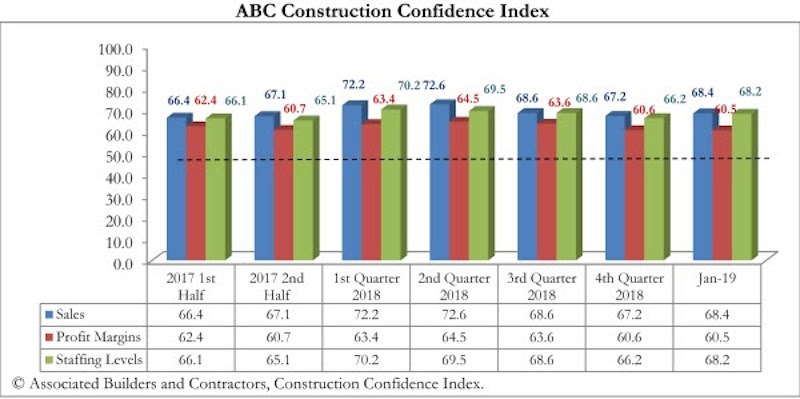

Construction industry leaders remained confident regarding the nonresidential construction sector’s prospects during January 2019, according to the latest Construction Confidence Index recently released by Associated Builders and Contractors.

Expectations for sales during the coming six-month period remained especially upbeat in January, with nearly 70% of respondents anticipating an increase in sales levels. A similar level of confidence characterizes contractors expectations on future staffing levels, with fewer than 7% of contractors indicating expectations of shrinking workforces.

While contractors became fractionally less confident regarding profit margins, more than half of respondents still expect their margins to increase in coming months, while less than 13% expect margins to shrink. All three principal components measured by the survey—sales, profit margins, and staffing levels—remain well above the diffusion index threshold of 50, signaling ongoing expansion in construction activity.

– The CCI for sales expectations increased from 67.2 to 68.4 in January.

– The CCI for profit margin expectations fell from 60.6 to 60.5.

– The CCI for staffing levels increased from 66.2 to 68.2.

“Indications of ongoing confidence in the construction sector have become more important," said ABC Chief Economist Anirban Basu. “Recent dips in consumer and small-business confidence have become a source of concern, as have weak reports regarding employment growth and retail sales. Thankfully, contractors continue to exhibit elevated levels of confidence regarding the near-term trajectory of the economy despite ongoing workforce shortages. Not only do contractors expect to further expand staffing levels, many continue to expect rising profit margins despite rapidly expanding payroll expenses.

“One source of relief has been a recent moderation in construction materials prices,” said Basu. “With the global economy continuing to soften, materials prices should remain well-behaved over the months to come. Investors continue to aggressively seek ways to deploy capital, including on new commercial construction. This helps explain a recent surge in the Architecture Billings Index, another leading indicator that, along with CCI, suggests ongoing economic momentum throughout the first half of 2019.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

[Editor’s note: ABC’s Construction Confidence Index will be reported monthly beginning with January 2019 data. This is the first monthly CCI release.]

Related Stories

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.

Student Housing | Feb 13, 2024

Student housing market expected to improve in 2024

The past year has brought tough times for student housing investment sales due to unfavorable debt markets. However, 2024 offers a brighter outlook if debt conditions improve as predicted.

Contractors | Feb 13, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of January 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator declined to 8.4 months in January, according to an ABC member survey conducted from Jan. 22 to Feb. 4. The reading is down 0.6 months from January 2023.

Industry Research | Feb 8, 2024

New multifamily development in 2023 exceeded expectations

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report.

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Industry Research | Jan 31, 2024

ASID identifies 11 design trends coming in 2024

The Trends Outlook Report by the American Society of Interior Designers (ASID) is the first of a three-part outlook series on interior design. This design trends report demonstrates the importance of connection and authenticity.

Apartments | Jan 26, 2024

New apartment supply: Top 5 metros delivering in 2024

Nationally, the total new apartment supply amounts to around 1.4 million units—well exceeding the apartment development historical average of 980,000 units.

Self-Storage Facilities | Jan 25, 2024

One-quarter of self-storage renters are Millennials

Interest in self-storage has increased in over 75% of the top metros according to the latest StorageCafe survey of self-storage preferences. Today, Millennials make up 25% of all self-storage renters.

Industry Research | Jan 23, 2024

Leading economists forecast 4% growth in construction spending for nonresidential buildings in 2024

Spending on nonresidential buildings will see a modest 4% increase in 2024, after increasing by more than 20% last year according to The American Institute of Architects’ latest Consensus Construction Forecast. The pace will slow to just over 1% growth in 2025, a marked difference from the strong performance in 2023.

Construction Costs | Jan 22, 2024

Construction material prices continue to normalize despite ongoing challenges

Gordian’s most recent Quarterly Construction Cost Insights Report for Q4 2023 describes an industry still attempting to recover from the impact of COVID. This was complicated by inflation, weather, and geopolitical factors that resulted in widespread pricing adjustments throughout the construction materials industries.