Overcapacity in global iron ore production was a major factor in keeping construction costs low through the first four months of 2015. And for the first time in years, subcontractor labor costs showed signs of softening.

Those are two key findings in the latest assessment of current and future pricing from IHS, the Englewood, Colo.-based market analysis firm.

IHS derives its monthly Cost Index from information it receives from member procurement executives working for several of the world’s largest construction and engineering companies, including AECOM and Bechtel. It breaks down those data into current pricing trends and projections for six months forward.

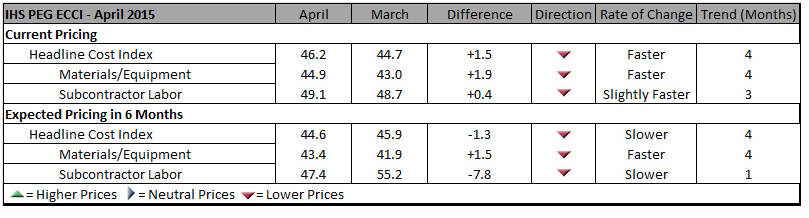

In April, its Cost Index was 46.2, a bit higher than 44.7 in March, but still below what IHS would consider a “neutral” reading. Its sub index for Materials/Equipment costs in April was 44.9 compared to 43.0 in March. And the April sub index for Subcontractor Labor costs stood at 49.1, compared to 48.7 in March.

Procurement execs from some of the world's largest construction and engineering firms report that costs for materials and labor are still falling, and are unlikely to see much inflation for the next six months. Chart: IHS

Procurement execs from some of the world's largest construction and engineering firms report that costs for materials and labor are still falling, and are unlikely to see much inflation for the next six months. Chart: IHS

IHS notes that eight of 12 construction components it tracks registered falling prices in April, led by carbon steel pipe and fabricated structural steel. Both are victims of “bloated capacity, weak profit growth, and lackluster demand,” explains John Anton, IHS’s Director of Steel Services. Iron ore companies that, in response to demand from China’s steel industry, have initiated massive projects whose capacity, so far, “is far ahead of demand,” and is holding prices down.

Anton adds that while the iron ore market may have some ostensible similarities to the recent decline of crude oil prices, what’s different is that iron ore producers have shown no inclinations toward cutting production to match demand. (IHS points out that three quarters of China’s mines are losing money.)

IHS also notes that several global construction and engineering firms, particularly those in the oil and gas sectors, have been taking a “wait and see” approach to investing in larger capital projects. “The capex environment has yet to thaw,” asserts Mark Eisinger, IHS’s senior economist.

While some markets, like the U.S. South, are still experiencing shortages in skilled subcontractor labor, manpower costs have been receding. For the third consecutive month, the U.S. did not register higher month-to-month labor costs in April. And for the first time in this survey’s history, projections about labor costs over the next six months are below the neutral mark. The six-month cost index for subcontractor labor fell to 47.4 in April, compared to 55.2 in March.

The forward-looking index for materials and equipment, at 43.4 April, rose from March’s record low of 41.9, even as 10 of 12 components showed falling price expectations.

Related Stories

Retail Centers | Nov 29, 2022

'Social' tenants play a vital role in the health of the retail center market

After a long Covid-induced period when the public avoided large gatherings, owners of malls and retail lifestyle centers are increasingly focused on attracting tenants that provide opportunities for socialization. Pent-up demand for experiences involving gatherings of people is fueling renovations and redesigns of large retail developments.

Giants 400 | Nov 28, 2022

Top 130 Office Sector Contractors and CM Firms for 2022

Turner Construction, STO Building Group, Gilbane, and CBRE top the ranking of the nation's largest office sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Legislation | Nov 23, 2022

7 ways the Inflation Reduction Act will impact the building sector

HOK’s Anica Landreneau and Stephanie Miller and Smart Surfaces Coalition’s Greg Kats reveal multiple ways the IRA will benefit the built environment.

Multifamily Housing | Nov 22, 2022

10 compelling multifamily developments debut in 2022

A smart home tech-focused apartment complex in North Phoenix, Ariz., and a factory conversion to lofts in St. Louis highlight the notable multifamily developments to debut recently.

Industrial Facilities | Nov 16, 2022

Industrial building sector construction, while healthy, might also be flattening

For all the hoopla about the ecommerce boom and “last mile” order fulfillment driving demand for more warehouse and manufacturing space, construction of industrial buildings actually declined over the past five years, albeit marginally by 2.1% to $27.3 billion in 2022, according to estimates by IBIS World. Still, construction in this sector remains buzzy.

Wood | Nov 16, 2022

5 steps to using mass timber in multifamily housing

A design-assist approach can provide the most effective delivery method for multifamily housing projects using mass timber as the primary building element.

Giants 400 | Nov 14, 2022

Top 60 Airport Terminal Contractors + CM Firms for 2022

Hensel Phelps, Turner Construction, Walsh Group, and Holder Construction top the ranking of the nation's largest airport terminal contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Nov 14, 2022

4 emerging trends from BD+C's 2022 Giants 400 Report

Regenerative design, cognitive health, and jobsite robotics highlight the top trends from the 519 design and construction firms that participated in BD+C's 2022 Giants 400 Report.

Contractors | Nov 14, 2022

U.S. construction firms lean on technology to manage growth and weather the pandemic

In 2021, Gilbane Building Company and Nextera Robotics partnered in a joint venture to develop an artificial intelligence platform utilizing a fleet of autonomous mobile robots. The platform, dubbed Didge, is designed to automate construction management, maximize reliability and safety, and minimize operational costs. This was just one of myriad examples over the past 18 months of contractor giants turning to construction technology (ConTech) to gather jobsite data, manage workers and equipment, and smooth the construction process.

University Buildings | Nov 13, 2022

University of Washington opens mass timber business school building

Founders Hall at the University of Washington Foster School of Business, the first mass timber building at Seattle campus of Univ. of Washington, was recently completed. The 84,800-sf building creates a new hub for community, entrepreneurship, and innovation, according the project’s design architect LMN Architects.