Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction. According to the report, Yardi finds that construction starts have remained "relatively robust" in the first half of 2023, with the under-construction pipeline increasing by 7.6% in Q3.

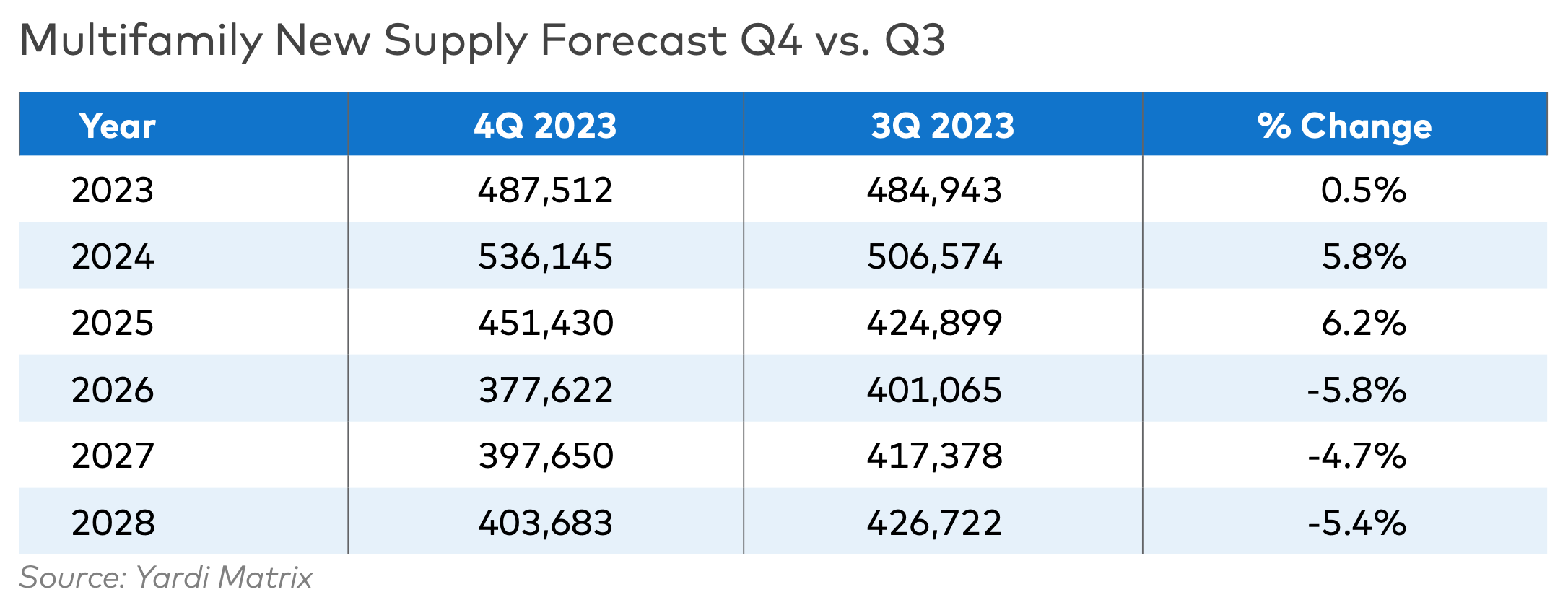

Because of this, new activity is starting to slow. The forecast for project completions has increased by 5.8% for 2024 and 6.2% for 2025. Completions for later years are forecasted to decrease by roughly 5 percent, according to Yardi.

Long-Term Multifamily Supply Forecast

"We continue to expect a mild recession will start in late 2023 or early 2024," the report states. Yardi's forecast for 2026 has therefore been reduced by 5.8% to 377,622 units, while the baseline forecast for 2027 and 2028 completions has been similarly reduced by 4.7% and 5.4% respectively.

For the multifamily markets monitored by Yardi Matrix, there are currently 1.2 million units within the under-construction pipeline. Of these units, just under 480,000 are in the lease-up phase, which is in line with the trailing six-month average of 483,000 units but represents a substantial 15.9% increase from the figures of the previous year. Most of these units are expected to be finalized either by the end of 2023 or during the first half of 2024.

What does this mean for 2024?

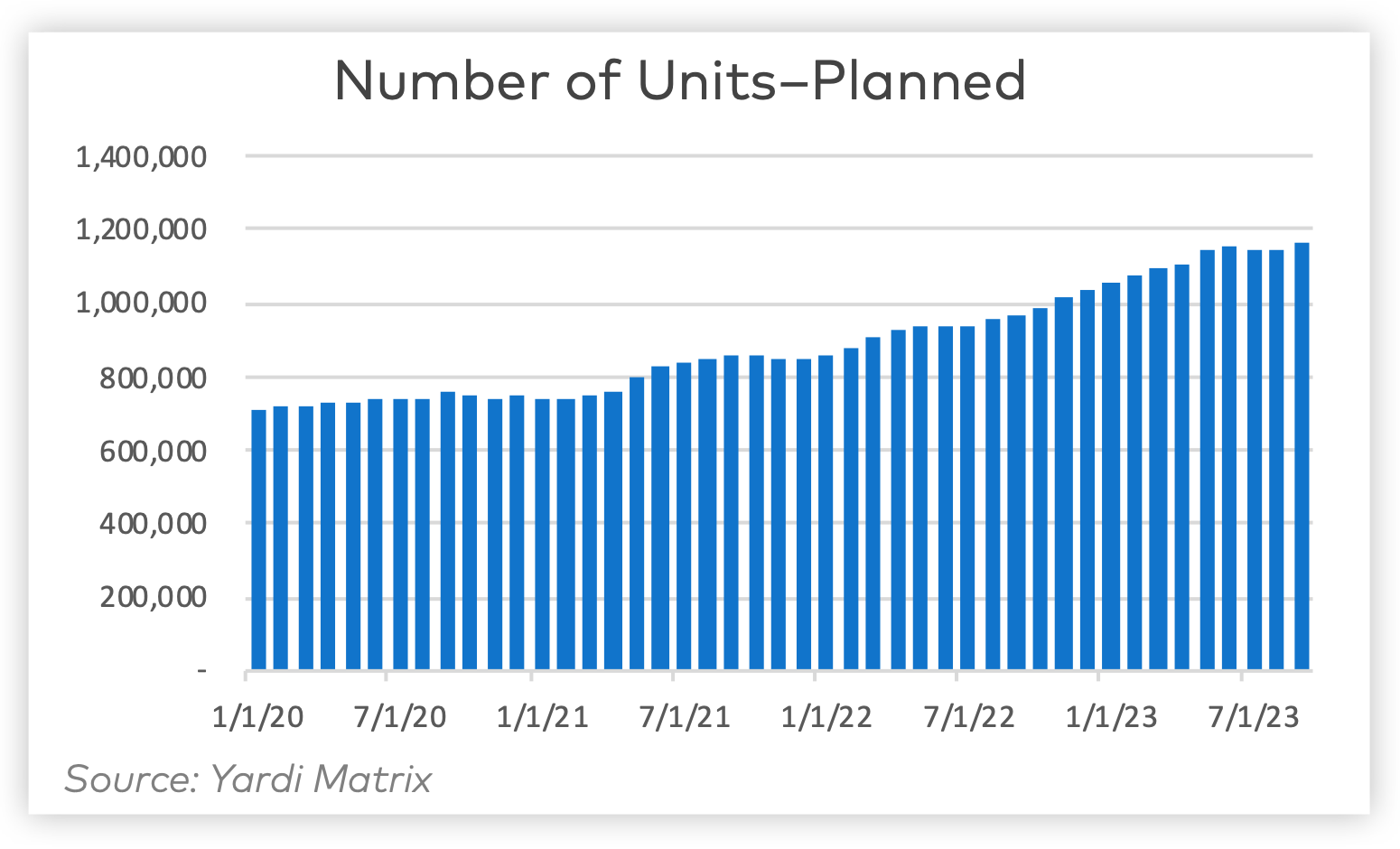

Though short-term construction starts remained elevated through the first half of 2023, several findings from the third quarter suggest that new development activity is slowing. The near flat growth recorded in Q3 is a sharp departure from the growth the planned pipeline recorded post pandemic—another sign that development interest is slowing, according to Yardi.

Overall, Yardi Matrix anticipates an uptick in construction completions in the next two years. Yardi's construction start data reached its year-over-year peak in May 2023. Both planned and prospective pipelines plateaued in Q3.

"Our baseline forecast envisions new supply bottoming in 2026 at around 377,000 units, while the alternative downside forecast models new supply bottoming in 2026 at 335,000 units," writes Ben Bruckner, Senior Research Analyst, Yardi Matrix.

Review the latest Multifamily Supply Forecast here.

Yardi Matrix offers the industry’s most comprehensive market intelligence tool for investment professionals, equity investors, lenders and property managers who underwrite and manage investments in commercial real estate. Yardi Matrix covers multifamily, student housing, industrial, office and self storage property types. Email matrix@yardi.com, call 480-663-1149 or visit yardimatrix.com to learn more.

Related Stories

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

Industrial Facilities | Nov 14, 2023

Some AEC firms are plugging into EV charging market

Decentralized electrical distribution is broadening recharger installation to several building types.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

MFPRO+ News | Nov 1, 2023

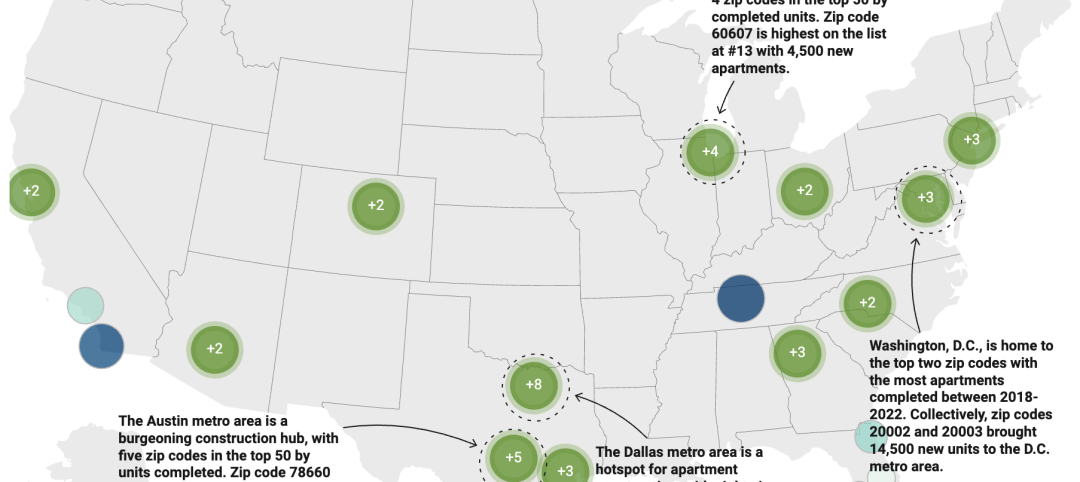

Washington, D.C., Queens, N.Y., lead nation in number of new apartments by zip code

A study of new apartment construction by zip code showed Washington D.C., and the Queens borough of New York City are the hottest multifamily markets since 2018, according to RentCafe.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Mass Timber | Oct 27, 2023

Five winners selected for $2 million Mass Timber Competition

Five winners were selected to share a $2 million prize in the 2023 Mass Timber Competition: Building to Net-Zero Carbon. The competition was co-sponsored by the Softwood Lumber Board and USDA Forest Service (USDA) with the intent “to demonstrate mass timber’s applications in architectural design and highlight its significant role in reducing the carbon footprint of the built environment.”

Sponsored | MFPRO+ Blog | Oct 26, 2023

Unlock New Potential—Can Multifamily Pop-Up Hotel Concepts Transform Lease-Ups?

Dive into the new trend of multifamily pop-up hotels! Learn how they're changing the game in lease-ups, creating vibrant communities, and offering property managers a lucrative new revenue stream. Join the conversation on the future of multifamily living spaces.