Construction employment declined in 20 states and D.C. in March, aligning with the results of a recent survey by the Associated General Contractors of America that found growing layoffs amid new project cancellations and state funding constraints. Association officials warned that these cancellations mean massive job losses are likely to occur soon in even more states unless Congress helps cover rapidly declining state revenues, adds funding for Paycheck Protection Program loans and takes other measures to help the industry recover.

“While construction employment declined in many parts of the country last month, far more states, local governments and project owners have halted construction in the five weeks since the government collected this data,” said Ken Simonson, the association’s chief economist. “Our two latest surveys show a steep rise in cancellations of scheduled projects, which is leading to furloughs and terminations for both jobsite and office workers.”

The association released an analysis of new government data that showed construction employment decreased in 20 states and the District of Columbia. from February to March, held steady in six states and increased in 25 states. The economist noted the figures represented a rapid deterioration in a previously vibrant job market for construction. Over the 12 months ending in March, construction employment declined in only six states and D.C., held steady in two states, and increased in 41 states. He added that the data is based on employment as of March 12, before most states or owners began curtailing construction.

In the association’s latest online survey, conducted April 6-9, 53 percent of the 830 respondents reported that a project owner had ordered a halt or cancellation to a current or upcoming project. The share of respondents reporting cancellations jumped to 19 percent from 7 percent a week earlier, suggesting that the volume of work will shrink rapidly once current projects finish. Another impediment to construction—listed by 27 percent of respondents—comes from state and local officials who have ordered construction shutdowns.

The survey also found that 40 percent of respondents had furloughed or terminated workers by April 9, an increase from 31 percent just a week earlier. While 36 percent of firms reported furloughs or terminations of jobsite workers, layoffs also affected office and other workers at 18 percent of firms.

Association officials warned that construction job losses were likely to accelerate in many states amid the coronavirus pandemic. They added those job losses will get worse now that several states have canceled or significantly delayed planned highway projects because the pandemic has resulted in dramatic declines in gas tax revenues. They urged Congress and the Trump administration to provide funding to cover the lost revenue to protect existing jobs and make sure roads are repaired at a time when traffic is relatively light. They also urged Washington officials to invest more funds in the now-depleted Paycheck Protection Program and other forms of infrastructure.

“There is a historic opportunity to repair aging roads and other types of infrastructure,” said Stephen E. Sandherr, the association’s chief executive officer. “Without more funding from Washington, government officials will not have the resources necessary to improve the nation’s infrastructure and protect tens of thousands of construction jobs.”

View the state employment data, rankings, and highs and lows.

Related Stories

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

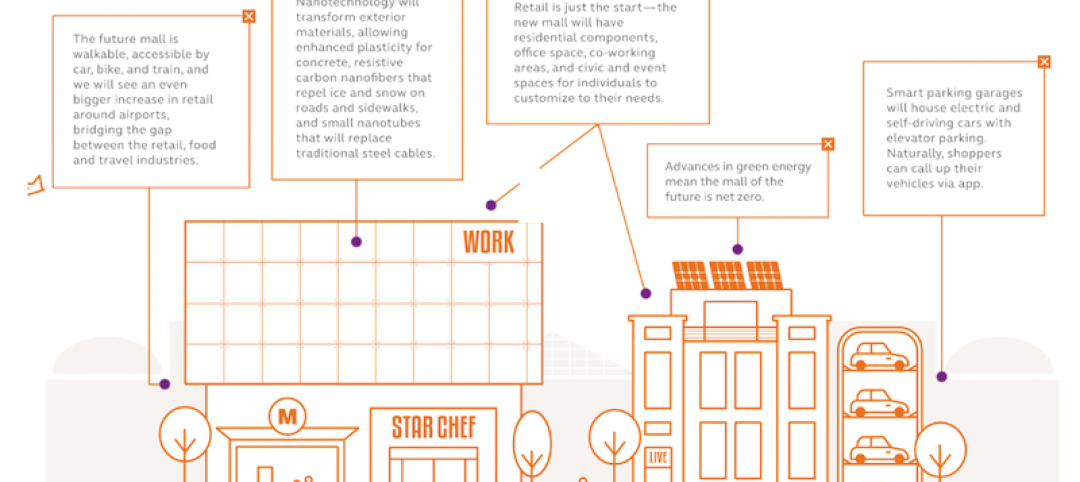

Retail Centers | Mar 16, 2016

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.

Market Data | Feb 10, 2016

Nonresidential building starts and spending should see solid gains in 2016: Gilbane report

But finding skilled workers continues to be a problem and could inflate a project's costs.

Market Data | Feb 9, 2016

Cushman & Wakefield is bullish on U.S. economy and its property markets

Sees positive signs for construction and investment growth in warehouses, offices, and retail