I’ve been going to trade shows for more than 35 years, and it never ceases to amaze me how many suppliers I’ve never heard of. While there are always well-known brands on display, like Kohler and

Whirlpool, marketing strategies for most suppliers typically view the general public as an afterthought.

The relevance of brand recognition has always been debatable in the B2B universe. With notable exceptions like BASF, few manufacturers or industry groups see value in generating top-of-mind awareness for their products and services with consumers. It’s far more advantageous, their thinking goes, to aim at municipalities, developers, and their AEC partners.

“It’s not in their organizational DNA” to market to the public, observes Kimberly Jones, President of Butler/Till, a media planning firm.

But the public isn’t a passive bystander anymore. It is an avid stakeholder insisting that its input be factored into the design and construction of all kinds of projects: schools, offices, hospitals, multifamily housing, even sports arenas. Marketing that relegates the public to the sidelines misses an opportunity to influence—even tangentially—these influencers.

I was thinking about branding while standing on the periphery of the International WELL Building Institute’s booth at last month’s Greenbuild convention in Los Angeles, watching one of a steady stream of interviews with company execs and partners, presented to Greenbuild attendees. IWBI, which launched in 2013, is striving to create a brand. But for whom, I wondered?

Its WELL Building Standard stems from a larger wellness movement being spurred by a public that is demanding healthier home and work environments. But certification programs that measure and grade buildings and products have been mostly indifferent about propagating their brands.

The EPA’s Energy Star program, which has been around for 24 years, gained purchase as energy rates rose. But EPA’s WaterSense labeling program, which celebrates its 10th anniversary this year, has yet to muster that level of brand awareness, in part, because water is relatively inexpensive in most markets.

The WaterSense label is on 16,000+ product models. Through 2015, it has helped consumers reduce energy and water costs by $32.6 billion. Yet, fewer than one-quarter of Americans are aware of the brand, according to a GfK survey.

My guess is that the same is true, to a greater or lesser degree, of LEED, Green Globes, Cradle to Cradle, and other regimens that hold buildings and products accountable for their efficiency, sustainability, or healthiness. Imagine the marketing boost for manufacturers and builders if these certification programs more broadly impacted consumers’ decisions about what to buy or where to live and work?

The Cradle to Cradle label is on nearly 6,000 products under 400-plus corporate certificates. Those products include many consumer brands, from Shaw Industries (flooring) to Method (soap). The Cradle to Cradle organization is confident that the brand means something to “knowledgeable consumers” (read: Millennials), says Stacy Glass, the group’s VP of Built Environment.

But any consumer branding campaign would be futile without critical mass. “What I’d like to see is our label on one million products under 10,000 certificates across the built environment,” says Glass.

Related Stories

Construction Costs | May 16, 2024

New download: BD+C's May 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Contractors | May 15, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of April 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator increased to 8.4 months in April, according to an ABC member survey conducted April 22 to May 6. The reading is down 0.5 months from April 2023, but expanded 0.2 months from the prior month.

Healthcare Facilities | May 6, 2024

Hospital construction costs for 2024

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Contractors | May 1, 2024

Nonresidential construction spending rises 0.2% in March 2024 to $1.19 trillion

National nonresidential construction spending increased 0.2% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.19 trillion.

AEC Tech | Apr 30, 2024

Lack of organizational readiness is biggest hurdle to artificial intelligence adoption

Managers of companies in the industrial sector, including construction, have bought the hype of artificial intelligence (AI) as a transformative technology, but their organizations are not ready to realize its promise, according to research from IFS, a global cloud enterprise software company. An IFS survey of 1,700 senior decision-makers found that 84% of executives anticipate massive organizational benefits from AI.

Hotel Facilities | Apr 24, 2024

The U.S. hotel construction market sees record highs in the first quarter of 2024

As seen in the Q1 2024 U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics (LE), at the end of the first quarter, there are 6,065 projects with 702,990 rooms in the pipeline. This new all-time high represents a 9% year-over-year (YOY) increase in projects and a 7% YOY increase in rooms compared to last year.

Construction Costs | Apr 18, 2024

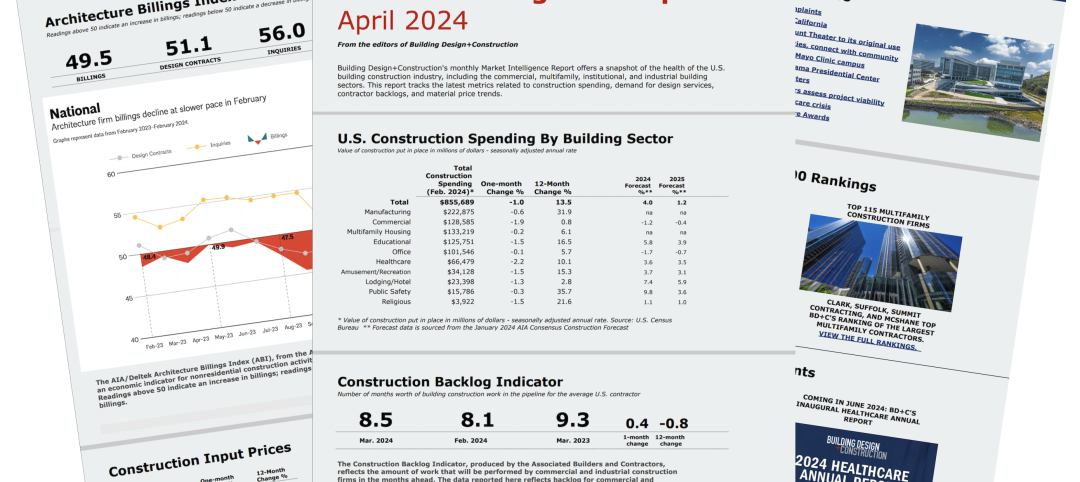

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

K-12 Schools | Apr 10, 2024

Surprise, surprise: Students excel in modernized K-12 school buildings

Too many of the nation’s school districts are having to make it work with less-than-ideal educational facilities. But at what cost to student performance and staff satisfaction?

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.