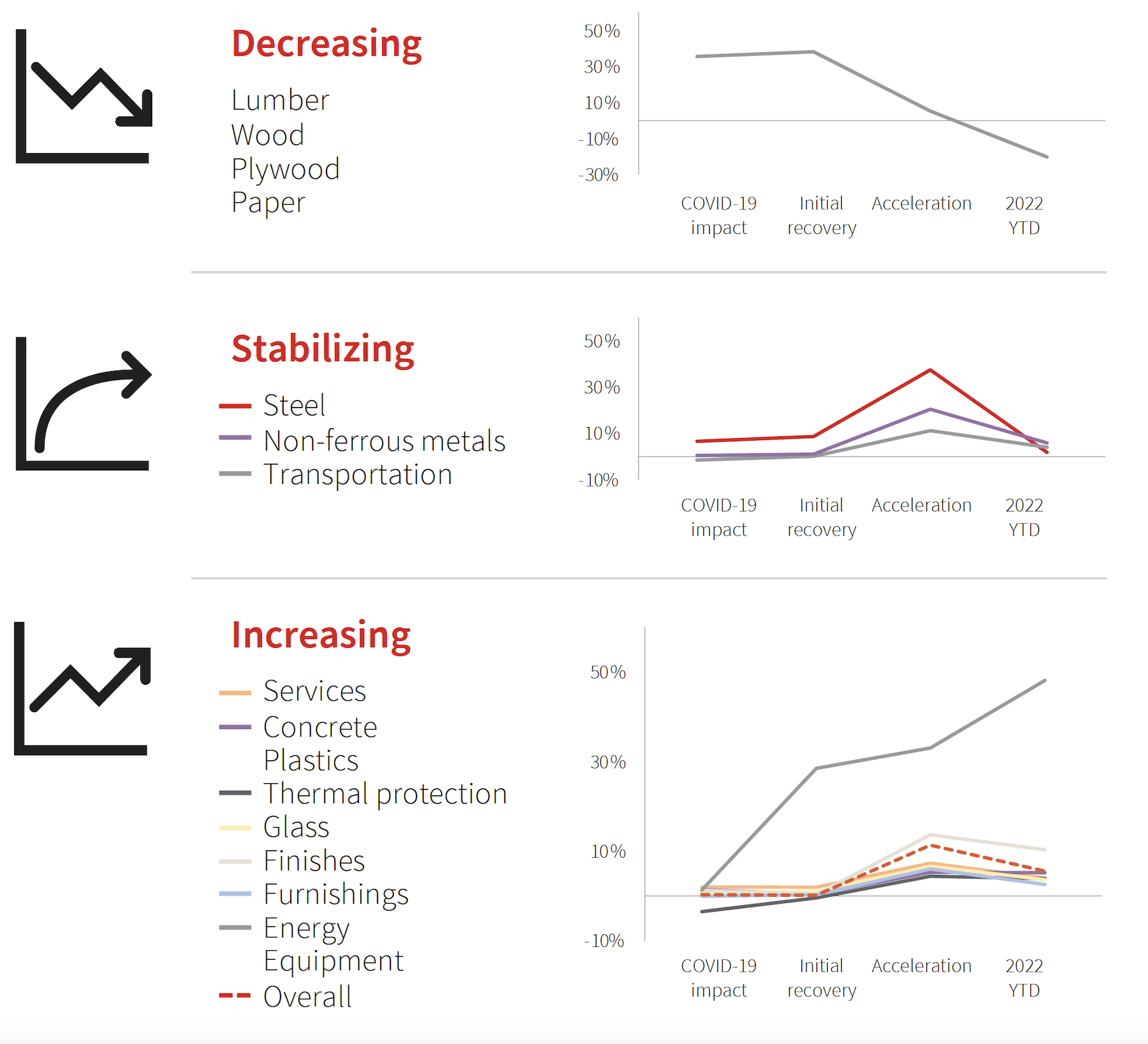

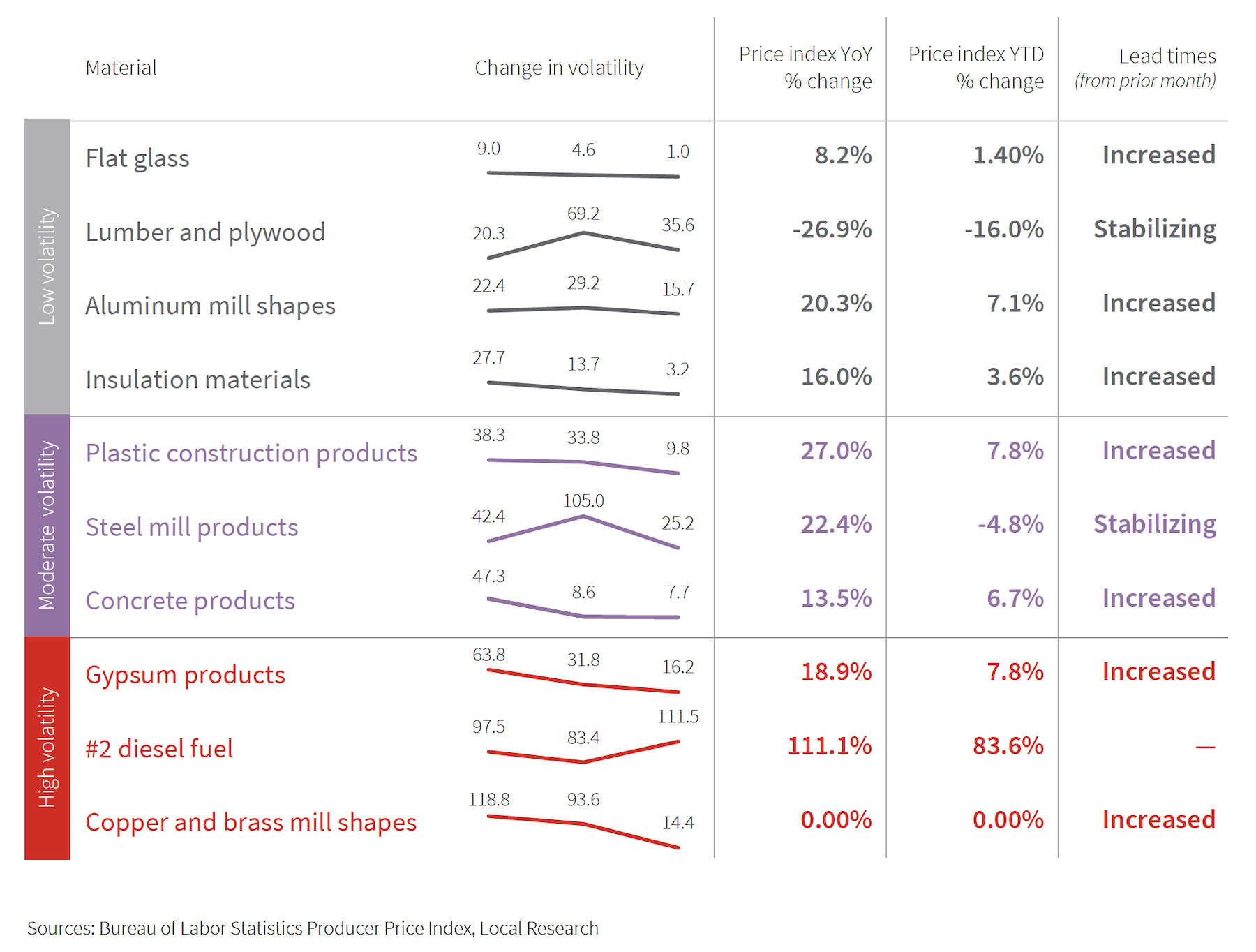

JLL’s Outlook is mixed about construction materials availability and costs. Steel and lumber, once the poster children for price inflation, have stabilized, thanks in part to domestic steel construction that’s 30 percent higher than prepandemic levels. However, “volatility has not gone down uniformly” across the spectrum of construction products.

That is particularly true of energy related materials that have been affected by Russia’s invasion of Ukraine, whose damages to its built environment are estimated at $750 billion and rising. Cement, glass manufacture, and semiconductors for equipment and machinery “are among some of the larger price increases,” with concrete and glass disproportionately reliant on few producers with extremely high energy usage for production. Plus, the 10 percent increase in domestic cement and concrete production hasn’t stabilized prices yet.

Consequently, JLL has revised its previous outlook and now projects that materials prices will be up between 12 and 18 percent this year. “Uncertainty is still widespread and, as demonstrated by the current changing patterns of costs, novel issues are likely to emerge and disrupt supply chains and pricing in the near term.”

An active industry

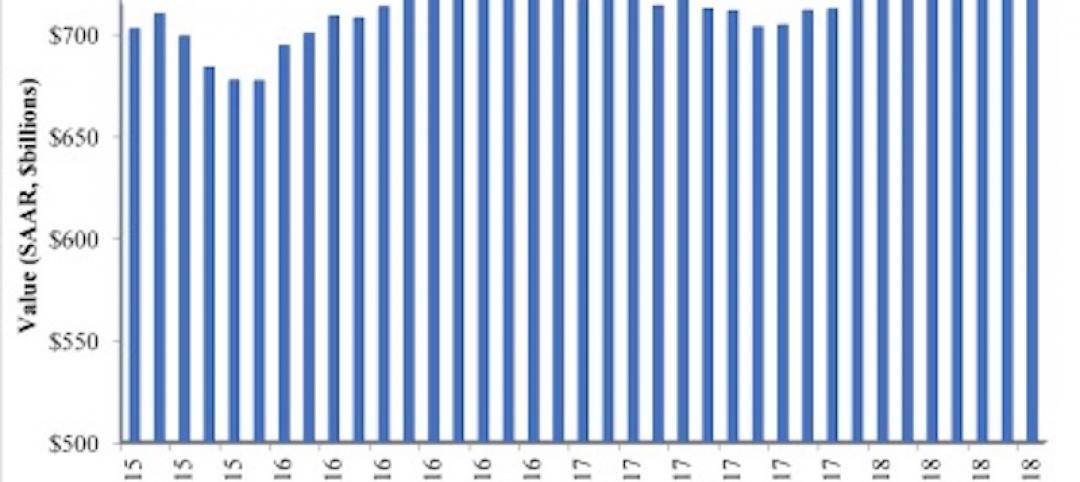

From January to May 2022, the seasonally adjusted annual rate of total construction spending expanded at a monthly rate of 0.63 percent, above the growth rate observed in 2021. June, though, was down a percentage point, and any increases through the first half of the year were attributable to inflation.

On the bright side, JLL expects construction activity to remain healthy, global economic concerns notwithstanding. In the U.S., the Northeast has faltered with numerous months of contraction in the first half of 2022, while the West has picked up the pace of billing and backlog increases in recent months. The South and Midwest have maintained billings growth that is beginning to decelerate but will nevertheless create an appreciable pipeline of construction activity in the regions.

Related Stories

Market Data | Sep 21, 2018

JLL fit out report portrays a hot but tenant-favorable office market

This year’s analysis draws from 2,800 projects.

Market Data | Sep 21, 2018

Mid-year forecast: No end in sight for growth cycle

The AIA Consensus Construction Forecast is projecting 4.7% growth in nonresidential construction spending in 2018.

Market Data | Sep 19, 2018

August architecture firm billings rebound as building investment spurt continues

Southern region, multifamily residential sector lead growth.

Market Data | Sep 18, 2018

Altus Group report reveals shifts in trade policy, technology, and financing are disrupting global real estate development industry

International trade uncertainty, widespread construction skills shortage creating perfect storm for escalating project costs; property development leaders split on potential impact of emerging technologies.

Market Data | Sep 17, 2018

ABC’s Construction Backlog Indicator hits a new high in second quarter of 2018

Backlog is up 12.2% from the first quarter and 14% compared to the same time last year.

Market Data | Sep 12, 2018

Construction material prices fall in August

Softwood lumber prices plummeted 9.6% in August yet are up 5% on a yearly basis (down from a 19.5% increase year-over-year in July).

Market Data | Sep 7, 2018

Safety risks in commercial construction industry exacerbated by workforce shortages

The report revealed 88% of contractors expect to feel at least a moderate impact from the workforce shortages in the next three years.

Market Data | Sep 5, 2018

Public nonresidential construction up in July

Private nonresidential spending fell 1% in July, while public nonresidential spending expanded 0.7%.

Market Data | Aug 30, 2018

Construction in ASEAN region to grow by over 6% annually over next five years

Although there are disparities in the pace of growth in construction output among the ASEAN member states, the region’s construction industry as a whole will grow by 6.1% on an annual average basis in the next five years.