Construction employment in May remained below the April level in 40 states and the District of Columbia, according to an analysis by the Associated General Contractors of America of government employment data released today. Association officials said skyrocketing materials prices and excessive delays in receiving key construction supplies were holding back the industry’s recovery.

“Today’s numbers show that impacts from the pandemic on demand for projects and on materials costs and the supply chain are weighing down construction in most parts of the country,” said Ken Simonson, the association’s chief economist. “In the few states where industry employment has topped the pre-pandemic levels of February 2020, most gains are likely attributable more to demand for homebuilding and remodeling than to most categories of nonresidential building and infrastructure projects.”

From April to May, construction employment decreased in 40 states and D.C., increased in only eight states, and held steady in Maryland and Utah. The largest decline over the month occurred in New York, which lost 5,900 construction jobs or 1.6%, followed by Illinois (-5,600 jobs, -2.5%) and Pennsylvania (-3,300 jobs, -1.3%). The steepest percentage declines since April occurred in Vermont (-3.9%, -600 jobs), followed by Maine (-3.5%, -1,100 jobs) and Delaware (-3.0%, -300 jobs).

Florida added the most construction jobs between April and May (3,700 jobs, 0.6%), followed by Michigan (1,600 jobs, 0.9%) and Minnesota (1,200 jobs, 0.9%). Oklahoma had the largest percentage gain for the month (1.3%, 1,000 jobs), followed by Minnesota and Michigan.

Employment declined from the pre-pandemic peak month of February 2020 in 42 states and D.C. Texas lost the most construction jobs over the period (-49,100 jobs or -6.3%), followed by New York (-45,200 jobs, -11.1%) and California (-30,800 jobs, -3.4%). Wyoming recorded the largest percentage loss (-15.3%, -3,500 jobs), followed by Louisiana (-15.1%, -20,700 jobs) and New York.

Among the eight states that added construction jobs since February 2020, the largest pickup occurred in Utah (5,000 jobs, 4.4%), followed by Idaho (3,400 jobs, 6.2%) and South Dakota (1,200 jobs, 5.0%). The largest percentage gain was in Idaho, followed by South Dakota and Utah.

Association officials noted that cost increases and extended lead times for producing many construction materials are exacerbating a slow recovery for construction. They urged the Biden administration to accelerate its timetable for reaching agreement with allies on removing tariffs on steel and aluminum, and to initiate talks to end tariffs on Canadian lumber.

“Federal officials can help get more construction workers employed by removing tariffs on essential construction materials such as lumber, steel and aluminum,” said Stephen E. Sandherr, the association’s chief executive officer. “These tariffs are causing unnecessary harm to construction workers and firms, as well as to the administration’s goals of building more affordable housing and infrastructure.”

View state February 2020-May 2021 data, 15-month rankings, 1-month rankings.

Related Stories

Market Data | Feb 20, 2019

Strong start to 2019 for architecture billings

“The government shutdown affected architecture firms, but doesn’t appear to have created a slowdown in the profession,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD, in the latest ABI report.

Market Data | Feb 19, 2019

ABC Construction Backlog Indicator steady in Q4 2018

CBI reached a record high of 9.9 months in the second quarter of 2018 and averaged about 9.1 months throughout all four quarters of last year.

Market Data | Feb 14, 2019

U.S. Green Building Council announces top 10 countries and regions for LEED green building

The list ranks countries and regions in terms of cumulative LEED-certified gross square meters as of December 31, 2018.

Market Data | Feb 13, 2019

Increasingly tech-enabled construction industry powers forward despite volatility

Construction industry momentum to carry through first half of 2019.

Market Data | Feb 4, 2019

U.S. Green Building Council announces annual Top 10 States for LEED Green Building in 2018

Illinois takes the top spot as USGBC defines the next generation of green building with LEED v4.1.

Market Data | Feb 4, 2019

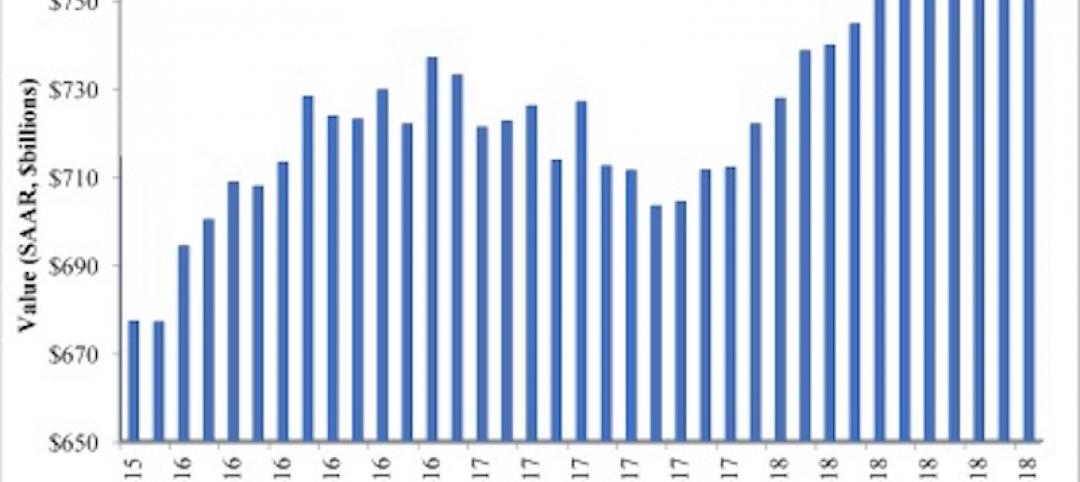

Nonresidential construction spending dips in November

Total nonresidential spending stood at $751.5 billion on a seasonally adjusted annualized rate.

Market Data | Feb 1, 2019

The year-end U.S. hotel construction pipeline continues steady growth trend

Project counts in the early planning stage continue to rise reaching an all-time high of 1,723 projects/199,326 rooms.

Market Data | Feb 1, 2019

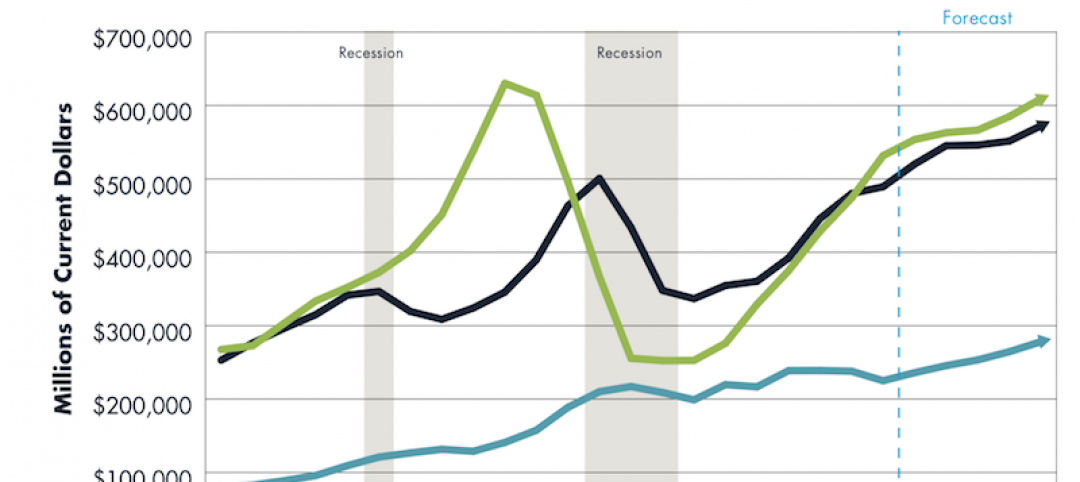

Construction spending is projected to increase by more than 11% through 2022

FMI’s annual outlook also expects the industry’s frantic M&A activity to be leavened by caution going forward.

Market Data | Jan 23, 2019

Architecture billings slow, but close 2018 with growing demand

AIA’s Architecture Billings Index (ABI) score for December was 50.4 compared to 54.7 in November.

Market Data | Jan 16, 2019

AIA 2019 Consensus Forecast: Nonresidential construction spending to rise 4.4%

The education, public safety, and office sectors will lead the growth areas this year, but AIA's Kermit Baker offers a cautious outlook for 2020.