Construction employment in December remained below pre-pandemic levels in two-thirds of the states even though 37 states and the District of Columbia added construction jobs from November to December, according to an analysis by the Associated General Contractors of America of government employment data released today. Association officials said the new data highlights how broadly the industry has been impacted by the pandemic and underscores the need for additional coronavirus recovery measures.

“While most states recorded construction employment gains in December, the pickup is likely to be temporary for many,” said Ken Simonson, the association’s chief economist. “Participants in our association’s recent Hiring and Business Outlook Survey expect the dollar volume of most project types available to bid on to decline in 2021.”

The survey, which included responses from more than 1,300 contractors in every state and D.C., asked about prospects for 16 categories of projects. On balance, respondents expect growth only for non-hospital health care, such as clinics, testing and screening facilities, and medical laboratories; warehouses; and water and sewer projects.

Seasonally adjusted construction employment in December was lower than in February—the last month before the pandemic forced many contractors to suspend work—in 34 states and was unchanged in Kansas, Simonson noted. Texas lost the most construction jobs over the 10-month period (-35,600 jobs or -4.5%), followed by New York (-30,900 jobs, -7.5%), Florida (-17,500 jobs, -3.0%) and New Jersey (-16,700 jobs, -10.0%). Vermont experienced the largest percentage loss (-23.1%, -3,400 jobs), followed by New Jersey.

Only 15 states and the District of Columbia added construction jobs from February to December. Virginia added the most jobs (10,800, 5.3%), followed by Utah (7,000 jobs, 6.1%) and Alabama (6,100 jobs, 6.4%). Alabama added the highest percentage, followed by Utah and South Dakota (5.7%, 1,400 jobs).

Construction employment decreased from November to December in 11 states and D.C., increased in 37 states and was unchanged in North Carolina and Rhode Island. Arizona had the largest loss of construction jobs for the month (-4,100 jobs or -2.3%), followed by Louisiana (-2,000 jobs, -1.5%). Delaware had the largest percentage decline (3.2%, -700 jobs), followed by Arizona, Alaska (-1.9%, -300 jobs), and Louisiana.

California added the most construction jobs over the month (31,600 jobs, 3.7%), followed by New York (8,500, 2.3%) and Illinois (8,300 jobs, 3.8%). New Hampshire had the largest percentage gain for the month (4.0%, 1,100 jobs), followed by Illinois and New Mexico (3.8%, 1,800 jobs).

Association officials said demand for construction will continue to suffer until the coronavirus is under control and urged federal officials to enact measures to help stem additional job losses in the sector. These new measures should include new federal investments in infrastructure, backfilling depleted state and local construction budgets and moving quickly to forgive Paycheck Protection Program loans issued last year.

“Contractors are eager to save as many jobs as possible during the next several months on the expectation demand will return once the coronavirus comes under control,” said Stephen E. Sandherr, the association’s chief executive officer. “Washington officials can help save countless construction careers by acting now to stabilize demand.

View state employment February-December data and rankings; and November-December rankings.

Related Stories

Hotel Facilities | Apr 24, 2024

The U.S. hotel construction market sees record highs in the first quarter of 2024

As seen in the Q1 2024 U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics (LE), at the end of the first quarter, there are 6,065 projects with 702,990 rooms in the pipeline. This new all-time high represents a 9% year-over-year (YOY) increase in projects and a 7% YOY increase in rooms compared to last year.

Construction Costs | Apr 18, 2024

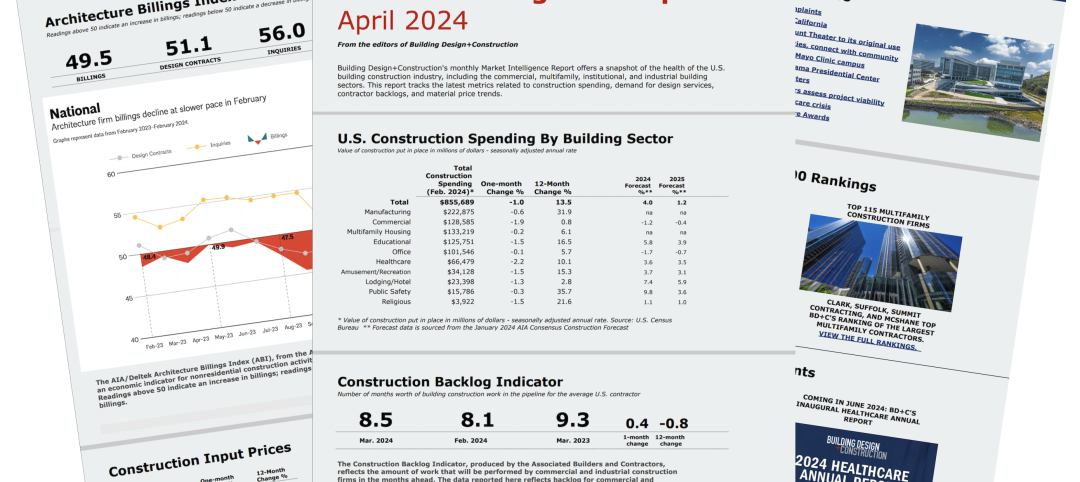

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

K-12 Schools | Apr 10, 2024

Surprise, surprise: Students excel in modernized K-12 school buildings

Too many of the nation’s school districts are having to make it work with less-than-ideal educational facilities. But at what cost to student performance and staff satisfaction?

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

Retail Centers | Apr 4, 2024

Retail design trends: Consumers are looking for wellness in where they shop

Consumers are making lifestyle choices with wellness in mind, which ignites in them a feeling of purpose and a sense of motivation. That’s the conclusion that the architecture and design firm MG2 draws from a survey of 1,182 U.S. adult consumers the firm conducted last December about retail design and what consumers want in healthier shopping experiences.

Market Data | Apr 1, 2024

Nonresidential construction spending dips 1.0% in February, reaches $1.179 trillion

National nonresidential construction spending declined 1.0% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.179 trillion.

Market Data | Mar 26, 2024

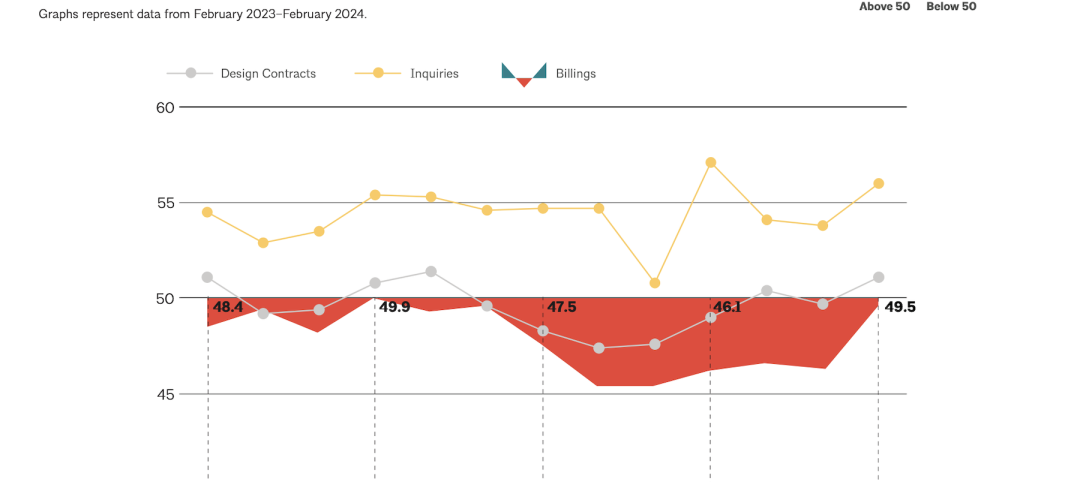

Architecture firm billings see modest easing in February

Architecture firm billings continued to decline in February, with an AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month. However, February’s score marks the most modest easing in billings since July 2023 and suggests that the recent slowdown may be receding.

K-12 Schools | Mar 18, 2024

New study shows connections between K-12 school modernizations, improved test scores, graduation rates

Conducted by Drexel University in conjunction with Perkins Eastman, the research study reveals K-12 school modernizations significantly impact key educational indicators, including test scores, graduation rates, and enrollment over time.

MFPRO+ News | Mar 16, 2024

Multifamily rents stable heading into spring 2024

National asking multifamily rents posted their first increase in over seven months in February. The average U.S. asking rent rose $1 to $1,713 in February 2024, up 0.6% year-over-year.