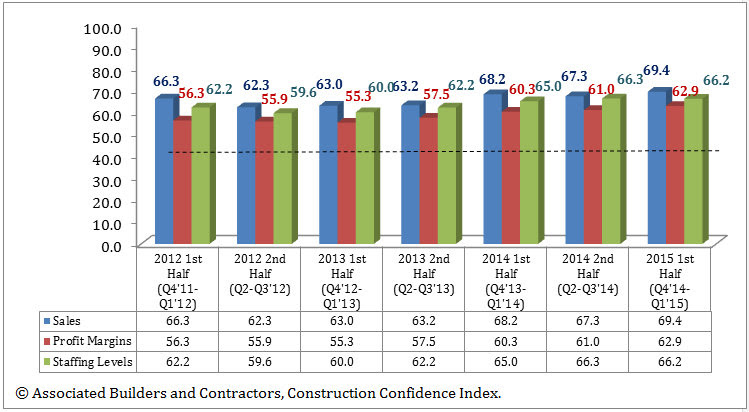

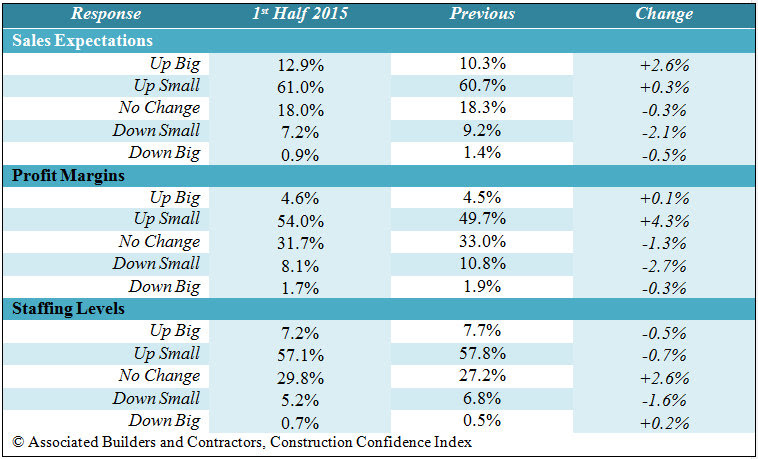

Associated Builders and Contractors' (ABC) Construction Confidence Index (CCI) indicates that contractor confidence will continue to rise in the first half of 2015. The diffusion index measures forward-looking construction industry expectations in sales, profit margins and staffing levels with readings above 50 indicating growth.

In summary, first half index readings are as follows:

- Sales expectations rose from 67.3 to 69.4;

- Profit margin expectations were up from 61.0 to 62.9;

- Staffing level intentions dipped slightly from 66.3 to 66.2.

Most expect that sales will continue to expand and profit margins will widen further. ABC's weighted diffusion index for profit margins is now approaching the highest reading in the index's three-year history. The sales expectation reading is even more optimistic with nearly three in four respondents expecting an increase in sales. While the rate of new hires will continue to be brisk, the pace of hiring is not expected to accelerate over the next six months due in large part to a lack of available skilled labor.

"The recovery continues and is now in its seventh year, but there is plenty of reason for concern with respect to the U.S. economy," said ABC Chief Economist Anirban Basu. "Financial markets have been jittery, the global economy has been slowing and Federal Reserve policy has become less predictable and more confusing. While U.S. economic expansion continues to be led by growth in consumer outlays, in part due to extraordinarily low interest rates, nonresidential construction spending growth has become an important supporting actor. Nonresidential spending, including on factories, hotels, office buildings and distribution centers, has continued to climb in the face of more readily available financing, lower retail and office vacancy rates and rising hotel occupancy rates.

"Though the U.S. economy refuses to boom, the pace of growth has been enough to allow the average contractor to secure more work at higher margins," said Basu. "Interestingly, the pace of hiring is not set to accelerate, which may be a partial reflection of the lack of appropriately skilled construction workers available for hire. The expectation is for construction compensation costs to continue to rise given expanding skills shortages, but apparently not by enough to preclude steadily expanding margins."

"While the decline in commodity prices has helped to slow construction in parts of the country, including in portions of Texas, Oklahoma and North Dakota, low fuel prices have induced faster investment elsewhere, including in the U.S. auto industry," said Basu. "The result appears to be that the average construction decision maker is more confident than six months ago when commodity prices were higher. A stronger U.S. dollar has served to suppress U.S. export growth, however, and business investment growth remains mediocre by historic standards. The implication is that the U.S. economy is not poised to break out anytime soon, and that stakeholders can continue to expect frustratingly unexceptional growth close to 2 to 2.5%."

To read more about the latest CCI, click here.

Related Stories

| Sep 21, 2010

New BOMA-Kingsley Report Shows Compression in Utilities and Total Operating Expenses

A new report from the Building Owners and Managers Association (BOMA) International and Kingsley Associates shows that property professionals are trimming building operating expenses to stay competitive in today’s challenging marketplace. The report, which analyzes data from BOMA International’s 2010 Experience Exchange Report® (EER), revealed a $0.09 (1.1 percent) decrease in total operating expenses for U.S. private-sector buildings during 2009.

| Sep 21, 2010

Forecast: Existing buildings to earn 50% of green building certifications

A new report from Pike Research forecasts that by 2020, nearly half the green building certifications will be for existing buildings—accounting for 25 billion sf. The study, “Green Building Certification Programs,” analyzed current market and regulatory conditions related to green building certification programs, and found that green building remain robust during the recession and that certifications for existing buildings are an increasing area of focus.

| Sep 21, 2010

Middough Inc. Celebrates its 60th Anniversary

Middough Inc., a top ranking U.S. architectural, engineering and management services company, announces the celebration of its 60th anniversary, says President and CEO, Ronald R. Ledin, PE.

| Sep 16, 2010

Green recreation/wellness center targets physical, environmental health

The 151,000-sf recreation and wellness center at California State University’s Sacramento campus, called the WELL (for “wellness, education, leisure, lifestyle”), has a fitness center, café, indoor track, gymnasium, racquetball courts, educational and counseling space, the largest rock climbing wall in the CSU system.

| Sep 13, 2010

Community college police, parking structure targets LEED Platinum

The San Diego Community College District's $1.555 billion construction program continues with groundbreaking for a 6,000-sf police substation and an 828-space, four-story parking structure at San Diego Miramar College.