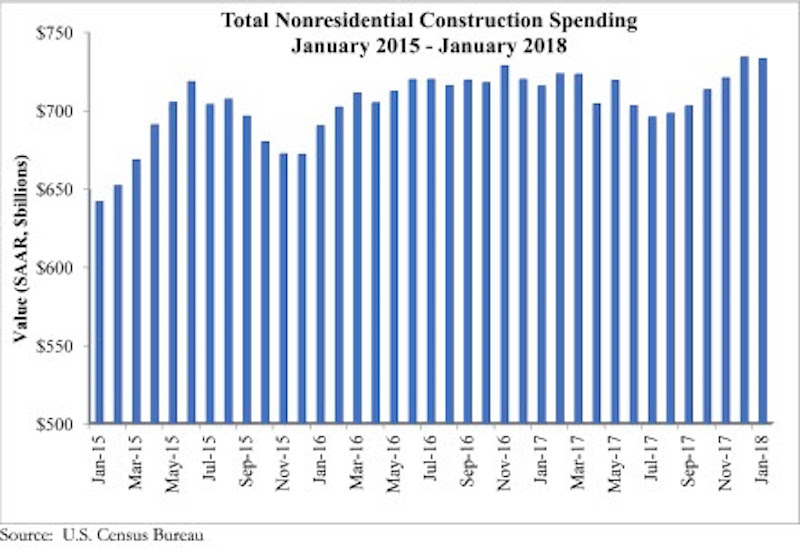

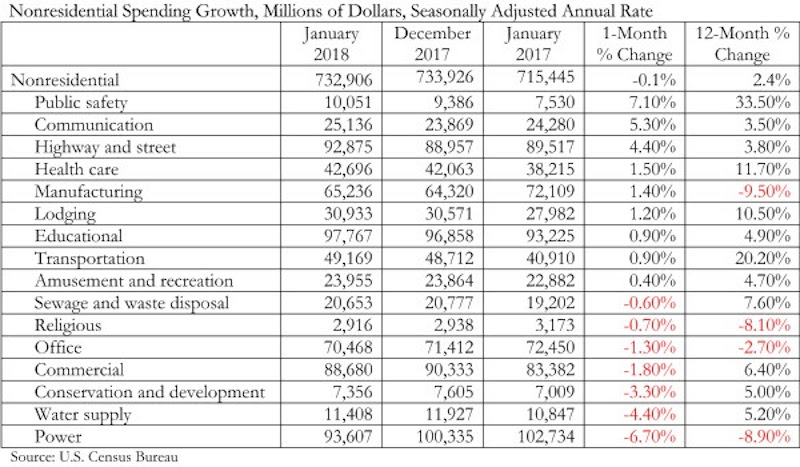

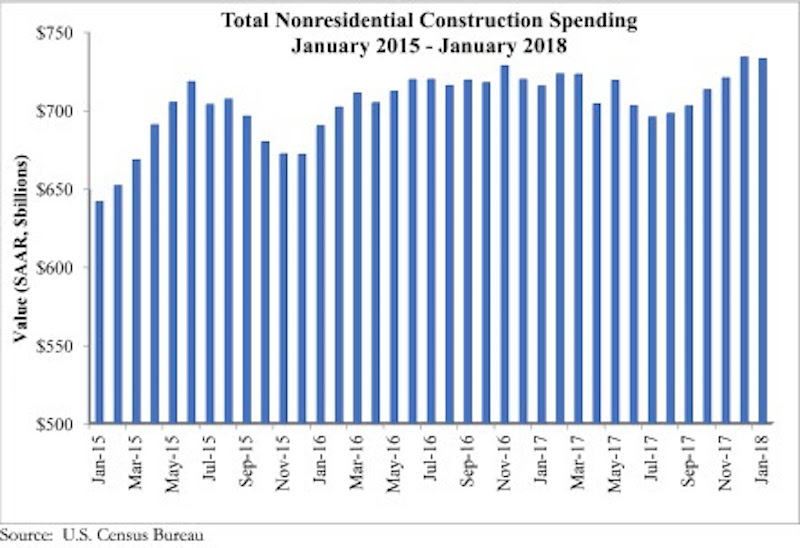

Nonresidential construction spending fell 0.1% on a monthly basis in January 2018, while year-over-year spending increased, according to an Associated Builders and Contractors (ABC) analysis of U.S. Census Bureau data released March 1. Nonresidential January spending totaled $732.9 billion on a seasonally adjusted annual rate, adding up to a 2.4% increase year over year.

Private nonresidential construction fell 1.5% for the month, while public sector nonresidential spending increased 1.9%. The largest year-over-year increases occurred in public safety (33.5%) and transportation (20.2%).

“Today’s data indicates that nonresidential spending continues to expand erratically and unevenly,” said ABC’s Chief Economist Anirban Basu. “On a monthly basis, nonresidential construction spending declined in January. While the decline was minimal, and may have been primarily attributable to freezing temperatures in much of the country, there has been a long-lived pattern of occasional spending setbacks in the context of broader expansion cycles. The result of the most recent spending setback is that nonresidential construction outlays are only 2.4% above year-ago levels.

“Interestingly, there is evidence of a reversal of fortune as spending picks up in certain public segments while flattening out in certain private ones,” said Basu. “With the housing market recovering, property tax and other forms of real estate tax collections have increased. This has positioned a growing number of public agencies to step up construction spending in education, public safety and other publicly financed categories.

“Meanwhile, there are growing concerns regarding excess inventory of commercial and office space in certain metropolitan areas,” said Basu. “This may help explain recent construction spending setbacks in a variety of privately financed construction segments. That said, there is little reason to believe that private construction will falter in 2018. Economic growth, including job growth, remains robust. Confidence is surging among many economic actors, including bankers and developers. The combination of capital and confidence should be enough to drive spending growth in most private segments as 2018 progresses.”

Related Stories

Market Data | Nov 29, 2016

It’s not just traditional infrastructure that requires investment

A national survey finds strong support for essential community buildings.

Industry Research | Nov 28, 2016

Building America: The Merit Shop Scorecard

ABC releases state rankings on policies affecting construction industry.

Multifamily Housing | Nov 28, 2016

Axiometrics predicts apartment deliveries will peak by mid 2017

New York is projected to lead the nation next year, thanks to construction delays in 2016

Market Data | Nov 22, 2016

Construction activity will slow next year: JLL

Risk, labor, and technology are impacting what gets built.

Market Data | Nov 17, 2016

Architecture Billings Index rebounds after two down months

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Nov 11, 2016

Brand marketing: Why the B2B world needs to embrace consumers

The relevance of brand recognition has always been debatable in the B2B universe. With notable exceptions like BASF, few manufacturers or industry groups see value in generating top-of-mind awareness for their products and services with consumers.

Industry Research | Nov 8, 2016

Austin, Texas wins ‘Top City’ in the Emerging Trends in Real Estate outlook

Austin was followed on the list by Dallas/Fort Worth, Texas and Portland, Ore.

Market Data | Nov 2, 2016

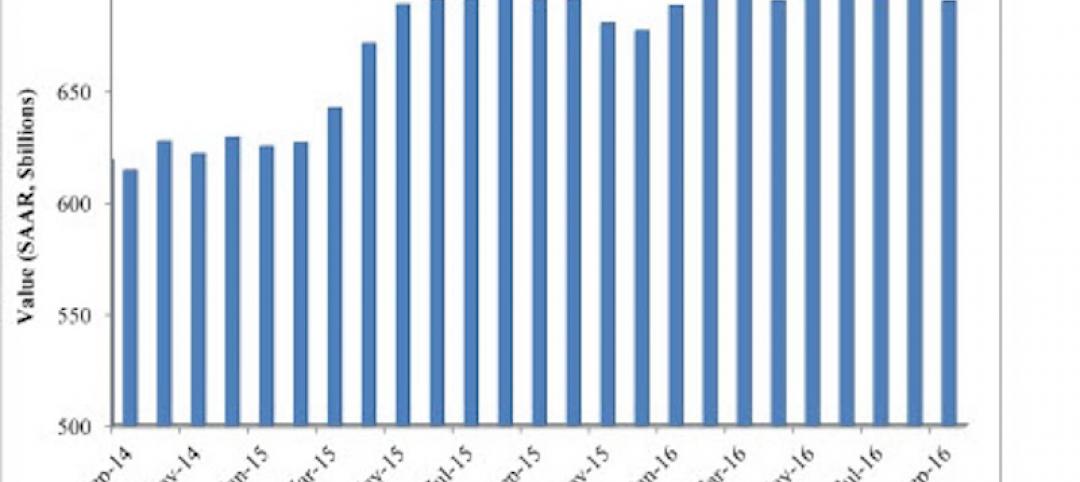

Nonresidential construction spending down in September, but August data upwardly revised

The government revised the August nonresidential construction spending estimate from $686.6 billion to $696.6 billion.

Market Data | Oct 31, 2016

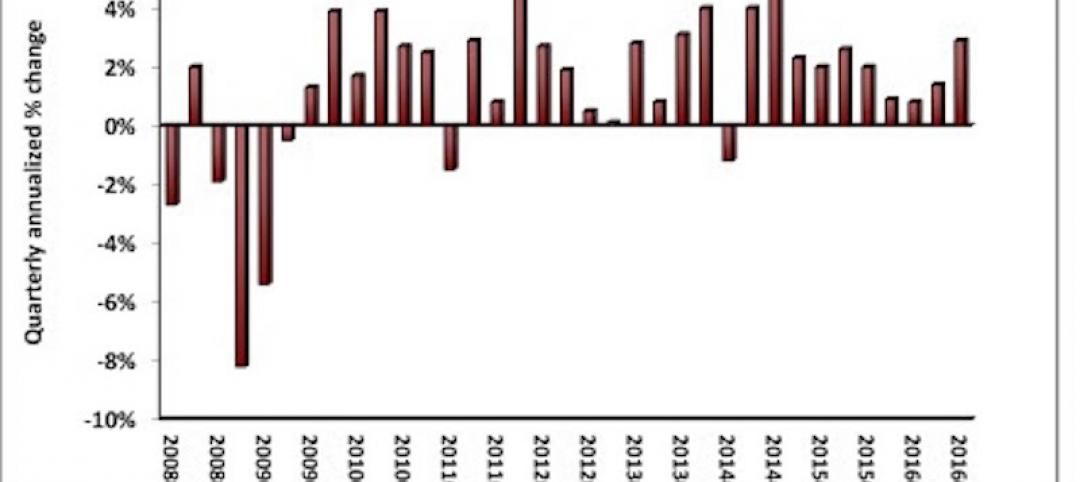

Nonresidential fixed investment expands again during solid third quarter

The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending, says ABC Chief Economist Anirban Basu.

Market Data | Oct 28, 2016

U.S. construction solid and stable in Q3 of 2016; Presidential election seen as influence on industry for 2017

Rider Levett Bucknall’s Third Quarter 2016 USA Construction Cost Report puts the complete spectrum of construction sectors and markets in perspective as it assesses the current state of the industry.