Construction employment declined in 20 states and D.C. in March, aligning with the results of a recent survey by the Associated General Contractors of America that found growing layoffs amid new project cancellations and state funding constraints. Association officials warned that these cancellations mean massive job losses are likely to occur soon in even more states unless Congress helps cover rapidly declining state revenues, adds funding for Paycheck Protection Program loans and takes other measures to help the industry recover.

“While construction employment declined in many parts of the country last month, far more states, local governments and project owners have halted construction in the five weeks since the government collected this data,” said Ken Simonson, the association’s chief economist. “Our two latest surveys show a steep rise in cancellations of scheduled projects, which is leading to furloughs and terminations for both jobsite and office workers.”

The association released an analysis of new government data that showed construction employment decreased in 20 states and the District of Columbia. from February to March, held steady in six states and increased in 25 states. The economist noted the figures represented a rapid deterioration in a previously vibrant job market for construction. Over the 12 months ending in March, construction employment declined in only six states and D.C., held steady in two states, and increased in 41 states. He added that the data is based on employment as of March 12, before most states or owners began curtailing construction.

In the association’s latest online survey, conducted April 6-9, 53 percent of the 830 respondents reported that a project owner had ordered a halt or cancellation to a current or upcoming project. The share of respondents reporting cancellations jumped to 19 percent from 7 percent a week earlier, suggesting that the volume of work will shrink rapidly once current projects finish. Another impediment to construction—listed by 27 percent of respondents—comes from state and local officials who have ordered construction shutdowns.

The survey also found that 40 percent of respondents had furloughed or terminated workers by April 9, an increase from 31 percent just a week earlier. While 36 percent of firms reported furloughs or terminations of jobsite workers, layoffs also affected office and other workers at 18 percent of firms.

Association officials warned that construction job losses were likely to accelerate in many states amid the coronavirus pandemic. They added those job losses will get worse now that several states have canceled or significantly delayed planned highway projects because the pandemic has resulted in dramatic declines in gas tax revenues. They urged Congress and the Trump administration to provide funding to cover the lost revenue to protect existing jobs and make sure roads are repaired at a time when traffic is relatively light. They also urged Washington officials to invest more funds in the now-depleted Paycheck Protection Program and other forms of infrastructure.

“There is a historic opportunity to repair aging roads and other types of infrastructure,” said Stephen E. Sandherr, the association’s chief executive officer. “Without more funding from Washington, government officials will not have the resources necessary to improve the nation’s infrastructure and protect tens of thousands of construction jobs.”

View the state employment data, rankings, and highs and lows.

Related Stories

Market Data | Mar 22, 2018

Architecture billings continue to hold positive in 2018

Billings particularly strong at firms in the West and Midwest regions.

Market Data | Mar 21, 2018

Construction employment increases in 248 metro areas as new metal tariffs threaten future sector job gains

Riverside-San Bernardino-Ontario, Calif., and Merced, Calif., experience largest year-over-year gains; Baton Rouge, La., and Auburn-Opelika, Ala., have biggest annual declines in construction employment.

Market Data | Mar 19, 2018

ABC's Construction Backlog Indicator hits a new high: 2018 poised to be a very strong year for construction spending

CBI is up by 1.36 months, or 16.3%, on a year-over-year basis.

Market Data | Mar 15, 2018

ABC: Construction materials prices continue to expand briskly in February

Compared to February 2017, prices are up 5.2%.

Market Data | Mar 14, 2018

AGC: Tariff increases threaten to make many project unaffordable

Construction costs escalated in February, driven by price increases for a wide range of building materials, including steel and aluminum.

Market Data | Mar 12, 2018

Construction employers add 61,000 jobs in February and 254,000 over the year

Hourly earnings rise 3.3% as sector strives to draw in new workers.

Steel Buildings | Mar 9, 2018

New steel and aluminum tariffs will hurt construction firms by raising materials costs; potential trade war will dampen demand, says AGC of America

Independent studies suggest the construction industry could lose nearly 30,000 jobs as a result of administration's new tariffs as many firms will be forced to absorb increased costs.

Market Data | Mar 8, 2018

Prioritizing your marketing initiatives

It’s time to take a comprehensive look at your plans and figure out the best way to get from Point A to Point B.

Market Data | Mar 6, 2018

Persistent workforce shortages challenge commercial construction industry as U.S. building demands continue to grow

To increase jobsite efficiency and improve labor productivity, increasingly more builders are turning to alternative construction solutions.

Market Data | Mar 2, 2018

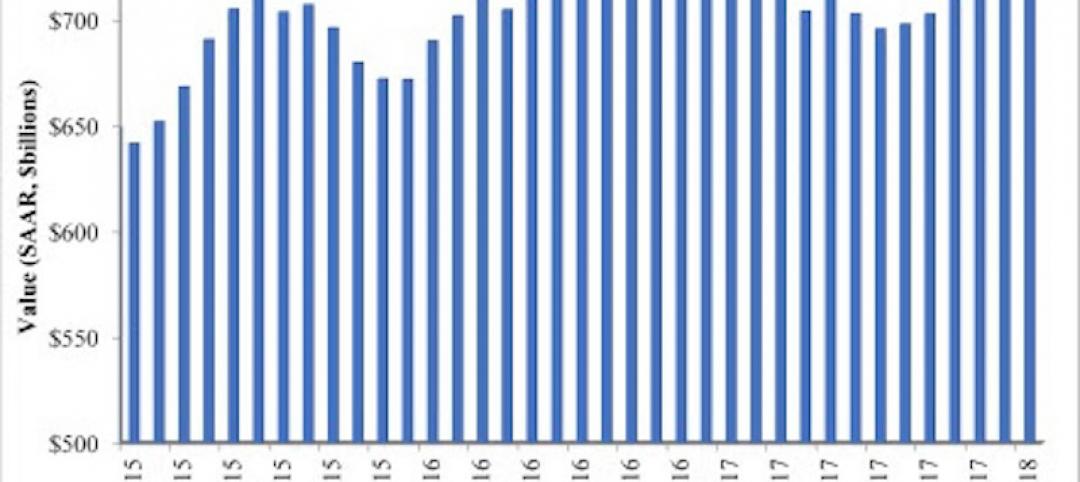

Nonresidential construction spending dips slightly in January

Private nonresidential construction fell 1.5% for the month, while public sector nonresidential spending increased 1.9%.