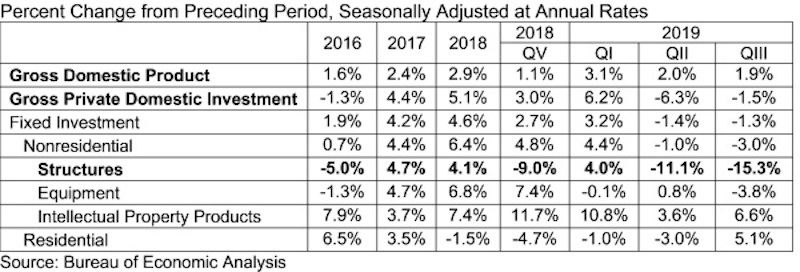

The U.S. economy expanded at an annualized rate of 1.9% in the third quarter of 2019 despite contracting levels of nonresidential investment, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Economic Analysis. Nonresidential fixed investment declined at a 3% annual rate in the third quarter after declining at a 1% rate in the second quarter.

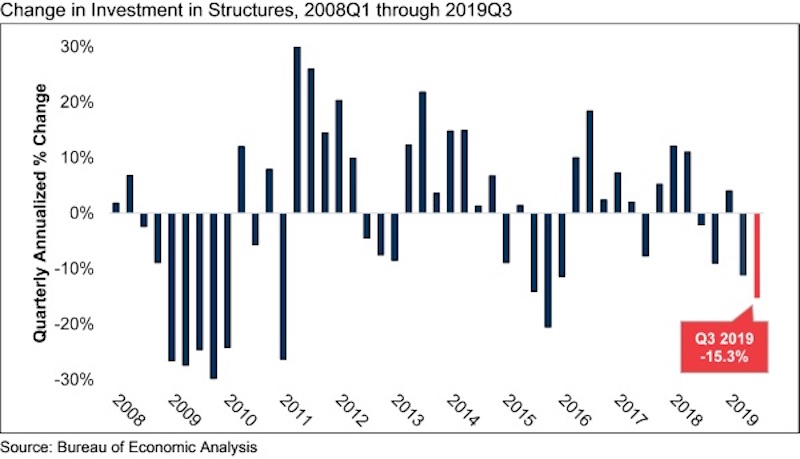

The annual rate for nonresidential fixed investment in structures, a component closely tied to construction, declined 15.3% in the third quarter. Investment in structures has now contracted in four of the previous five quarters, including an 11.1% decline in the second quarter of 2019.

“Today’s report reinforced a number of observations regarding the U.S. economy and the nation’s nonresidential construction sector,” said ABC Chief Economist Anirban Basu. “First, the economy is slowing. While consumer spending and government outlays remain elevated, gross private domestic investment continues to slip, this time by 1.5% on an annualized basis in the third quarter. While this is less than the 6.3% decline registered during the second quarter, the key takeaway is that the current economic expansion is narrowing, increasingly fueled by consumers and public agencies taking on additional debt.

“Second, certain segments of nonresidential construction continue to soften,” said Basu. “Recent data regarding nonresidential construction spending indicate weaker spending in categories such as office and lodging. This was reflected in today’s GDP report, which indicated that spending on structures contracted significantly during the third quarter. For the most part, nonresidential construction spending growth continues to be driven by public construction, including in categories such as water supply and public safety.

“The primary question now is whether the slowdown in economic activity will persist into 2020,” said Basu. “Many factors suggest it will, including a weakening global economy, a U.S. manufacturing sector that is arguably already in recession, vulnerability attributable to massive accumulations of public, corporate and household debt and the uncertain outcomes attached to ongoing trade negotiations. On the other hand, U.S. equity markets have continued to surge higher in the context of better-than-expected corporate earnings and ongoing accommodation by the Federal Reserve. Put it all together and the outlook for the U.S. economy has seldom been more uncertain, especially given next year’s elections.

Related Stories

Data Centers | Jan 28, 2016

Top 10 markets for data center construction

JLL’s latest outlook foresees a maturation in certain metros.

Market Data | Jan 20, 2016

Nonresidential building starts sag in 2015

CDM Research finds only a few positive signs among the leading sectors.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.

Market Data | Jan 15, 2016

ABC: Construction material prices continue free fall in December

In December, construction material prices fell for the sixth consecutive month. Prices have declined 7.2% since peaking in August 2014.

Market Data | Jan 13, 2016

Morgan Stanley bucks gloom and doom, thinks U.S. economy has legs through 2020

Strong job growth and dwindling consumer debt give rise to hope.

Hotel Facilities | Jan 13, 2016

Hotel construction should remain strong through 2017

More than 100,000 rooms could be delivered this year alone.

Market Data | Jan 6, 2016

Census Bureau revises 10 years’ worth of construction spending figures

The largest revisions came in the last two years and were largely upward.

Market Data | Jan 5, 2016

Majority of AEC firms saw growth in 2015, remain optimistic for 2016: BD+C survey

By all indications, 2015 was another solid year for U.S. architecture, engineering, and construction firms.

Market Data | Jan 5, 2016

Nonresidential construction spending falters in November

Only 4 of 16 subsectors showed gains

Market Data | Dec 15, 2015

AIA: Architecture Billings Index hits another bump

Business conditions show continued strength in South and West regions.