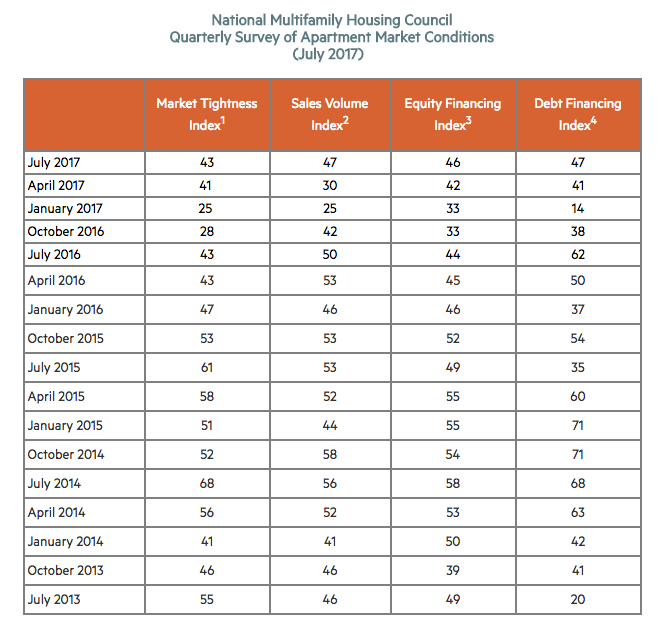

All four indexes of the National Multifamily Housing Council’s (NMHC) July Quarterly Survey of Apartment Market Conditions remained slightly below the breakeven level of 50, the fourth consecutive quarter indicating softening conditions. The Market Tightness (43), Sales Volume (47), Equity Financing (46), and Debt Financing (47) Indexes all improved from April, but still hovered just below 50.

“All four indexes are below 50 but rising, suggesting that the softening is less wide-spread than in previous quarters,” said Mark Obrinsky, NMHC’s SVP of Research and Chief Economist. “Despite some softness at the high end of the apartment market—due to construction having finally ramped up to the level needed—demand for apartments will continue to be substantial for years to come.”

The Market Tightness Index edged up from 41 to 43, as almost half of respondents (48 percent) reported unchanged conditions. One-third (33 percent) of respondents saw conditions as looser than three months ago, while the remaining 19 percent reported tighter conditions. This marks the seventh consecutive quarter of overall declining conditions.

The Sales Volume Index increased from 30 to 47, just shy of the breakeven level of 50. Twenty-seven percent of respondents reported higher sales volume than three months prior, compared to 33 percent that reported lower volume.

The Equity Financing Index increased four points to 46, with almost a quarter (24 percent) of respondents believing that equity financing was less available than three months prior. Sixteen percent thought that equity financing was more available compared to three months ago.

The Debt Financing Index increased from 41 to 47, showing a similar trend to the equity market. While a quarter of respondents (25 percent) reported worse conditions for debt financing compared to three months prior, another 19 percent disagreed, believing conditions had become more favorable.

About the Survey:

The July 2017 Quarterly Survey of Apartment Market Conditions was conducted July 10-July 17, 2017; 123 CEOs and other senior executives of apartment-related firms nationwide responded.

Related Stories

| Jan 27, 2011

Perkins Eastman's report on senior housing signals a changing market

Top international design and architecture firm Perkins Eastman is pleased to announce that the Perkins Eastman Research Collaborative recently completed the “Design for Aging Review 10 Insights and Innovations: The State of Senior Housing” study for the American Institute of Architects (AIA). The results of the comprehensive study reflect the changing demands and emerging concepts that are re-shaping today’s senior living industry.

| Jan 21, 2011

Harlem facility combines social services with retail, office space

Harlem is one of the first neighborhoods in New York City to combine retail with assisted living. The six-story, 50,000-sf building provides assisted living for residents with disabilities and a nonprofit group offering services to minority groups, plus retail and office space.

| Jan 21, 2011

Nothing dinky about these residences for Golden Gophers

The Sydney Hall Student Apartments combines 125 student residences with 15,000 sf of retail space in the University of Minnesota’s historic Dinkytown neighborhood, in Minneapolis.

| Jan 21, 2011

Revamped hotel-turned-condominium building holds on to historic style

The historic 89,000-sf Hotel Stowell in Los Angeles was reincarnated as the El Dorado, a 65-unit loft condominium building with retail and restaurant space. Rockefeller Partners Architects, El Segundo, Calif., aimed to preserve the building’s Gothic-Art Nouveau combination style while updating it for modern living.

| Jan 21, 2011

Upscale apartments offer residents a twist on modern history

The Goodwynn at Town: Brookhaven, a 433,300-sf residential and retail building in DeKalb County, Ga., combines a historic look with modern amenities. Atlanta-based project architect Niles Bolton Associates used contemporary materials in historic patterns and colors on the exterior, while concealing a six-level parking structure on the interior.

| Jan 20, 2011

Worship center design offers warm and welcoming atmosphere

The Worship Place Studio of local firm Ziegler Cooper Architects designed a new 46,000-sf church complex for the Pare de Sufrir parish in Houston.

| Jan 19, 2011

Baltimore mixed-use development combines working, living, and shopping

The Shoppes at McHenry Row, a $117 million mixed-use complex developed by 28 Walker Associates for downtown Baltimore, will include 65,000 sf of office space, 250 apartments, and two parking garages. The 48,000 sf of main street retail space currently is 65% occupied, with space for small shops and a restaurant remaining.

| Jan 7, 2011

Mixed-Use on Steroids

Mixed-use development has been one of the few bright spots in real estate in the last few years. Successful mixed-use projects are almost always located in dense urban or suburban areas, usually close to public transportation. It’s a sign of the times that the residential component tends to be rental rather than for-sale.

| Jan 4, 2011

An official bargain, White House loses $79 million in property value

One of the most famous office buildings in the world—and the official the residence of the President of the United States—is now worth only $251.6 million. At the top of the housing boom, the 132-room complex was valued at $331.5 million (still sounds like a bargain), according to Zillow, the online real estate marketplace. That reflects a decline in property value of about 24%.