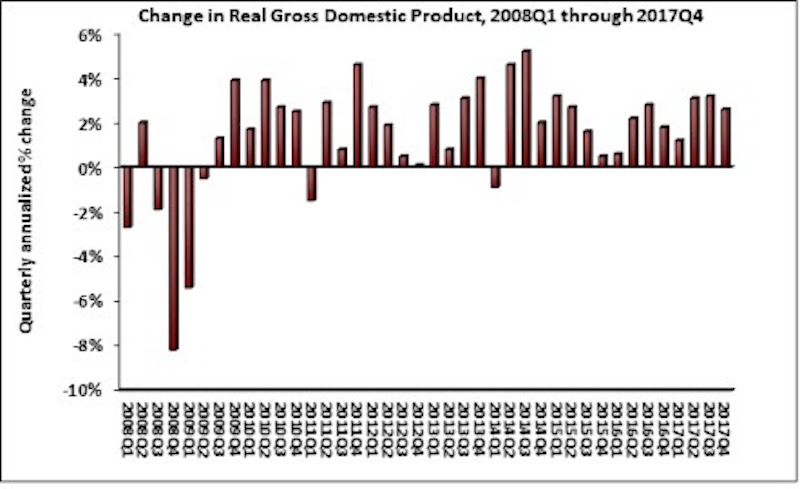

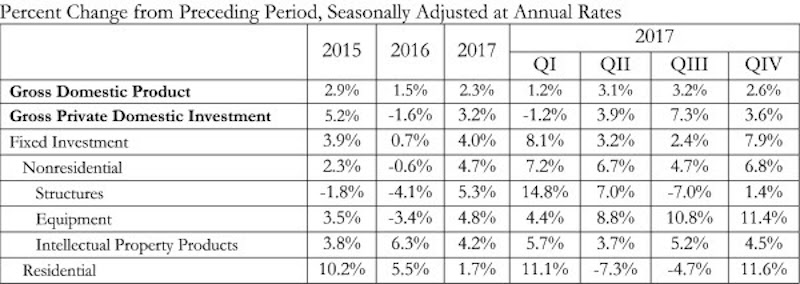

The U.S. economy grew by 2.3% in 2017, while fixed investment increased at a annual rate of 7.9%, according to an Associated Builders and Contractors (ABC) analysis of data released today by the Bureau of Economic Analysis.

The economy expanded at an annual rate of 2.6% during the fourth quarter of 2017 after expanding at a 3.2% rate during the third quarter. Nonresidential fixed investment performed similarly to overall fixed investment in the fourth quarter by increasing at a 6.8% rate. This represents the third time in the past four quarters that nonresidential fixed investment increased by at least 6.7%.

The year-end figure for GDP growth of 2.3% is up from 1.5% in 2016 but down from the 2.9% figure posted in 2015. Nonresidential fixed investment increased 4.7% in 2017, its best year since increasing 6.9% in 2014. This followed a 0.6% contraction in 2016.

“Many will look at this report and conclude that consumer spending, the largest component of the economy, drove fourth quarter growth by expanding at a 3.8% annual rate,” said ABC Chief Economist Anirban Basu. “Upon further inspection, however, the fourth quarter consumer spending missed its 3% expectation due to imports increasing at twice the rate of exports. This widening trade deficit subtracted 1.13 percentage points from fourth quarter GDP growth.

“The factors that have helped to accelerate economic growth in America remain in place, including a strengthening global economy, abundant consumer and business confidence, elevated liquidity flowing through the veins of the international financial system and deregulation,” said Basu. “Stakeholders should be aware that although many companies have announced big plans for stepped-up investment, staffing and compensation—due at least in part to the recently enacted tax cut—the plans have yet to fully manifest within the data. The implication is that the U.S. economy is set to roar in 2018.

“As always, contractors are warned to remain wary,” said Basu. “The combination of extraordinary confidence and capital can fuel excess financial leverage and spur asset price bubbles. The implication is that as contractors remain busy, there should be an ongoing stockpiling of defensive cash. That recommendation will be difficult for many contractors to implement, however, with labor shortages and materials costs rising more rapidly and slender profit margins in many construction segments.”

Related Stories

Multifamily Housing | Jan 27, 2021

2021 multifamily housing outlook: Dallas, Miami, D.C., will lead apartment completions

In its latest outlook report for the multifamily rental market, Yardi Matrix outlined several reasons for hope for a solid recovery for the multifamily housing sector in 2021, especially during the second half of the year.

Market Data | Jan 26, 2021

Construction employment in December trails pre-pandemic levels in 34 states

Texas and Vermont have worst February-December losses while Virginia and Alabama add the most.

Market Data | Jan 19, 2021

Architecture Billings continue to lose ground

The pace of decline during December accelerated from November.

Market Data | Jan 19, 2021

2021 construction forecast: Nonresidential building spending will drop 5.7%, bounce back in 2022

Healthcare and public safety are the only nonresidential construction sectors that will see growth in spending in 2021, according to AIA's 2021 Consensus Construction Forecast.

Market Data | Jan 13, 2021

Atlanta, Dallas seen as most favorable U.S. markets for commercial development in 2021, CBRE analysis finds

U.S. construction activity is expected to bounce back in 2021, after a slowdown in 2020 due to challenges brought by COVID-19.

Market Data | Jan 13, 2021

Nonres construction could be in for a long recovery period

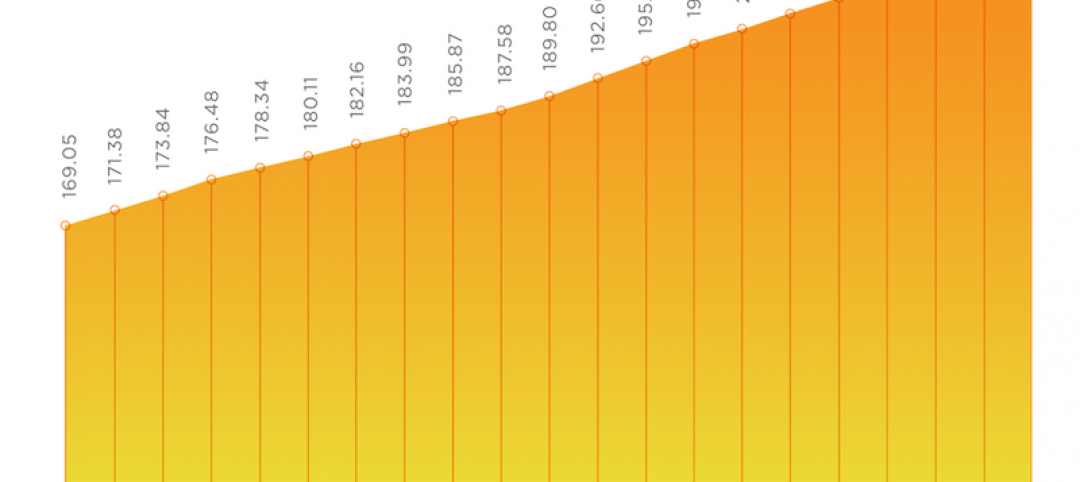

Rider Levett Bucknall’s latest cost report singles out unemployment and infrastructure spending as barometers.

Market Data | Jan 13, 2021

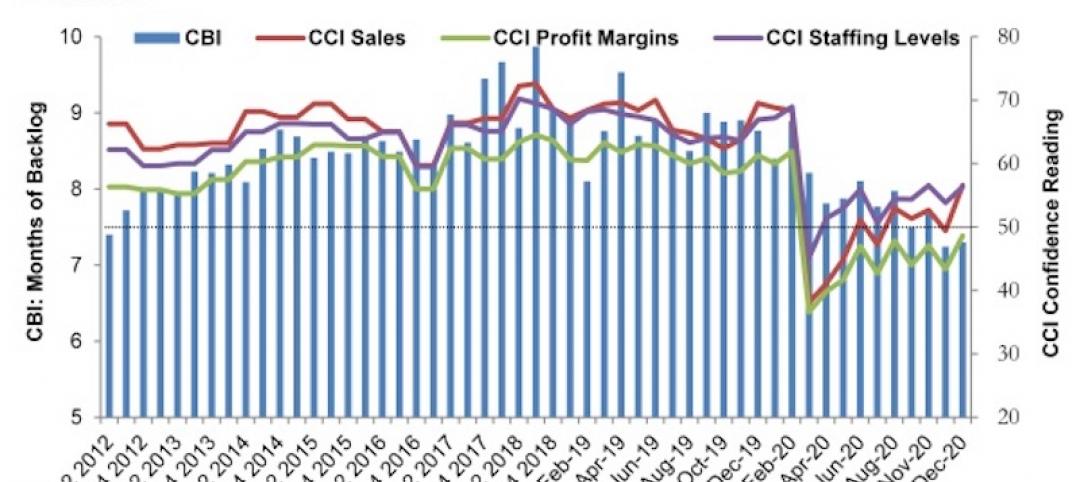

Contractor optimism improves as ABC’s Construction Backlog inches up in December

ABC’s Construction Confidence Index readings for sales, profit margins, and staffing levels increased in December.

Market Data | Jan 11, 2021

Turner Construction Company launches SourceBlue Brand

SourceBlue draws upon 20 years of supply chain management experience in the construction industry.

Market Data | Jan 8, 2021

Construction sector adds 51,000 jobs in December

Gains are likely temporary as new industry survey finds widespread pessimism for 2021.

Market Data | Jan 7, 2021

Few construction firms will add workers in 2021 as industry struggles with declining demand, growing number of project delays and cancellations

New industry outlook finds most contractors expect demand for many categories of construction to decline.