Last week, The World Bank lowered its estimate for global growth in 2016 to 2.9%, from its 3.5% prediction last June. The Bank is particularly concerned about slowdowns in China and developing companies that could reverberate, long term, to advanced economies.

However, the Bank’s forecast was more optimistic about the United States, whose 2.7% economic growth in 2016, if realized, would be its fastest pace since 2006.

Whether the U.S. can outpace other nations’ economies is a topic of some debate. James Pethokoukis, a Fellow at the American Enterprise Institute, thinks the U.S. could face decades of “unhealthy economic populism” if GDP and job growth aren’t matched by productivity gains, which over the past five years have averaged only 0.6%. More dour is Citigroup, which is on record that there’s a 65% chance of another recession in the U.S. this year.

The current state of America’s stock market, which got off to a miserable start in 2016, doesn’t exactly augur happy days ahead. But that downturn, and the generally mediocre pace at which the world’s economies are moving, didn’t deter Morgan Stanley from reiterating its belief that the U.S. would continue growing through 2020, and thereby achieve the longest economic expansion in the post-World War II era.

Morgan also thinks that if the U.S. skirts another recession, corporate profit growth could lift the S&P 500 to 3,000 by 2020. (That Index ended Jan. 13 at 1,890.28, down 48.40 to its lowest level since last September. Morgan’s prediction is in sharp contrast with economic bears who are already predicting the S&P 500 could collapse by as much as 75% from its peak of 2100 last year, driven down by China’s currency deflation.)

There are three main reasons why Morgan Stanley remains bullish about the American economy:

•The U.S added about 200,000 jobs per month in 2015, its second-best year for employment gains since 1999. The employment picture spurred consumer confidence, as measured by the University of Michigan, to average 92.9 last year, the highest it’s been at since 2004.

•Americans are getting themselves out of the red. Morgan Stanley notes that debt to disposable income, at about 106%, has fallen from 138% in 2008. And the portion of loan balances that are 90-plus days delinquent fell below 4% for the first time since the recession ended.

•Big companies are cleaning up their balance sheets and being a lot more careful about what they invest in. Morgan Stanley expects capital spending-to sales at the largest 1,500 corporations to fall to 4.6%, compared to between 6% and 9% before the last two recessions. S&P 500 companies have about $100 billion in loans coming due this year and $300 billion in 2017, which Morgan considers manageable amounts.

Related Stories

Hotel Facilities | Apr 24, 2024

The U.S. hotel construction market sees record highs in the first quarter of 2024

As seen in the Q1 2024 U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics (LE), at the end of the first quarter, there are 6,065 projects with 702,990 rooms in the pipeline. This new all-time high represents a 9% year-over-year (YOY) increase in projects and a 7% YOY increase in rooms compared to last year.

Construction Costs | Apr 18, 2024

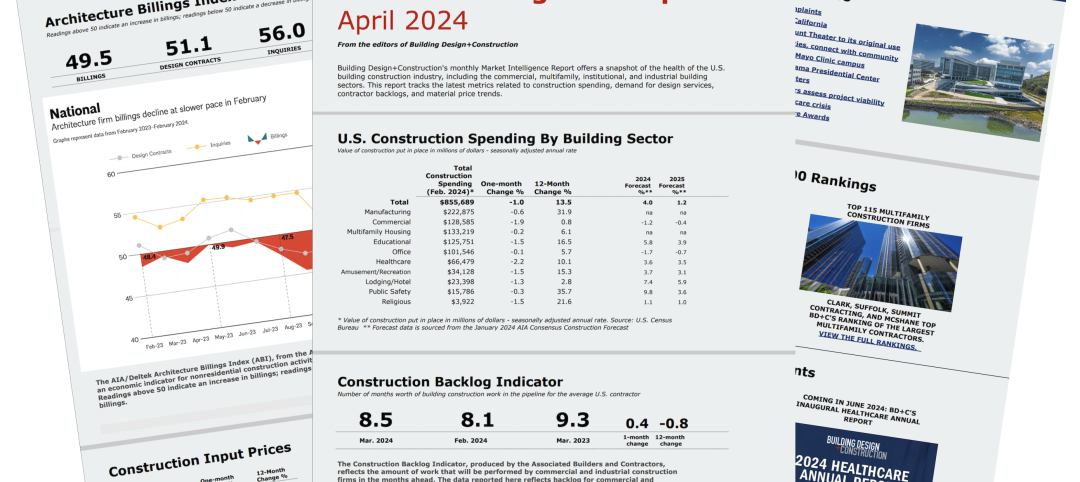

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

K-12 Schools | Apr 10, 2024

Surprise, surprise: Students excel in modernized K-12 school buildings

Too many of the nation’s school districts are having to make it work with less-than-ideal educational facilities. But at what cost to student performance and staff satisfaction?

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

Retail Centers | Apr 4, 2024

Retail design trends: Consumers are looking for wellness in where they shop

Consumers are making lifestyle choices with wellness in mind, which ignites in them a feeling of purpose and a sense of motivation. That’s the conclusion that the architecture and design firm MG2 draws from a survey of 1,182 U.S. adult consumers the firm conducted last December about retail design and what consumers want in healthier shopping experiences.

Market Data | Apr 1, 2024

Nonresidential construction spending dips 1.0% in February, reaches $1.179 trillion

National nonresidential construction spending declined 1.0% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.179 trillion.

Market Data | Mar 26, 2024

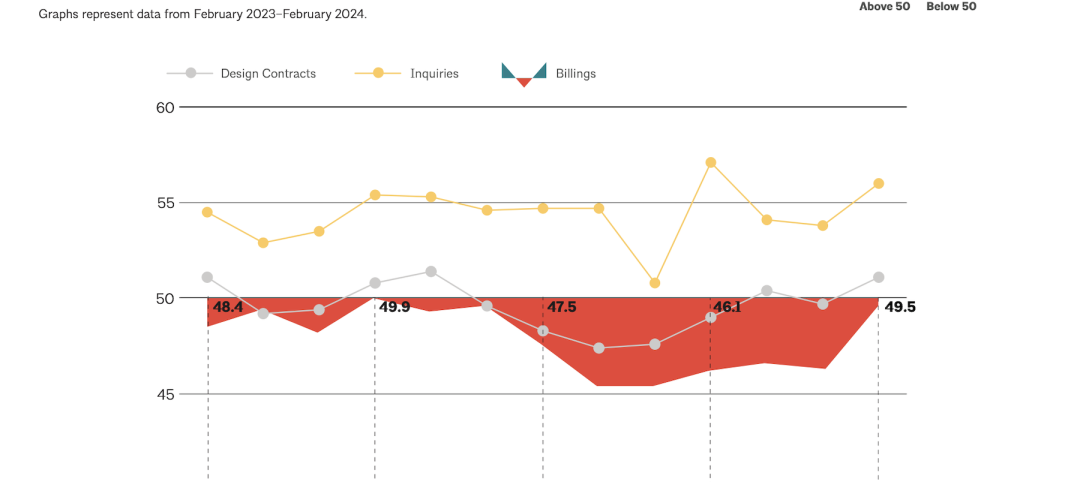

Architecture firm billings see modest easing in February

Architecture firm billings continued to decline in February, with an AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month. However, February’s score marks the most modest easing in billings since July 2023 and suggests that the recent slowdown may be receding.

K-12 Schools | Mar 18, 2024

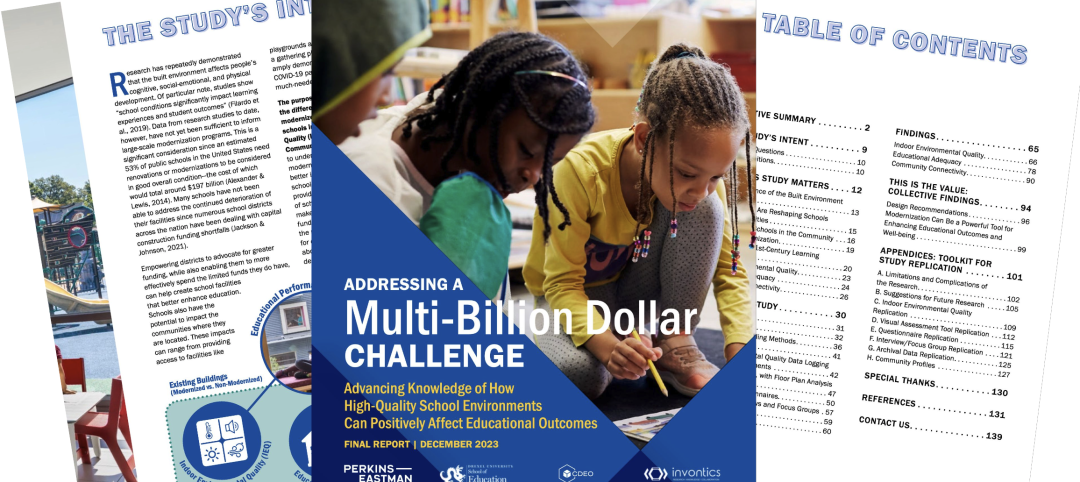

New study shows connections between K-12 school modernizations, improved test scores, graduation rates

Conducted by Drexel University in conjunction with Perkins Eastman, the research study reveals K-12 school modernizations significantly impact key educational indicators, including test scores, graduation rates, and enrollment over time.

MFPRO+ News | Mar 16, 2024

Multifamily rents stable heading into spring 2024

National asking multifamily rents posted their first increase in over seven months in February. The average U.S. asking rent rose $1 to $1,713 in February 2024, up 0.6% year-over-year.