The pressure to reduce cap-ex and op-ex costs in the data center sector, while meeting an ever-growing demand for IT capacity, is driving owners and operators to employ advanced tools and services for the precise tracking and monitoring of nearly every component within their installations—from energy performance and power reliability to IT systems capacity and space utilization.

With better information, and more of it, data center owners believe they will be able to extend the life and optimize the performance of their buildings and IT infrastructure, enabling them to defer, or even avoid, costly upgrades, renovations, expansions, and new construction projects.

The demand for sophisticated monitoring solutions has spurred a new market segment—data center infrastructure management (DCIM)—that is likely to impact the way data center projects are planned, designed, built, and operated.

“DCIM is a powerful tool, when properly designed and deployed, to help manage the capacity, delivery, consumption, and energy across a data center,” says Jay Chester, PE, Senior Project Manager with SSOE’s Advanced Technology group (www.ssoe.com). “The data captured for analysis models can be structured to help predict performance and allow for ‘what if’ testing of equipment placement and operational scheduling.”

While still in its infancy, the DCIM movement is expected to grow sixfold by 2020, according to a new report by Navigant Research (www.navigantresearch.com). The firm’s Research Director, Eric Woods, predicts annual spending on DCIM-related software and services will balloon to more than $4.5 billion over the next six years, from its current market size of $663 million. Moreover, research firm Gartner predicts that 60% of large data centers (at least 3,000 sf) in North America will adopt some type of DCIM solution by 2017.

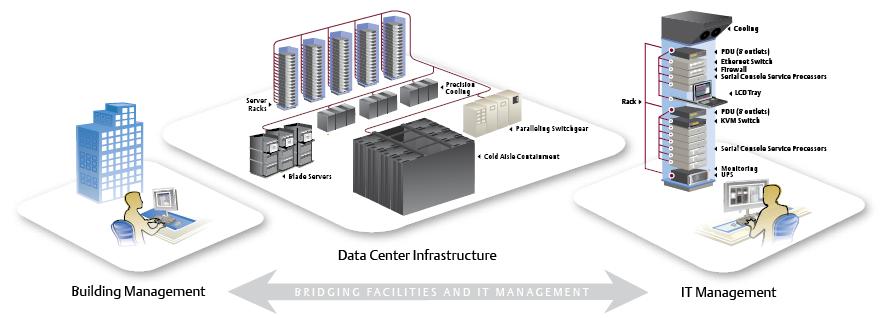

“One of the underlying trends driving the greater adoption and visibility of DCIM solutions is new thinking about the relationship between the building infrastructure for data centers and the IT capacity,” says Woods. “Traditionally, you built the building, put in the basic infrastructure management systems, and largely forgot about it. That is, all the changes occurred at the IT level, in terms of the various evolutions of technology. The two functions—facilities and IT—operated in silos.”

Emerson’s Trellis DCIM platform combines software and hardware into a solution that is managed with a single, Web-enabled, real-time view. It allows data center owners to monitor and measure, in real time, everything from energy and space efficiency to power allocation and server capacity.

Using advanced data collection and monitoring tools, data center providers believe they can bridge the gap between the facilities management function and IT function to offer a holistic, real-time view of their data centers, in an effort to optimize performance, utilization, and longevity.

“What we’re seeing among leading-edge players, as well as in academic research, is moving in the direction of thinking about data centers as a whole unit, sort of like a giant computer,” says Woods. “The data center is a big box that itself is part of the optimized capacity of the computing power in the space.”

DCIM's impact on the Building Team

This more holistic approach to data center planning and operations means that the design table is about to get a little more crowded, as IT managers begin to play a larger role in the planning, design, and preconstruction processes. It also means that Building Teams will be partly responsible for fostering collaboration between their clients’ facilities staff and IT team—two groups with very different priorities and agendas, says Addam Friedl, Senior Vice President, Mission Critical Facilities, with Environmental Systems Design (www.esdesign.com).

“Getting the two sides to sit down at the same table and agree on what the systems are supposed to do, what information needs to be gathered, and how it should be disseminated can be a real challenge, depending on the client,” says Friedl.

A thornier issue, he says, is the mind-boggling amount of data being collected and figuring out how to put it to use. Depending on the scale of the DCIM implementation, data center facilities could be looking at millions of data points that must be collected, organized, and analyzed.

“My challenge to the client is always: What are you going to do with all this data?” says Friedl. “A large data center with just a basic building management system and power monitoring system will have tens of thousands of data points; a DCIM setup could have millions. A lot of operators don’t use the data to the level they think they want to use it to.”

Furthermore, who’s going to be responsible for crunching the data? Facilities? IT? A third-party DCIM provider? An AEC firm? These are questions that need to be sorted out well before the data center is constructed and occupied. Friedl envisions many data center owners outsourcing the DCIM functions, either to an AEC firm involved in the project or a DCIM solutions provider.

Other advice for Building Teams from our experts includes:

Be prepared to coach clients through the DCIM implementation process. Because the movement is so new, clients will likely lean on the Building Team for guidance on everything from choosing the DCIM components to identifying critical data points to figuring out how best to use the data for performance optimization.

Beef up the infrastructure. “As the DCIM system becomes more robust, you’ll need more cabling, a larger cable tray or raceway, and potentially more monitoring capabilities,” says SSOE’s Chester. A more sophisticated control room will also be required. In addition, he says Building Teams will need to design for I/O (input/output) points for gear and equipment that traditionally have not been monitored by a central system.

Flexibility will become more crucial. The ultimate goal of DCIM is to minimize future capital expenditures, so clients will be looking to Building Teams to create facilities that can be easily and inexpensively expanded or reconfigured to keep up with the fast pace of technology and demand for computing power.

Expect to lose business to DCIM solution providers. Some data center clients may choose to completely outsource the DCIM-related functions to a third-party provider, which would almost certainly impact billings on the project.

Related Stories

| Nov 29, 2011

Turner Construction establishes partnership with Clark Builders

Partnership advances growth in the Canadian marketplace.

| Nov 29, 2011

AIA launches stalled projects database

To populate this database with both stalled projects and investors interested in financing them, the AIA in the last week initiated a communications campaign to solicit information about stalled projects around the country from its members and allied professionals.

| Nov 28, 2011

Leo A Daly and McCarthy Building complete Casino Del Sol expansion in Tucson, Ariz.

Firms partner with Pascua Yaqui Tribe to bring new $130 million Hotel, Spa & Convention Center to the Tucson, Ariz., community.

| Nov 28, 2011

Armstrong acquires Simplex Ceilings

Simplex will become part of the Armstrong Building Products division.

| Nov 28, 2011

Nauset Construction completes addition for Franciscan Hospital for Children

The $6.5 million fast-track, urban design-build projectwas completed in just over 16 months in a highly sensitive, occupied and operational medical environment.

| Nov 23, 2011

Lord, Aeck & Sargent opens fourth U.S. office, acquiring architecture firm in Austin, Texas

Strategic move offers growth opportunity and strengthens the firm’s historic preservation portfolio.

| Nov 23, 2011

Griffin Electric completes Gwinnett Tech project

Accommodating up to 3,000 students annually beginning this fall, the 78,000-sf, three-story facility consists of thirteen classrooms and twelve high-tech laboratories, in addition to several lecture halls and faculty offices.

| Nov 22, 2011

Corporate America adopting revolutionary technology

The survey also found that by 2015, the standard of square feet allocated per employee is expected to drop from 200 to estimates ranging from 50 to 100 square feet per person dependent upon the industry sector.

| Nov 22, 2011

Report finds that L.A. lags on solar energy, offers policy solutions

Despite robust training programs, L.A. lacks solar jobs; lost opportunity for workers in high-need communities.

| Nov 22, 2011

Saskatchewan's $1.24 billion carbon-capture project

The government of Saskatchewan has approved construction of the Boundary Dam Integrated Carbon Capture and Storage Demonstration Project.