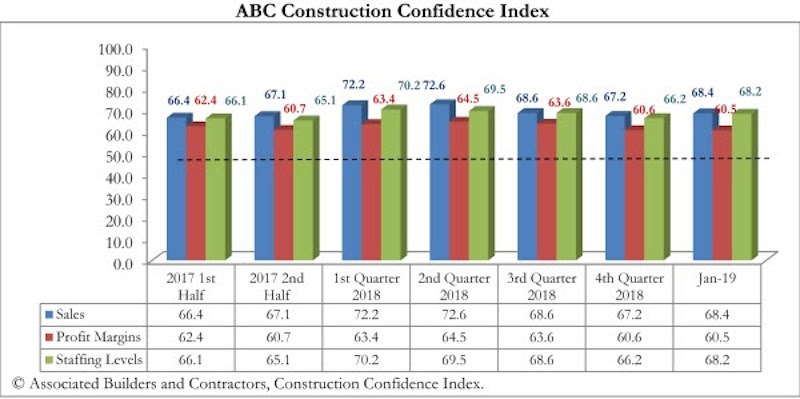

Construction industry leaders remained confident regarding the nonresidential construction sector’s prospects during January 2019, according to the latest Construction Confidence Index recently released by Associated Builders and Contractors.

Expectations for sales during the coming six-month period remained especially upbeat in January, with nearly 70% of respondents anticipating an increase in sales levels. A similar level of confidence characterizes contractors expectations on future staffing levels, with fewer than 7% of contractors indicating expectations of shrinking workforces.

While contractors became fractionally less confident regarding profit margins, more than half of respondents still expect their margins to increase in coming months, while less than 13% expect margins to shrink. All three principal components measured by the survey—sales, profit margins, and staffing levels—remain well above the diffusion index threshold of 50, signaling ongoing expansion in construction activity.

– The CCI for sales expectations increased from 67.2 to 68.4 in January.

– The CCI for profit margin expectations fell from 60.6 to 60.5.

– The CCI for staffing levels increased from 66.2 to 68.2.

“Indications of ongoing confidence in the construction sector have become more important," said ABC Chief Economist Anirban Basu. “Recent dips in consumer and small-business confidence have become a source of concern, as have weak reports regarding employment growth and retail sales. Thankfully, contractors continue to exhibit elevated levels of confidence regarding the near-term trajectory of the economy despite ongoing workforce shortages. Not only do contractors expect to further expand staffing levels, many continue to expect rising profit margins despite rapidly expanding payroll expenses.

“One source of relief has been a recent moderation in construction materials prices,” said Basu. “With the global economy continuing to soften, materials prices should remain well-behaved over the months to come. Investors continue to aggressively seek ways to deploy capital, including on new commercial construction. This helps explain a recent surge in the Architecture Billings Index, another leading indicator that, along with CCI, suggests ongoing economic momentum throughout the first half of 2019.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

[Editor’s note: ABC’s Construction Confidence Index will be reported monthly beginning with January 2019 data. This is the first monthly CCI release.]

Related Stories

Contractors | Apr 19, 2023

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

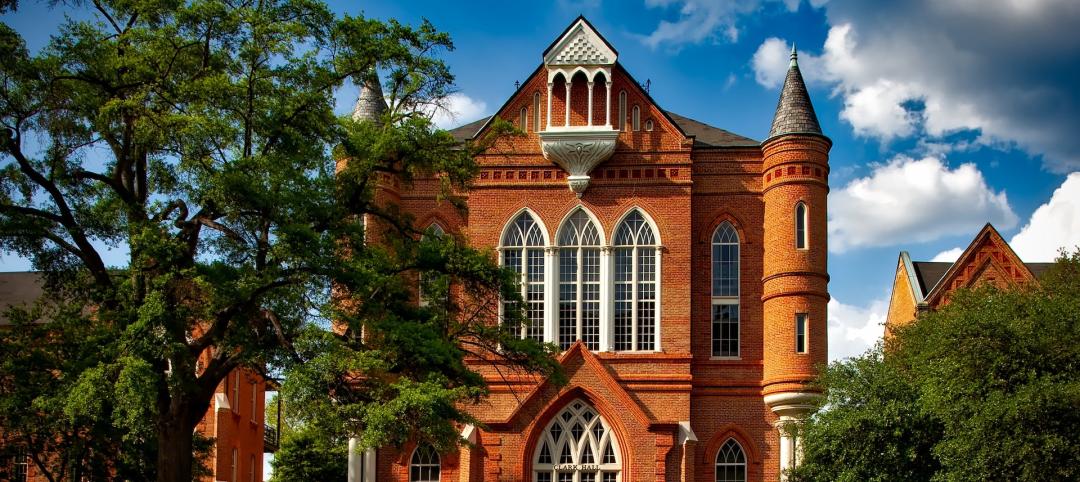

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.

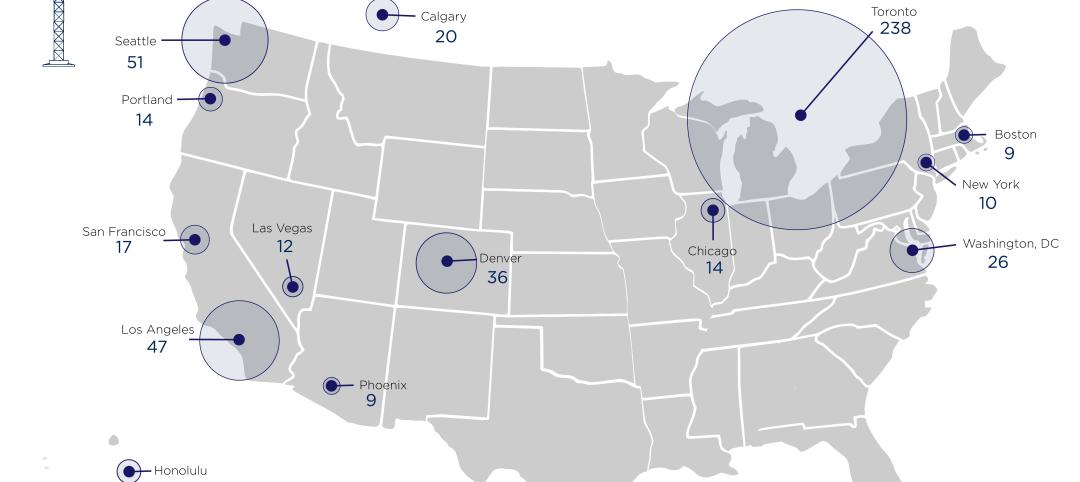

Market Data | Apr 11, 2023

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Market Data | Apr 4, 2023

Nonresidential construction spending up 0.4% in February 2023

National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month, up 16.8% from the previous year.

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.