A business-financed marketing campaign that began more than seven years ago may have contributed to the surge in construction and development that is transforming Greater Fort Lauderdale in Florida.

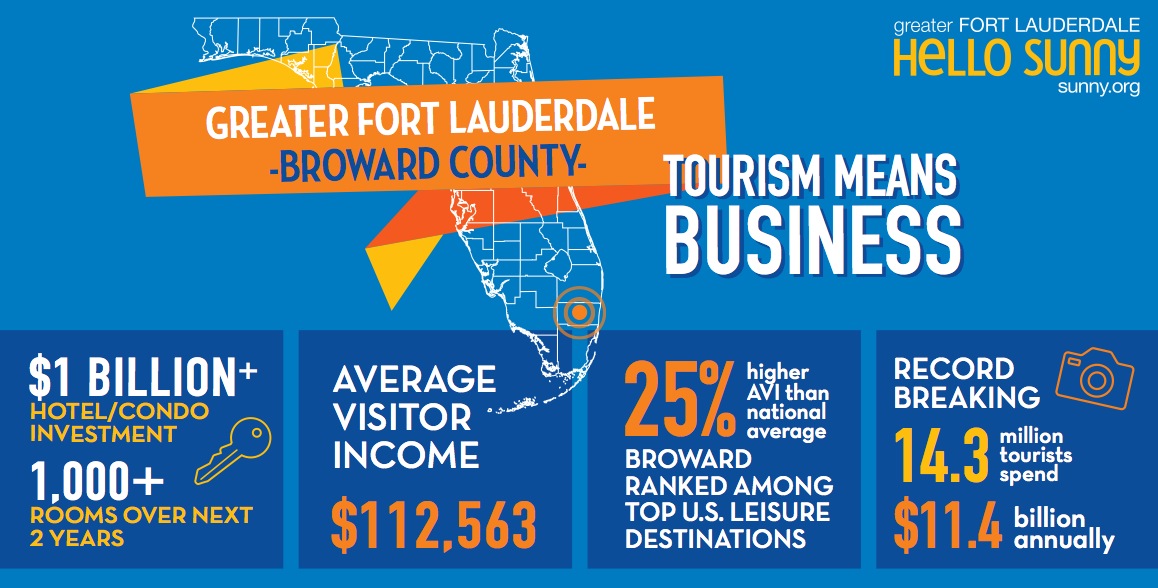

More than $1 billion is being invested in new hotel and condo development alone there, with more than $704 million of that development already underway, which will add in excess of 1,000 new rooms and apartments to this market over the next two years. Another $222 million in expenditures for renovations and improvements are earmarked for several hotel properties.

This activity is creating a new landscape of high-rise residential and commercial buildings that is attracting visitors from Washington D.C., Boston, Dallas, and South America.

“By 2030, there are expected to be seven million more Floridians, and South Florida will make up a large part of that growth,” says Bob Swindell, President and CEO of the Greater Fort Lauderdale Alliance, an economic development organization that promotes and markets the advantages of Broward County’s 31 municipalities for business, residential, and tourist interests.

Swindell notes that 2015 was the first year during which the Florida legislature approved funding—$10 million—to market businesses in that county. About one-third of the companies and investors that have projects underway in Broward benefit from publicly funded tax incentives.

New hotel projects include the $200 million Four Seasons Hotel and Private Residences, which is scheduled to open in 2018; the $500 million Auberge Beach Residences & Spa, slated to open in 2017; the $120 million Gale Boutique Hotel & Residences, opening in 2017; and the $40 million Conrad Fort Lauderdale Beach Resort, opening this year.

Also in the works is the $1 billion Metropica mixed-use development in nearby Sunrise, Fla., which when completed within the next seven years will include more than 1,900 condos, 345 apartments, a hotel, 400,000 sf of retail (including 12 restaurants), and 150,000 sf of offices. Construction on the first condos began last October, and is scheduled to begin on the commercial component in the first quarter of 2016.

Plans are underway for a $2.3 billion expansion of the Fort-Lauderdale-Hollywood International Airport. Funding is in place, says Swindell, for a $600 million expansion of the Broward County Convention Center, which would include a new hotel with between 700 and 1,000 rooms by 2019. He adds that this market could soon have sufficient density to support a light-rail system.

“We made a move to buy the building for the Conrad two years ago,” says Andreas Ioannou, a former executive with Hilton Hotels and now CEO of Orchestra Hotels & Resorts, which he formed in 2014. The 24-story Ocean Resort Residences Conrad Fort Lauderdale Beach Resort will have 290 for-sale condos and residences, including 20 oceanfront villas and three penthouses. It has 178 studio apartments that average 640 sf and start in the low $400s.

Even with so much new construction going on, Ioannou isn’t worried about the market overheating. “Exactly the opposite. Fort Lauderdale has very controlled growth at the ocean.” And he’s confident that Greater Fort Lauderdale will continue to be a magnet for homebuyers and businesses from the Northeast, Midwest, Canada, and other parts of Florida, too. “Miami Beach prices are more than double those in Fort Lauderdale,” he says about the cost of apartments in both metros.

Fort Lauderdale’s growth spurt coincides with a nearly 7% increase in this area’s population over the past decade, according to Census Bureau estimates. The University of Florida’s Bureau of Economic and Business Research has estimated that Broward County could expand to 2.46 million people by 2040, from 1.9 million in 2015.

Some 15 million tourists are expected to visit Greater Fort Lauderdale in 2016, including a significant number from South America. “As long as those countries remain OK, they will keep coming to South Florida,” predicts Ioannou.

Swindell believes his organization has played a role in this market’s development boom, starting with a “perception survey” the Alliance conducted in the mid 2000s. That pool revealed that Broward County “did not have much name recognition” and that referring to this market as Greater Fort Lauderdale had more brand equity.

So the Alliance convinced local businesses to invest in a rebranding campaign that played up the market’s plusses, which include its Triple-A bond rating and its low business taxes. The Alliance directed that campaign toward the New York metropolitan area, as well as Chicago and Boston. Since 2008, the Alliance and its business partners have spent more than $6 million on this effort.

On its website, the Alliance identifies the industries that it is tries attract to Greater Fort Lauderdale: Advanced Materials & High Tech Manufacturing, Creative Economy and Film, Global Logistics, Information and Communications Technologies, Life Sciences, and Marine. Last year, the Alliance hired a consultant to make sure it was going after the right sectors (it was, says Swindell). The market has also seen promising growth in the aviation sector, particularly on the maintenance and repair sides.

Other Florida cities, including Orlando and Miami, have their own strategies to get their share of the ongoing influx of people and businesses into the Sunshine State. But Swindell doesn’t see Florida metros as competition with Fort Lauderdale as much as places like Atlanta, Charlotte, and even Panama City.

He makes his pitch to the AEC community by pointing out that a lot of what’s going up in Greater Fort Lauderdale is “architecturally interesting,” and that projects there aren’t just being planned but are also being financed and getting built.

Related Stories

| Aug 11, 2010

'Feebate' program to reward green buildings in Portland, Ore.

Officials in Portland, Ore., have proposed a green building incentive program that would be the first of its kind in the U.S. Under the program, new commercial buildings, 20,000 sf or larger, that meet Oregon's state building code would be assessed a fee by the city of up to $3.46/sf. The fee would be waived for buildings that achieve LEED Silver certification from the U.

| Aug 11, 2010

Five-star resort breaks ground on the Black Sea

Construction work has commenced on a five-star resort and leisure destination along the Black Sea coast in Batumi, Georgia. The RTKL-designed resort consists of two towers rising 86 and 58 meters over a two-story podium. The larger tower contains 250 guestrooms and suites while the smaller tower offers 78 residential apartments.

| Aug 11, 2010

Outdated office tower becomes Nashville's newest boutique hotel

A 1960s office tower in Nashville, Tenn., has been converted into a 248-room, four-star boutique hotel. Designed by Earl Swensson Associates, with PowerStrip Studio as interior designer, the newly converted Hutton Hotel features 54 suites, two penthouse apartments, 13,600 sf of meeting space, and seven "cardio" rooms.

| Aug 11, 2010

New hospital expands Idaho healthcare options

Ascension Group Architects, Arlington, Texas, is designing a $150 million replacement hospital for Portneuf Medical Center in Pocatello, Idaho. An existing facility will be renovated as part of the project. The new six-story, 320-000-sf complex will house 187 beds, along with an intensive care unit, a cardiovascular care unit, pediatrics, psychiatry, surgical suites, rehabilitation clinic, and ...

| Aug 11, 2010

Aloft hotel opens at Washington National Harbor

A partnership of five developers, including the John Hardy Group and Peterson Companies, have completed a 190-room aloft hotel at Washington National Harbor, a mixed-use retail/entertainment development in Oxon Hill, Md., near Washington, D.C. Designed in conjunction with David Rockwell and the Rockwell Group, the aloft prototype offers atmospheric public spaces designed to draw guests from the...

| Aug 11, 2010

D.C. gets sweeter with expanded green eatery

Greens Restaurant Group has expanded its popular salad and yogurt eatery, sweetgreen, to two neighborhoods in the Washington, D.C., area, Dupont Circle and Bethesda, Md. Designed by local architect CORE architecture + design, the experiential dining projects use salvaged hickory for the walls, wood recycled from the old bowling alleys for the tables and chairs, and sustainable paper/dye product...

| Aug 11, 2010

Manhattan's latest boutique hotel will be LEED Silver certified

New York-based developer Tribeca Associates has commissioned Brennan Beer Gorman Architects to design its latest mixed-use office and boutique hotel at 330 Hudson Street. Located in the downtown Hudson Square area of Manhattan, the LEED-Silver development will involve the redevelopment of a historic, eight-story warehouse building into 292,000 sf of office space, 15,000 sf of retail space, and ...

| Aug 11, 2010

Manhattan's Gouverneur Healthcare Services tops out renovation, expansion

One year after breaking ground, the Building Team for the renovation and expansion of the Gouverneur Healthcare Services facility on Manhattan's Lower East Side topped out the $180 million project. Designed by New York-based RMJM, the development involves a 316,000-sf renovation and 108,000-sf addition that will house a 295-bed nursing facility and five-story ambulatory care center.

| Aug 11, 2010

Decline expected as healthcare slows, but hospital work will remain steady

The once steady 10% growth rate in healthcare construction spending has slowed, but hasn't entirely stopped. Spending is currently 1.7% higher than the same time last year when construction materials costs were 8% higher. The 2.5% monthly jobsite spending decline since last fall is consistent with the decline in materials costs.