Associated Builders and Contractors Chief Economist Anirban Basu forecasts another strong year for construction sector performance, yet warns about inflationary pressures, according to a 2019 economic outlook.

Job growth, high backlog and healthy infrastructure investment all spell good news for the industry. However, historically low unemployment has created a construction workforce shortage of an estimated 500,000 positions, which is leading to increased compensation costs.

“U.S. economic performance has been brilliant of late. Sure, there has been a considerable volume of negativity regarding the propriety of tariffs, shifting immigration policy, etc., but the headline statistics make it clear that domestic economic performance is solid,” said Basu. “Nowhere is this more evident than the U.S. labor market. As of July, there were a record-setting 6.94 million job openings in the United States, and construction unemployment reached a low of 3.6 percent in October.”

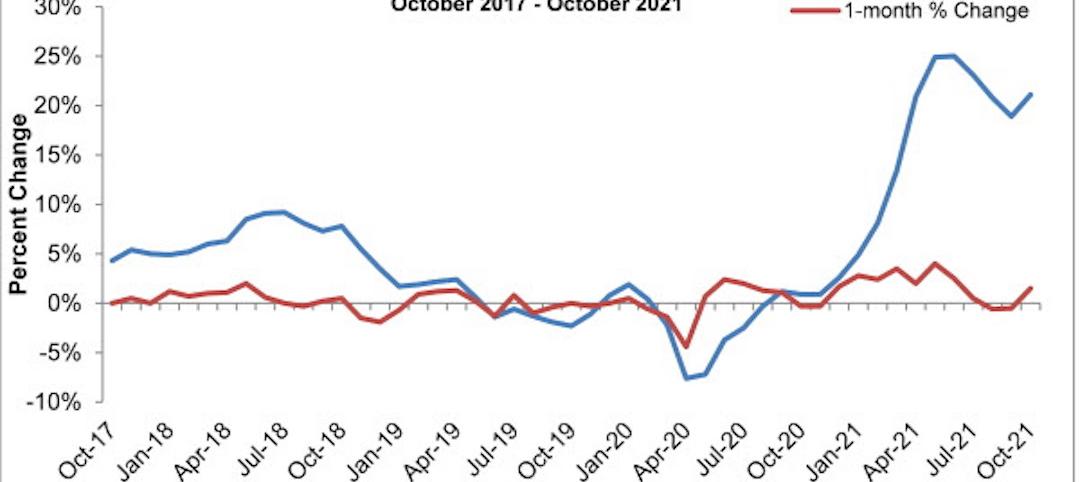

While the U.S. economy is thriving, Basu cited the potential long-term impact of rising interest rates and materials prices—up 7.9 percent on a year-over-year basis in October—on the U.S. construction market. In addition, the workforce shortage will continue to influence the market in the coming year.

That said, Basu stressed that a recession is unlikely in 2019, even with recent financial market volatility. Indicators such as the Conference Board’s Leading Economic Index, which often signals an economic downturn, have continued to tick higher, implying current momentum will continue for at least two to three more quarters. In addition, ABC’s Construction Backlog Indicator, which reflects the amount of work that will be performed by commercial and industrial contractors in the months ahead, reported a record backlog of 9.9 months in the second quarter of 2018.

While optimistic for next year, Basu warned that, “Contractors should be aware that recessions often follow within two years of peak confidence. The average contractor is likely to be quite busy in 2019, but beyond that, the outlook is quite murky.”

Related Stories

Market Data | Nov 22, 2021

Only 16 states and D.C. added construction jobs since the pandemic began

Texas, Wyoming have worst job losses since February 2020, while Utah, South Dakota add the most.

Market Data | Nov 10, 2021

Construction input prices see largest monthly increase since June

Construction input prices are 21.1% higher than in October 2020.

Market Data | Nov 9, 2021

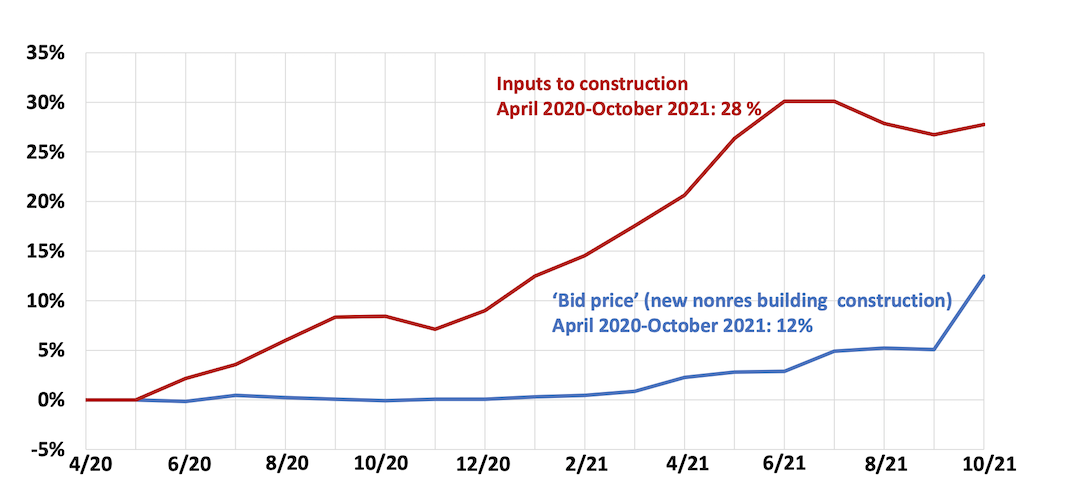

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.